WM Holding Company, LLC (MAPS): Price and Financial Metrics

MAPS Price/Volume Stats

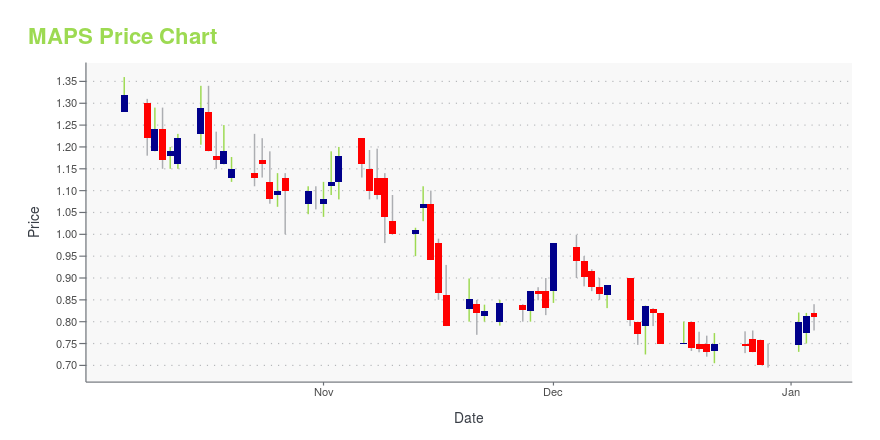

| Current price | $1.03 | 52-week high | $1.88 |

| Prev. close | $1.00 | 52-week low | $0.70 |

| Day low | $1.00 | Volume | 207,071 |

| Day high | $1.03 | Avg. volume | 636,152 |

| 50-day MA | $1.01 | Dividend yield | N/A |

| 200-day MA | $1.00 | Market Cap | 155.05M |

MAPS Stock Price Chart Interactive Chart >

WM Holding Company, LLC (MAPS) Company Bio

WM Technology, Inc. engages in the operation of a listings marketplace with SaaS subscription offerings sold to retailers and brands in the U.S. state-legal and Canadian cannabis markets. It also provides information on the cannabis plant and the industry and advocates for legalization. The company was founded by Douglas Francis and Justin Hartfield in 2008 and is headquartered in Irvine, CA.

Latest MAPS News From Around the Web

Below are the latest news stories about WM TECHNOLOGY INC that investors may wish to consider to help them evaluate MAPS as an investment opportunity.

3 Tech Stocks Set to Deliver Triple-Digit Gains in 2024These three overlooked tech stocks have triple-digit upside potential in 2024 as their valuations are disconnected from fundamentals. |

Why These 3 Cannabis Stocks Should Be on Your Radar in 2024The legalization of Cannabis across the economy will inevitably cause these winning stocks to bring you green days in 2024. |

The 7 Most Undervalued Cannabis Stocks to Buy in DecemberThese seven cannabis stocks are either undervalued based on traditional metrics, or are undervalued relative to future potential. |

WM Technology, Inc. Reports Third Quarter 2023 Financial ResultsIRVINE, Calif., November 08, 2023--WM Technology, Inc. ("WM Technology" or the "Company") (Nasdaq: MAPS), a leading technology and software infrastructure provider to the cannabis industry, today announced its financial results for the third quarter ended September 30, 2023. |

The DIY Cannabis Portfolio: 7 Stocks From Seed to StemCannabis stocks are well beyond past peaks, but ongoing efforts create opportunity for diversified portfolios spanning the sector. |

MAPS Price Returns

| 1-mo | 0.98% |

| 3-mo | -2.83% |

| 6-mo | 22.60% |

| 1-year | 4.57% |

| 3-year | -92.14% |

| 5-year | N/A |

| YTD | 43.00% |

| 2023 | -28.68% |

| 2022 | -83.11% |

| 2021 | -53.17% |

| 2020 | 28.86% |

| 2019 | N/A |

Loading social stream, please wait...