Maxeon Solar Technologies, Ltd. (MAXN): Price and Financial Metrics

MAXN Price/Volume Stats

| Current price | $0.21 | 52-week high | $26.33 |

| Prev. close | $0.21 | 52-week low | $0.17 |

| Day low | $0.21 | Volume | 30,378,400 |

| Day high | $0.21 | Avg. volume | 28,392,963 |

| 50-day MA | $1.28 | Dividend yield | N/A |

| 200-day MA | $3.81 | Market Cap | 11.69M |

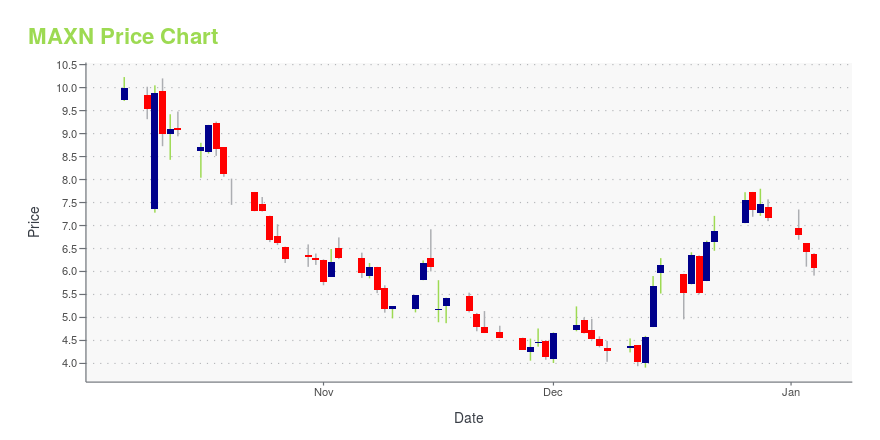

MAXN Stock Price Chart Interactive Chart >

Maxeon Solar Technologies, Ltd. (MAXN) Company Bio

Maxeon Solar Technologies, Ltd. manufactures renewable energy equipment.

Latest MAXN News From Around the Web

Below are the latest news stories about MAXEON SOLAR TECHNOLOGIES LTD that investors may wish to consider to help them evaluate MAXN as an investment opportunity.

Maxeon Solar Technologies Expands Patent Dispute Against AikoMaxeon Solar Technologies, Ltd. (NASDAQ: MAXN), a global leader in solar innovation and channels, today announced that its subsidiary Maxeon Solar Pte. Ltd. has filed a request to initiate preliminary injunction proceedings concerning patent infringement claims against Eironn Netherlands B.V. (Aiko Energy) and its wholesalers VDH Solar Groothandel B.V. and Libra Energy B.V. in the Hague District Court, Netherlands. |

Maxeon Solar Technologies Initiates TOPCon Patent Infringement InvestigationMaxeon Solar Technologies, Ltd. (NASDAQ:MAXN), a global leader in solar innovation and channels, today announced that it has initiated an investigation of several companies for infringement of Maxeon patents pertaining to TOPCon (Tunnel Oxide Passivated Contact) solar cell technology in the United States. Several companies have announced plans to import into the United States or manufacture in the United States solar panels that utilize TOPCon solar cells. In response, Maxeon has begun actively |

Maxeon Solar Technologies Announces Third Quarter 2023 Financial ResultsMaxeon Solar Technologies, Ltd. (NASDAQ:MAXN) ("Maxeon" or "the Company"), a global leader in solar innovation and channels, today announced its financial results for the third quarter ended October 1, 2023. |

Maxeon Solar Technologies and SunPower Corporation Announce Supply Agreement Amendment and Resolution of DisputesMaxeon Solar Technologies, Ltd. (NASDAQ:MAXN), a global leader in solar innovation and channels, and SunPower Corporation (NASDAQ:SPWR), a leading residential solar technology and energy services provider, today announced an amendment of their supply agreement and resolution of disputes between the companies. |

Maxeon Solar Technologies Files Patent Action Against Aiko in GermanyMaxeon Solar Technologies, Ltd. (NASDAQ: MAXN), a global leader in solar innovation and channels, today announced that its subsidiary Maxeon Solar Pte. Ltd. filed patent infringement lawsuits against Shanghai Aiko Solar Energy Co., Ltd., its subsidiaries Aiko Energy Germany GmbH and Solarlab Aiko Europe GmbH, and its wholesaler Memodo GmbH in Mannheim District Court, Germany. |

MAXN Price Returns

| 1-mo | -81.08% |

| 3-mo | -89.95% |

| 6-mo | -95.61% |

| 1-year | -99.12% |

| 3-year | -98.61% |

| 5-year | N/A |

| YTD | -97.07% |

| 2023 | -55.35% |

| 2022 | 15.54% |

| 2021 | -51.00% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...