Warning: This security is no longer trading.

defunct

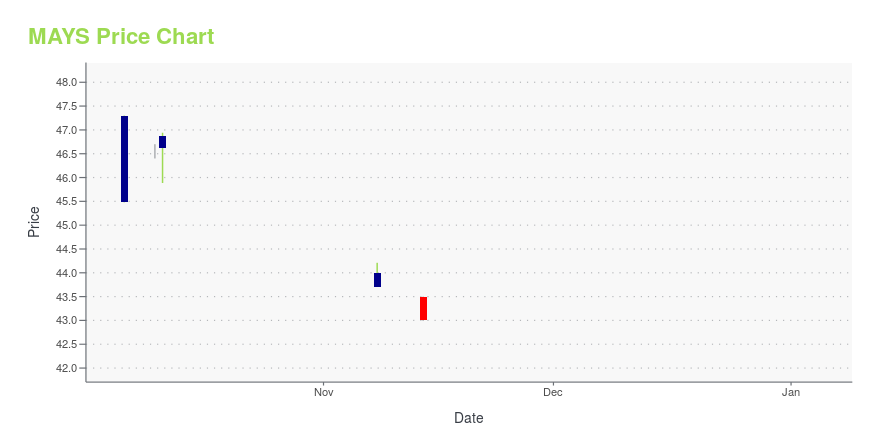

J. W. Mays, Inc. (MAYS): Price and Financial Metrics

MAYS Price/Volume Stats

| Current price | $43.33 | 52-week high | $56.12 |

| Prev. close | $45.79 | 52-week low | $42.01 |

| Day low | $43.33 | Volume | 100 |

| Day high | $43.33 | Avg. volume | 394 |

| 50-day MA | $45.28 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 87.53M |

MAYS Stock Price Chart Interactive Chart >

Latest MAYS News From Around the Web

Below are the latest news stories about MAYS J W INC that investors may wish to consider to help them evaluate MAYS as an investment opportunity.

MAYS Stock Earnings: J. W. Mays Reported Results for Q1 2024J. |

MAYS Stock Earnings: J. W. Mays Reported Results for Q4 2023J. |

J.W. Mays' (NASDAQ:MAYS) investors will be pleased with their favorable 90% return over the last three yearsIt hasn't been the best quarter for J.W. Mays, Inc. ( NASDAQ:MAYS ) shareholders, since the share price has fallen 12... |

J.W. Mays, Inc. (NASDAQ:MAYS) most popular amongst private companies who own 58%, insiders hold 17%Key Insights The considerable ownership by private companies in J.W. Mays indicates that they collectively have a... |

J.W. Mays' (NASDAQ:MAYS) investors will be pleased with their respectable 99% return over the last three yearsBy buying an index fund, investors can approximate the average market return. But if you pick the right individual... |

MAYS Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | 22.06% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | 0.00% |

Continue Researching MAYS

Want to see what other sources are saying about Mays J W Inc's financials and stock price? Try the links below:Mays J W Inc (MAYS) Stock Price | Nasdaq

Mays J W Inc (MAYS) Stock Quote, History and News - Yahoo Finance

Mays J W Inc (MAYS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...