Ramaco Resources, Inc. (METC): Price and Financial Metrics

METC Price/Volume Stats

| Current price | $13.61 | 52-week high | $22.70 |

| Prev. close | $13.14 | 52-week low | $7.65 |

| Day low | $13.25 | Volume | 413,200 |

| Day high | $13.66 | Avg. volume | 773,487 |

| 50-day MA | $13.60 | Dividend yield | 4.15% |

| 200-day MA | $15.69 | Market Cap | 602.42M |

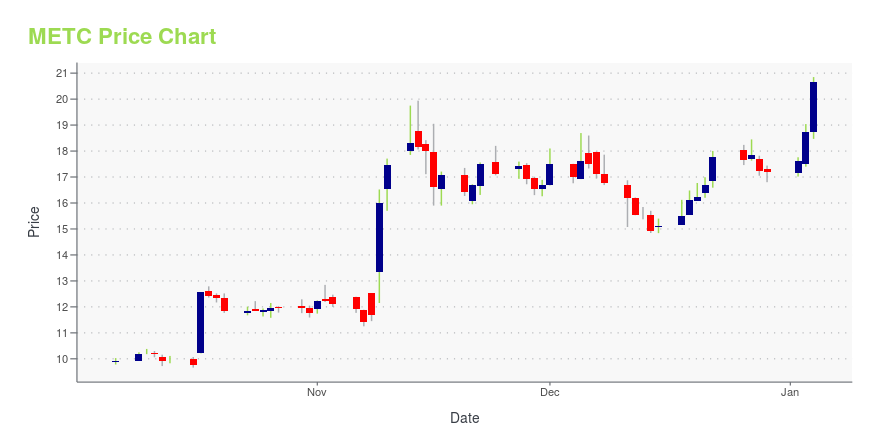

METC Stock Price Chart Interactive Chart >

Ramaco Resources, Inc. (METC) Company Bio

Ramaco Resources, Inc. owns and operates coal mining properties. The company was founded in 2016 and is headquartered in Lexington, Kentucky.

Latest METC News From Around the Web

Below are the latest news stories about RAMACO RESOURCES INC that investors may wish to consider to help them evaluate METC as an investment opportunity.

Estimating The Intrinsic Value Of Ramaco Resources, Inc. (NASDAQ:METC)Key Insights Using the 2 Stage Free Cash Flow to Equity, Ramaco Resources fair value estimate is US$21.84 With US$17.78... |

Here's Why Ramaco Resources (METC) Looks Ripe for Bottom FishingRamaco Resources (METC) appears to have found support after losing some value lately, as indicated by the formation of a hammer chart. In addition to this technical chart pattern, strong agreement among Wall Street analysts in revising earnings estimates higher enhances the stock's potential for a turnaround in the near term. |

Zacks Industry Outlook Highlights Arch Resources, Warrior Met Coal and Ramco ResourcesArch Resources, Warrior Met Coal and Ramco Resources are part of the Zacks Industry Outlook article. |

3 Coal Stocks to Watch From the Challenging IndustryDespite the expected drop in U.S. coal production volumes, high-quality coal producers like Arch Resources (ARCH), Warrior Met Coal (HCC) and Ramaco Resources (METC) are likely to remain competitive with improving export volumes. |

Ramaco Resources (NASDAQ:METC) Will Pay A Larger Dividend Than Last Year At $0.1375Ramaco Resources, Inc. ( NASDAQ:METC ) will increase its dividend from last year's comparable payment on the 15th of... |

METC Price Returns

| 1-mo | 13.89% |

| 3-mo | -13.98% |

| 6-mo | -26.22% |

| 1-year | 57.95% |

| 3-year | 190.20% |

| 5-year | 264.46% |

| YTD | -19.34% |

| 2023 | 151.75% |

| 2022 | -32.95% |

| 2021 | 372.22% |

| 2020 | -19.55% |

| 2019 | -27.68% |

METC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching METC

Want to see what other sources are saying about Ramaco Resources Inc's financials and stock price? Try the links below:Ramaco Resources Inc (METC) Stock Price | Nasdaq

Ramaco Resources Inc (METC) Stock Quote, History and News - Yahoo Finance

Ramaco Resources Inc (METC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...