Moxian Inc (MOXC): Price and Financial Metrics

MOXC Price/Volume Stats

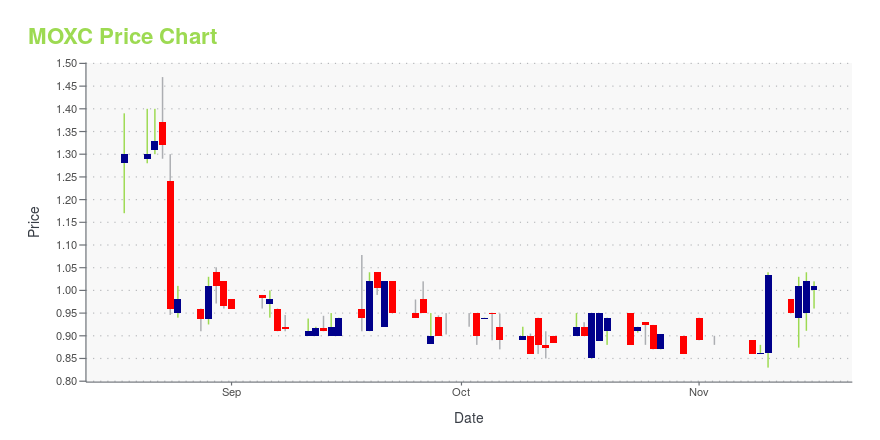

| Current price | $1.01 | 52-week high | $1.80 |

| Prev. close | $1.02 | 52-week low | $0.43 |

| Day low | $0.96 | Volume | 65,900 |

| Day high | $1.02 | Avg. volume | 52,280 |

| 50-day MA | $0.92 | Dividend yield | N/A |

| 200-day MA | $1.00 | Market Cap | 35.91M |

MOXC Stock Price Chart Interactive Chart >

Moxian Inc (MOXC) Company Bio

Moxian Inc provides a social marketing and promotion platform to merchants who desire to promote their businesses through online social media. The Company aims to build a one-stop comprehensive solution with a social customer relation management tool that ties with data analysis capabilities to allow business owners to engage in precision marketing. Moxian serves customers worldwide.

Latest MOXC News From Around the Web

Below are the latest news stories about MOXIAN (BVI) INC that investors may wish to consider to help them evaluate MOXC as an investment opportunity.

Moxian Announces Name Change to Abits Group IncHong Kong, Nov. 16, 2023 (GLOBE NEWSWIRE) -- Moxian (BVI) Inc (the “Company”) (NASDAQ: MOXC), a company engaged in bitcoin mining and related services in the United States, today announced that it has changed its corporate name from Moxian (BVI) Inc to Abits Group Inc. In addition, the Company’s ticker symbol on the Nasdaq Capital Market will be changed to “ABTS” from “MOXC” effective before the opening of trading on November 17, 2023. “The date marks an important milestone in the Company’s hist |

We Think Moxian (BVI) (NASDAQ:MOXC) Needs To Drive Business Growth CarefullyEven when a business is losing money, it's possible for shareholders to make money if they buy a good business at the... |

Management Discussion and Analysis of Results for the half-year to June 30, 2023Beijing, Nov. 08, 2023 (GLOBE NEWSWIRE) -- Moxian (BVI) Inc (NASDAQ: MOXC) Following a very difficult year in 2022, when bitcoin prices to a low of about $15,000, 2023 began with a more cheerful note. Bitcoin prices on average for the six months to June 2023 hover around the $26,000 mark. For the Company, the immediate priority was the location of a new permanent site for its bitcoin operations. The earlier site, Columbus in Georgia proved to be untenable following volatile electricity prices as |

Moxian Receives NASDAQ Notification Regarding Minimum Bid Price RequirementsBeijing, Oct. 18, 2023 (GLOBE NEWSWIRE) -- Moxian (BVI) Inc (“Moxian” or the “Company”) (NASDAQ: MOXC), a company engaged in bitcoin mining and related services in the United States, announced today on October 12, 2023, it received a letter from The Nasdaq Stock Market LLC (“Nasdaq”), notifying the Company that it is currently not in compliance with the minimum bid price requirement set forth under Nasdaq Listing Rule 5550(a)(2). It resulted from the fact that the closing bid price of the Compan |

MOXIAN POWERS UP ITS DUFF SITEHong Kong, Oct. 02, 2023 (GLOBE NEWSWIRE) -- Moxian (BVI) Inc. (NASDAQ: MOXC), is proud to announce the launch of its subsidiary, ABit USA's, groundbreaking bitcoin self mining site. As a fully owned subsidiary of Moxian, ABit USA has established itself as a key player in the cryptocurrency mining industry, and this latest venture marks a significant milestone in the company's growth and innovation. In April 2023, ABit USA secured a prime piece of land in Duff, Tennessee, to construct a state-of |

MOXC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 7.45% |

| 3-year | -93.37% |

| 5-year | -46.84% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -84.22% |

| 2021 | 107.25% |

| 2020 | -34.60% |

| 2019 | 23.75% |

Continue Researching MOXC

Want to do more research on Moxian Inc's stock and its price? Try the links below:Moxian Inc (MOXC) Stock Price | Nasdaq

Moxian Inc (MOXC) Stock Quote, History and News - Yahoo Finance

Moxian Inc (MOXC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...