MP Materials Corp. (MP): Price and Financial Metrics

MP Price/Volume Stats

| Current price | $13.90 | 52-week high | $24.44 |

| Prev. close | $13.80 | 52-week low | $12.09 |

| Day low | $13.76 | Volume | 1,403,117 |

| Day high | $14.15 | Avg. volume | 3,296,835 |

| 50-day MA | $14.91 | Dividend yield | N/A |

| 200-day MA | $15.98 | Market Cap | 2.30B |

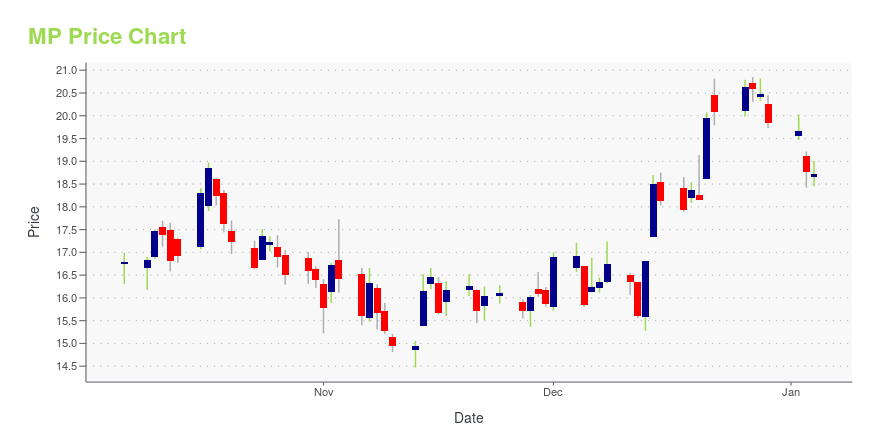

MP Stock Price Chart Interactive Chart >

MP Materials Corp. (MP) Company Bio

MP Materials Corp. owns and operates integrated rare earth mining and processing facilities. It owns and operates the Mountain Pass facility located in the Western Hemisphere. The company holds the mineral rights to the Mountain Pass mine and surrounding areas, as well as intellectual property rights related to the processing and development of rare earth minerals. It offers neodymium and praseodymium that are rare earth elements, which in combination form neodymium-praseodymium. The company was founded in 2017 and is headquartered in Las Vegas, Nevada.

Latest MP News From Around the Web

Below are the latest news stories about MP MATERIALS CORP that investors may wish to consider to help them evaluate MP as an investment opportunity.

RIO or MP: Which Is the Better Value Stock Right Now?RIO vs. MP: Which Stock Is the Better Value Option? |

13 Most Promising EV Stocks According To Hedge FundsIn this piece, we will take a look at the 13 most promising EV stocks according to hedge funds. If you want to skip our overview of the electric vehicle industry, then you can take a look at the 5 Most Promising EV Stocks According To Hedge Funds. The 21st century has bred several new […] |

MP Materials (NYSE:MP) Is Looking To Continue Growing Its Returns On CapitalFinding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key... |

RIO vs. MP: Which Stock Is the Better Value Option?RIO vs. MP: Which Stock Is the Better Value Option? |

Billionaire Lee Cooperman’s 10 Stock Picks with Huge Upside PotentialIn this article, we discuss billionaire Lee Cooperman’s 10 stock picks with huge upside potential. To skip the details of Mr. Cooperman’s life and investment strategy, go directly to Billionaire Lee Cooperman’s 5 Stock Picks with Huge Upside Potential. Leon Cooperman is the true definition of a “self-made” person. He was born in the South […] |

MP Price Returns

| 1-mo | 10.41% |

| 3-mo | -13.13% |

| 6-mo | -12.14% |

| 1-year | -40.42% |

| 3-year | -61.43% |

| 5-year | N/A |

| YTD | -29.97% |

| 2023 | -18.25% |

| 2022 | -46.54% |

| 2021 | 41.19% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...