Marpai, Inc. (MRAI): Price and Financial Metrics

MRAI Price/Volume Stats

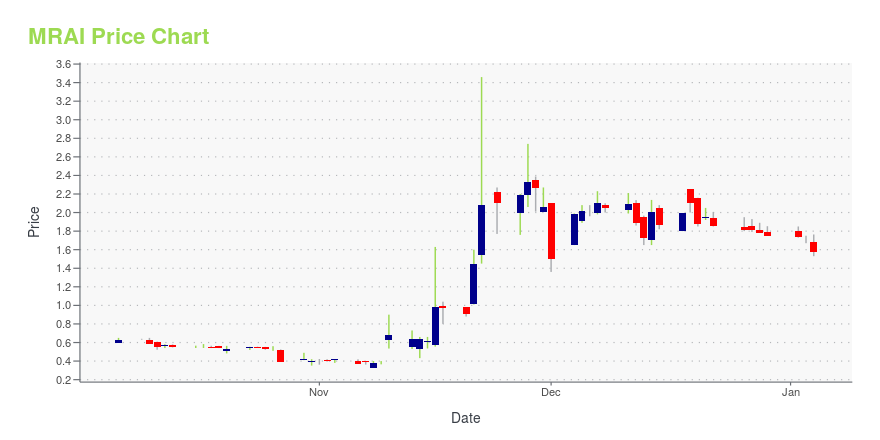

| Current price | $0.68 | 52-week high | $3.46 |

| Prev. close | $0.62 | 52-week low | $0.33 |

| Day low | $0.66 | Volume | 269 |

| Day high | $0.68 | Avg. volume | 423,239 |

| 50-day MA | $0.95 | Dividend yield | N/A |

| 200-day MA | $1.44 | Market Cap | 7.50M |

MRAI Stock Price Chart Interactive Chart >

Marpai, Inc. (MRAI) Company Bio

Marpai, Inc., a technology-driven healthcare payer, focuses on providing services to the self-insured employer market. It also offers ancillary services, such as care management, case management, actuarial services, health savings account administration, and cost containment services. The company was incorporated in 2021 and is based in Tampa, Florida.

Latest MRAI News From Around the Web

Below are the latest news stories about MARPAI INC that investors may wish to consider to help them evaluate MRAI as an investment opportunity.

Further Upside For Marpai, Inc. (NASDAQ:MRAI) Shares Could Introduce Price Risks After 93% BounceMarpai, Inc. ( NASDAQ:MRAI ) shares have continued their recent momentum with a 93% gain in the last month alone. Not... |

MARPAI, INC. ANNOUNCES APPOINTMENT OF TWO NEW INDEPENDENT DIRECTORSMarpai, Inc. ("Marpai" or the "Company") (Nasdaq: MRAI), an independent national Third-Party Administrator (TPA) company transforming the $22 billion TPA market supporting self-funded employer health plans, today announced the addition of two new members to its Board of Directors (the "Board") as part of the Company's ongoing transformation plan and commitment to strong corporate governance and shareholder value creation. Effective December 7, 2023, Jennifer Calabrese and Robert Pons joined Marp |

MARPAI, INC. REGAINS COMPLIANCE WITH NASDAQ MINIMUM BID PRICE COMPLIANCEMarpai, Inc. ("Marpai" or the "Company") (Nasdaq: MRAI), an independent national Third-Party Administrator (TPA) company transforming the $22 billion TPA market supporting self-funded employer health plans, today announced that the Company received a notification letter (the "Notification Letter") from the Listings Qualifications Department of The Nasdaq Stock Market LLC ("Nasdaq") notifying the Company that it has regained compliance with Nasdaq's minimum bid price requirement and that the matt |

MARPAI, INC. CONFIRMS IT HAS FILED AN APPEAL TO NASDAQ DELISTING LETTERMarpai, Inc. ("Marpai" or the "Company") (Nasdaq: MRAI), an independent national Third-Party Administrator (TPA) company transforming the $22 billion TPA market supporting self-funded employer health plans, today announced that it has requested and been granted a hearing before the Nasdaq Listing Qualifications Panel ("Panel") to appeal the determination by the Listing Qualifications Department of The Nasdaq Stock Market (the "Staff") and request a further extension of time and present its plan |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time for a breakdown of the biggest pre-market stock movers as we check out all of the hottest news on Thursday morning! |

MRAI Price Returns

| 1-mo | -24.44% |

| 3-mo | -68.81% |

| 6-mo | -47.69% |

| 1-year | -61.58% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -61.14% |

| 2023 | -39.24% |

| 2022 | -83.56% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...