Morgan Stanley (MS): Price and Financial Metrics

MS Price/Volume Stats

| Current price | $144.14 | 52-week high | $144.56 |

| Prev. close | $142.86 | 52-week low | $90.94 |

| Day low | $142.67 | Volume | 3,974,600 |

| Day high | $144.56 | Avg. volume | 7,040,234 |

| 50-day MA | $128.39 | Dividend yield | 2.62% |

| 200-day MA | $123.90 | Market Cap | 231.25B |

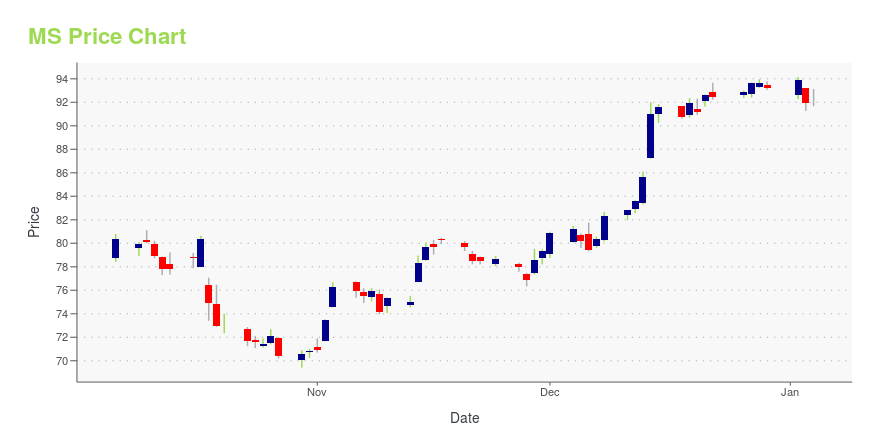

MS Stock Price Chart Interactive Chart >

Morgan Stanley (MS) Company Bio

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in the Morgan Stanley Building, Midtown Manhattan, New York City. With offices in more than 42 countries and more than 60,000 employees, the firm's clients include corporations, governments, institutions, and individuals. Morgan Stanley ranked No. 67 in the 2018 Fortune 500 list of the largest United States corporations by total revenue. (Source:Wikipedia)

MS Price Returns

| 1-mo | 12.47% |

| 3-mo | 45.54% |

| 6-mo | 16.14% |

| 1-year | N/A |

| 3-year | 110.88% |

| 5-year | N/A |

| YTD | 16.34% |

| 2024 | 39.73% |

| 2023 | 13.93% |

| 2022 | -10.34% |

| 2021 | 46.65% |

| 2020 | 38.09% |

MS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MS

Want to do more research on Morgan Stanley's stock and its price? Try the links below:Morgan Stanley (MS) Stock Price | Nasdaq

Morgan Stanley (MS) Stock Quote, History and News - Yahoo Finance

Morgan Stanley (MS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...