Mesabi Trust (MSB): Price and Financial Metrics

MSB Price/Volume Stats

| Current price | $16.68 | 52-week high | $22.39 |

| Prev. close | $16.68 | 52-week low | $16.08 |

| Day low | $16.54 | Volume | 23,100 |

| Day high | $16.72 | Avg. volume | 33,015 |

| 50-day MA | $17.56 | Dividend yield | 6.89% |

| 200-day MA | $19.05 | Market Cap | 218.84M |

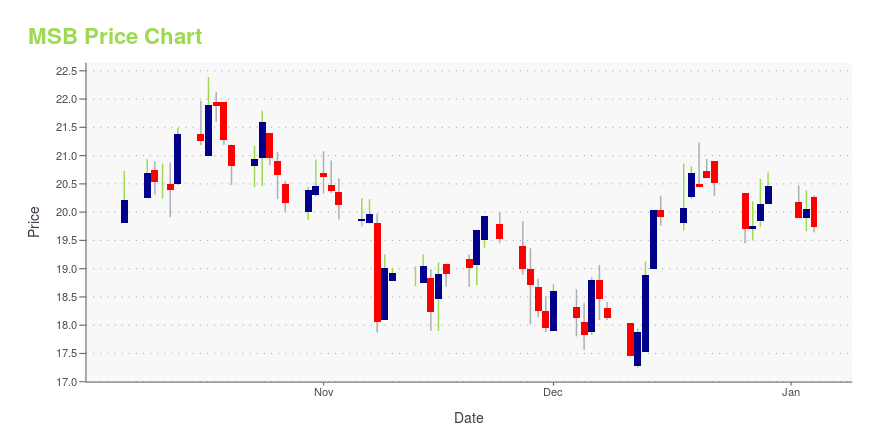

MSB Stock Price Chart Interactive Chart >

Mesabi Trust (MSB) Company Bio

Mesabi Trust engages in the collection and distribution of royalties and payment of expenses and liabilities. It holds interest in Peter Mitchell iron mine located near Babbitt and in Silver Bay, Minnesota. The company was founded on July 18, 1961 and is headquartered in New York, NY.

Latest MSB News From Around the Web

Below are the latest news stories about MESABI TRUST that investors may wish to consider to help them evaluate MSB as an investment opportunity.

Mesabi Trust Press ReleaseNEW YORK, October 13, 2023--Announcement of Mesabi Trust Distribution |

MSB Price Returns

| 1-mo | -2.28% |

| 3-mo | -7.80% |

| 6-mo | -8.68% |

| 1-year | -15.91% |

| 3-year | -44.17% |

| 5-year | -16.89% |

| YTD | -15.60% |

| 2023 | 15.55% |

| 2022 | -22.81% |

| 2021 | 3.66% |

| 2020 | 30.10% |

| 2019 | 12.34% |

MSB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MSB

Here are a few links from around the web to help you further your research on Mesabi Trust's stock as an investment opportunity:Mesabi Trust (MSB) Stock Price | Nasdaq

Mesabi Trust (MSB) Stock Quote, History and News - Yahoo Finance

Mesabi Trust (MSB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...