McEwen Mining Inc. (MUX): Price and Financial Metrics

MUX Price/Volume Stats

| Current price | $9.12 | 52-week high | $12.50 |

| Prev. close | $9.19 | 52-week low | $5.92 |

| Day low | $9.02 | Volume | 527,387 |

| Day high | $9.30 | Avg. volume | 707,145 |

| 50-day MA | $10.31 | Dividend yield | N/A |

| 200-day MA | $8.68 | Market Cap | 464.87M |

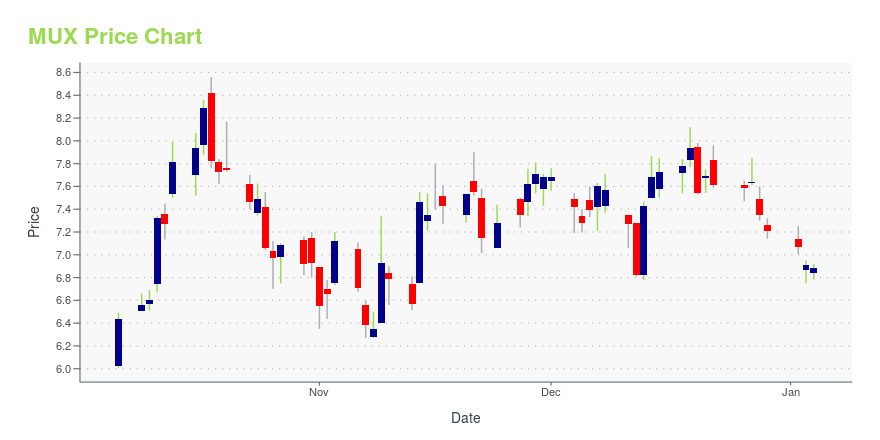

MUX Stock Price Chart Interactive Chart >

McEwen Mining Inc. (MUX) Company Bio

McEwen Mining Inc. explores for, develops, produces, and sells precious and base metals in Argentina, Mexico, and the United States. It primarily explores for gold, silver, and copper. The company was founded in 1979 and is based in Toronto, Canada.

Latest MUX News From Around the Web

Below are the latest news stories about MCEWEN MINING INC that investors may wish to consider to help them evaluate MUX as an investment opportunity.

McEwen Mining Closes Flow-Through FinancingTORONTO, Dec. 14, 2023 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce the closing of the previously announced private placement financing of 1,903,000 flow-through common shares for total gross proceeds of US$16.1 million (Cdn$22,016,150). The proceeds of this financing will be used exclusively for qualifying Canadian Exploration Expenditures (CEE) and Canadian Development Expenditures (CDE), within the meaning of subsection 66(15) of the Income Tax Act (Can |

McEwen Mining Appoints a New DirectorTORONTO, Dec. 13, 2023 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to welcome Nicolas Darveau-Garneau as the newest member of our Board of Directors. Nicolas Darveau-Garneau (“Nick”) is an artificial intelligence (AI) and digital transformation expert with over 25 years of experience. As Google’s Chief Evangelist, Nick worked with the C-suites of more than 800 of Google’s top customers to help them accelerate their digital transformation. He also worked as Chief Stra |

McEwen Mining: Q4 PreviewDecember 2023 Visit at Los Azules December 2023 Visit at Los Azules TORONTO, Dec. 12, 2023 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report consolidated production in the October-November period has increased to 29,600 gold equivalent ounces (“GEOs”)(1), a significant improvement over the first nine months of the year. In November, Gold Bar production increased to 7,800 gold ounces. As a result of the strong performance at Gold Bar, partially offset by slightly |

McEwen Mining Announces Flow-Through FinancingTORONTO, Nov. 22, 2023 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce a financing to fund continued exploration and development at the Fox Complex in the Timmins region of Ontario. The proceeds of this financing will be used exclusively for qualifying Canadian Exploration Expenditures (CEE) and Canadian Development Expenditures (CDE), within the meaning of subsection 66(15) of the Income Tax Act (Canada), on McEwen’s properties in the Timmins region: Part 1 |

McEwen Mining Inc. (NYSE:MUX) Q3 2023 Earnings Call TranscriptMcEwen Mining Inc. (NYSE:MUX) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Hello ladies and gentlemen. Welcome to McEwen Mining’s Q3 2023 Operating and Financial Results Conference Call. Present from the company today are Rob McEwen, Chairman and Chief Owner; Perry Ing, Chief Financial Officer; William Shaver, Chief Operating Officer; Michael Meding, Vice President […] |

MUX Price Returns

| 1-mo | -1.51% |

| 3-mo | -25.61% |

| 6-mo | 34.71% |

| 1-year | 11.08% |

| 3-year | -20.00% |

| 5-year | -49.89% |

| YTD | 26.49% |

| 2023 | 23.04% |

| 2022 | -33.90% |

| 2021 | -10.00% |

| 2020 | -22.44% |

| 2019 | -30.01% |

Continue Researching MUX

Want to see what other sources are saying about McEwen Mining Inc's financials and stock price? Try the links below:McEwen Mining Inc (MUX) Stock Price | Nasdaq

McEwen Mining Inc (MUX) Stock Quote, History and News - Yahoo Finance

McEwen Mining Inc (MUX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...