Norwegian Cruise Line Holdings Ltd. (NCLH): Price and Financial Metrics

NCLH Price/Volume Stats

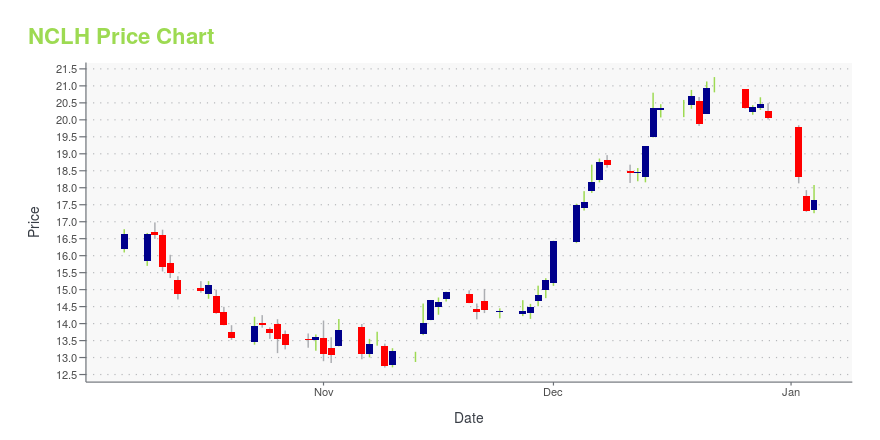

| Current price | $16.09 | 52-week high | $29.29 |

| Prev. close | $16.31 | 52-week low | $14.21 |

| Day low | $15.85 | Volume | 13,137,377 |

| Day high | $16.63 | Avg. volume | 13,144,223 |

| 50-day MA | $21.19 | Dividend yield | N/A |

| 200-day MA | $22.13 | Market Cap | 7.08B |

NCLH Stock Price Chart Interactive Chart >

Norwegian Cruise Line Holdings Ltd. (NCLH) Company Bio

Norwegian Cruise Line (NCL), also known in short as Norwegian, is an American cruise line founded in 1966, incorporated in Bermuda and headquartered in Miami. It is the third-largest cruise line in the world by passengers, controlling about 8.7% of the total worldwide share of the cruise market by passengers as of 2018. It is wholly owned by parent company Norwegian Cruise Line Holdings. (Source:Wikipedia)

NCLH Price Returns

| 1-mo | -19.71% |

| 3-mo | -39.15% |

| 6-mo | -32.42% |

| 1-year | -7.90% |

| 3-year | N/A |

| 5-year | 29.97% |

| YTD | -37.47% |

| 2024 | 28.39% |

| 2023 | 63.73% |

| 2022 | -40.98% |

| 2021 | -18.44% |

| 2020 | -56.46% |

Continue Researching NCLH

Want to see what other sources are saying about Norwegian Cruise Line Holdings Ltd's financials and stock price? Try the links below:Norwegian Cruise Line Holdings Ltd (NCLH) Stock Price | Nasdaq

Norwegian Cruise Line Holdings Ltd (NCLH) Stock Quote, History and News - Yahoo Finance

Norwegian Cruise Line Holdings Ltd (NCLH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...