Norwegian Cruise Line Holdings Ltd. (NCLH): Price and Financial Metrics

NCLH Price/Volume Stats

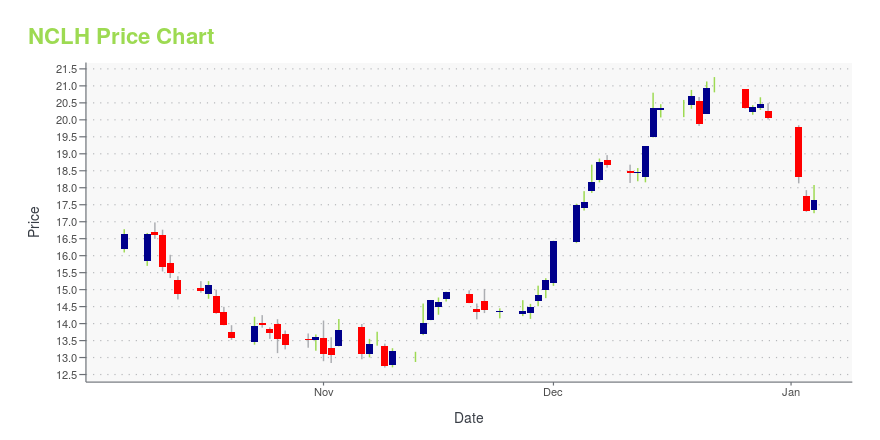

| Current price | $18.47 | 52-week high | $22.23 |

| Prev. close | $18.36 | 52-week low | $12.70 |

| Day low | $18.32 | Volume | 7,831,246 |

| Day high | $18.89 | Avg. volume | 12,822,600 |

| 50-day MA | $17.84 | Dividend yield | N/A |

| 200-day MA | $17.43 | Market Cap | 7.92B |

NCLH Stock Price Chart Interactive Chart >

Norwegian Cruise Line Holdings Ltd. (NCLH) Company Bio

Norwegian Cruise Line (NCL), also known in short as Norwegian, is an American cruise line founded in 1966, incorporated in Bermuda and headquartered in Miami. It is the third-largest cruise line in the world by passengers, controlling about 8.7% of the total worldwide share of the cruise market by passengers as of 2018. It is wholly owned by parent company Norwegian Cruise Line Holdings. (Source:Wikipedia)

Latest NCLH News From Around the Web

Below are the latest news stories about NORWEGIAN CRUISE LINE HOLDINGS LTD that investors may wish to consider to help them evaluate NCLH as an investment opportunity.

Anchors Aweigh for Hot Cruise Line StocksIt was the perfect year to own cruise line stocks. Royal Caribbean, Carnival and Norwegian Cruise shares are all on pace for their best annual performance on record, according to Dow Jones Market Data. |

Cruise Smooth Sailing to Continue in 2024: 3 Stocks to WatchCruise stocks like Royal Caribbean (RCL), Norwegian Cruise (NCLH) and Carnival (CCL) ride on pent-up demand, fleet expansion efforts, and digital performance marketing strategies. |

Investors in Norwegian Cruise Line Holdings (NYSE:NCLH) have seen favorable returns of 67% over the past yearPassive investing in index funds can generate returns that roughly match the overall market. But investors can boost... |

Cruise Stocks Rise After Carnival EarningsShares of cruise companies, one of the year’s best-performing industries, are ending 2023 with a bang. + Carnival Corp. shares gained 6.8% after reporting fourth-quarter results, the second-best gainer in the S&P 500. |

Norwegian Cruise (NCLH) Gains 62% YTD: Will it Continue?Norwegian Cruise (NCLH) benefits from strong demand and booking volume growth. |

NCLH Price Returns

| 1-mo | -0.70% |

| 3-mo | -2.99% |

| 6-mo | 7.26% |

| 1-year | -13.41% |

| 3-year | -27.43% |

| 5-year | -62.34% |

| YTD | -7.83% |

| 2023 | 63.73% |

| 2022 | -40.98% |

| 2021 | -18.44% |

| 2020 | -56.46% |

| 2019 | 37.79% |

Continue Researching NCLH

Want to see what other sources are saying about Norwegian Cruise Line Holdings Ltd's financials and stock price? Try the links below:Norwegian Cruise Line Holdings Ltd (NCLH) Stock Price | Nasdaq

Norwegian Cruise Line Holdings Ltd (NCLH) Stock Quote, History and News - Yahoo Finance

Norwegian Cruise Line Holdings Ltd (NCLH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...