New England Realty Associates Limited Partnership Class A Depositary Receipts Evidencing Units of Limited Partnership (NEN): Price and Financial Metrics

NEN Price/Volume Stats

| Current price | $71.25 | 52-week high | $73.72 |

| Prev. close | $69.46 | 52-week low | $64.00 |

| Day low | $70.00 | Volume | 1,832 |

| Day high | $71.50 | Avg. volume | 814 |

| 50-day MA | $70.81 | Dividend yield | 2.3% |

| 200-day MA | $70.65 | Market Cap | 202.07M |

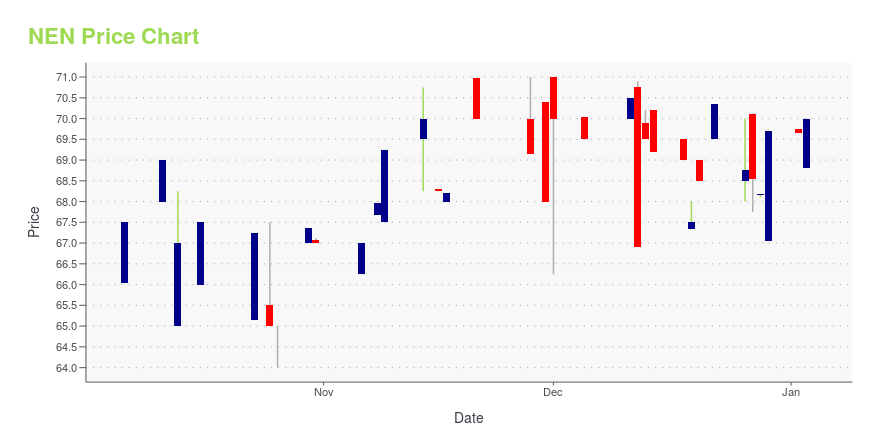

NEN Stock Price Chart Interactive Chart >

New England Realty Associates Limited Partnership Class A Depositary Receipts Evidencing Units of Limited Partnership (NEN) Company Bio

New England Realty Associates Limited Partnership engages in acquiring, developing, holding for investment, operating, and selling real estate properties in the United States. It owns and operates various residential apartment buildings, condominium units, and commercial properties located in Massachusetts and New Hampshire. The company was founded in 1977 and is based in Allston, Massachusetts.

Latest NEN News From Around the Web

Below are the latest news stories about NEW ENGLAND REALTY ASSOCIATES LIMITED PARTNERSHIP that investors may wish to consider to help them evaluate NEN as an investment opportunity.

New England Realty Associates (NYSE American: NEN) Receives Notice of Noncompliance with NYSE American Continued Listing StandardsNew England Realty Associates Limited Partnership (the "Partnership") today announced that on November 15, 2022, it received a notification letter from the Corporate Compliance Department of the NYSE American Exchange (the "NYSE American") indicating that as of November 15, 2022, the Partnership is not in compliance with the NYSE American's standards for continued listing of the Partnership's Depositary Receipts on the NYSE American as set forth in Section 1007 of the NYSE American Company Guide |

NEN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 4.98% |

| 3-year | 33.43% |

| 5-year | 39.25% |

| YTD | 5.75% |

| 2023 | 2.09% |

| 2022 | 8.24% |

| 2021 | 38.06% |

| 2020 | -17.02% |

| 2019 | 13.14% |

NEN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NEN

Want to do more research on New England Realty Associates Limited Partnership's stock and its price? Try the links below:New England Realty Associates Limited Partnership (NEN) Stock Price | Nasdaq

New England Realty Associates Limited Partnership (NEN) Stock Quote, History and News - Yahoo Finance

New England Realty Associates Limited Partnership (NEN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...