New Relic, Inc. (NEWR): Price and Financial Metrics

NEWR Price/Volume Stats

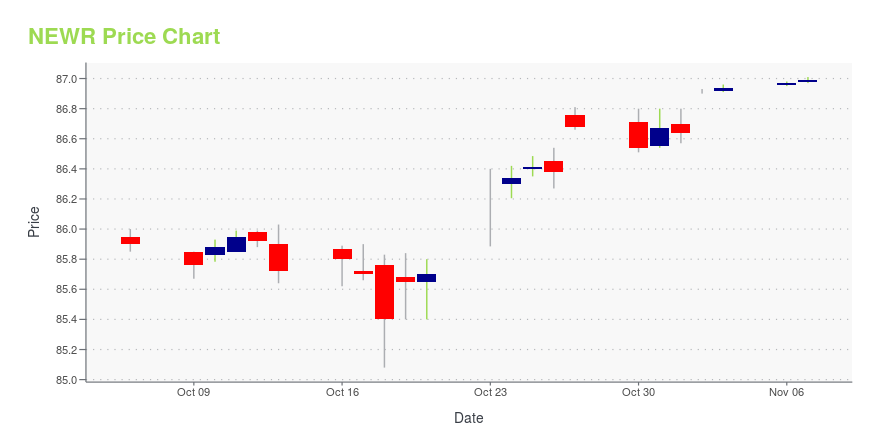

| Current price | $86.99 | 52-week high | $87.01 |

| Prev. close | $86.97 | 52-week low | $50.30 |

| Day low | $86.97 | Volume | 4,222,800 |

| Day high | $87.01 | Avg. volume | 1,044,550 |

| 50-day MA | $85.81 | Dividend yield | N/A |

| 200-day MA | $76.33 | Market Cap | 6.18B |

NEWR Stock Price Chart Interactive Chart >

New Relic, Inc. (NEWR) Company Bio

New Relic Inc. provides software analytics products worldwide. The companys cloud-based platform and suite of products enables organizations to collect, store, and analyze massive amounts of software data in real time. The company was founded in 2007 and is based in San Francisco, California.

Latest NEWR News From Around the Web

Below are the latest news stories about NEW RELIC INC that investors may wish to consider to help them evaluate NEWR as an investment opportunity.

New Relic Inc (NEWR) Reports Q2 2024 Earnings: Revenue Up 7% Year Over YearA detailed look at New Relic's financial performance for the second quarter of fiscal year 2024 |

New Relic Announces Second Quarter Fiscal Year 2024 ResultsSAN FRANCISCO, October 27, 2023--New Relic, Inc. (NYSE: NEWR), the all-in-one observability platform for every engineer, announced financial results for the second quarter of fiscal year 2024. |

New Relic (NYSE:NEWR) shareholders have earned a 43% return over the last yearThese days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can... |

Retailers Report Median Annual Outage Cost is Nearly $10 MillionSAN FRANCISCO, October 25, 2023--New Relic's State of Observability for Retail report finds that retailers report median annual outage cost is nearly $10 million. |

New Relic Named an APM Leader by GigaOmSAN FRANCISCO, October 20, 2023--New Relic (NYSE: NEWR), the all-in-one observability platform for every engineer, announced it has been named a Leader in the 2023 GigaOm Radar for APM. The report positions New Relic closest to the center of all four axes (Innovation, Maturity, Feature Play, and Platform Play), outperforming direct competitors in the observability space, and as the only vendor with outstanding focus and execution across all Key Criteria and Evaluation Metrics. This position repr |

NEWR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 19.16% |

| 3-year | 26.49% |

| 5-year | -8.21% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -48.66% |

| 2021 | 68.13% |

| 2020 | -0.47% |

| 2019 | -18.85% |

Continue Researching NEWR

Here are a few links from around the web to help you further your research on New Relic Inc's stock as an investment opportunity:New Relic Inc (NEWR) Stock Price | Nasdaq

New Relic Inc (NEWR) Stock Quote, History and News - Yahoo Finance

New Relic Inc (NEWR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...