Nano Dimension Ltd. ADR (NNDM): Price and Financial Metrics

NNDM Price/Volume Stats

| Current price | $2.46 | 52-week high | $3.35 |

| Prev. close | $2.29 | 52-week low | $2.06 |

| Day low | $2.37 | Volume | 3,056,261 |

| Day high | $2.50 | Avg. volume | 1,445,036 |

| 50-day MA | $2.43 | Dividend yield | N/A |

| 200-day MA | $2.51 | Market Cap | 522.64M |

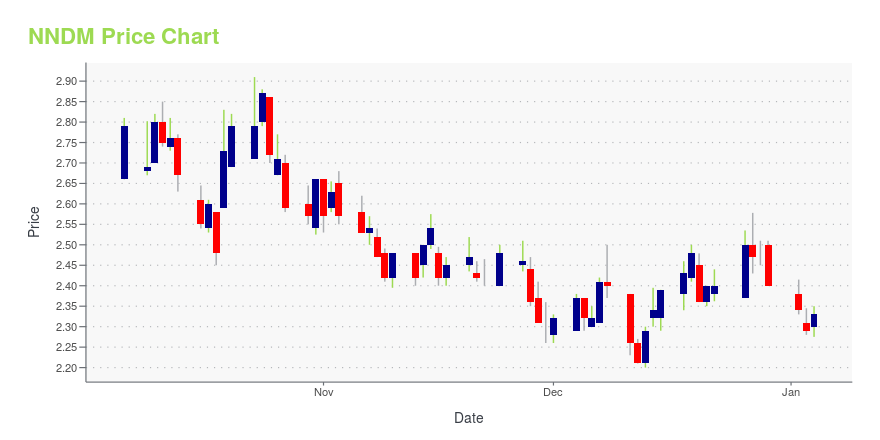

NNDM Stock Price Chart Interactive Chart >

Nano Dimension Ltd. ADR (NNDM) Company Bio

Nano Dimension Ltd. engages in the provision of intelligent machines for the fabrication of additively manufactured electronics. Its products and services include DragonFly Pro System, conductive and insulating inks for printed electronics, and optimized multi-material design of complex electronics. The company was founded by Amit Dror and Simon Fried in 2012 and headquartered in Ness Ziona, Israel.

Latest NNDM News From Around the Web

Below are the latest news stories about NANO DIMENSION LTD that investors may wish to consider to help them evaluate NNDM as an investment opportunity.

Why Stratasys Stock Blasted 13% Higher TodayA buyout offer got the market excited as 2023 draws to a close. |

Stratasys (SSYS) Gets Unsolicited Proposal From Nano DimensionStratasys (SSYS) confirms that the 3D printed electronics systems and additive manufacturing company, Nano Dimension, has offered a takeover proposal in an all-cash deal. |

Why Is 3D Printing Solutions Provider Stratasys Stock Soaring Today?Stratasys Ltd (NASDAQ: SSYS) shares are trading higher after it disclosed receiving a preliminary acquisition proposal from Nano Dimension Ltd (NASDAQ: NNDM) last week. NNDM intends to buy all the remaining outstanding shares that it currently doesn't own for $16.50 per share in cash. In September, SSYS' Board of directors disclosed that they had initiated a process to explore strategic alternatives for the company. SSYS' Board will review and consider Nano's unsolicited preliminary proposal, re |

Nano Dimension Offers to Buy Stratasys in $1.1 Billion Deal(Bloomberg) -- Nano Dimension Ltd. of Israel offered to buy Stratasys Ltd. in a cash deal that values the company at about $1.1 billion, the latest maneuvering in months of attempted dealmaking in the 3D printer industry. Most Read from BloombergHyperloop One to Shut Down After Failing to Reinvent TransitOpenAI Is in Talks to Raise New Funding at Valuation of $100 Billion or MoreSupreme Court Refuses to Fast-Track Trump Immunity ClashTencent Leads $80 Billion Rout as China Rekindles Crackdown Fe |

Nano Dimension Announces Preliminary All Cash Proposal to Acquire Stratasys for $16.50 per shareWaltham, Mass., Dec. 23, 2023 (GLOBE NEWSWIRE) -- Nano Dimension Ltd. (Nasdaq: NNDM) (“Nano Dimension”, or “Nano” or the “Company”), a leading supplier of Additively Manufactured Electronics (“AME”) and multi-dimensional polymer, metal & ceramic Additive Manufacturing (“AM”) 3D printers, today announced that it has submitted a preliminary all cash proposal to the Board of Directors of Stratasys Ltd. (Nasdaq: SSYS) (“Stratasys”) to purchase all the outstanding shares of Stratasys that it does not |

NNDM Price Returns

| 1-mo | 12.84% |

| 3-mo | 0.41% |

| 6-mo | 3.36% |

| 1-year | -22.40% |

| 3-year | -60.32% |

| 5-year | -38.75% |

| YTD | 2.50% |

| 2023 | 4.35% |

| 2022 | -39.47% |

| 2021 | -58.24% |

| 2020 | 259.68% |

| 2019 | -77.21% |

Continue Researching NNDM

Want to see what other sources are saying about Nano Dimension Ltd's financials and stock price? Try the links below:Nano Dimension Ltd (NNDM) Stock Price | Nasdaq

Nano Dimension Ltd (NNDM) Stock Quote, History and News - Yahoo Finance

Nano Dimension Ltd (NNDM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...