Optical Cable Corporation (OCC): Price and Financial Metrics

OCC Price/Volume Stats

| Current price | $2.67 | 52-week high | $4.01 |

| Prev. close | $2.79 | 52-week low | $2.26 |

| Day low | $2.67 | Volume | 5,624 |

| Day high | $2.75 | Avg. volume | 5,617 |

| 50-day MA | $2.76 | Dividend yield | N/A |

| 200-day MA | $2.76 | Market Cap | 21.07M |

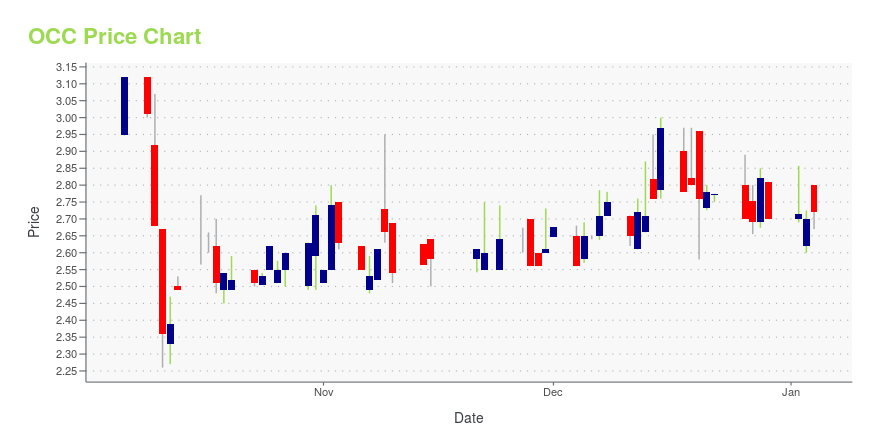

OCC Stock Price Chart Interactive Chart >

Latest OCC News From Around the Web

Below are the latest news stories about OPTICAL CABLE CORP that investors may wish to consider to help them evaluate OCC as an investment opportunity.

Optical Cable Full Year 2023 Earnings: EPS: US$0.26 (vs US$0.046 loss in FY 2022)Optical Cable ( NASDAQ:OCC ) Full Year 2023 Results Key Financial Results Revenue: US$72.2m (up 4.5% from FY 2022). Net... |

Q4 2023 Optical Cable Corp Earnings CallQ4 2023 Optical Cable Corp Earnings Call |

OCC Stock Earnings: Optical Cable Reported Results for Q4 2023Optical Cable just reported results for the fourth quarter of 2023. |

OPTICAL CABLE CORPORATION REPORTS FOURTH QUARTER AND FISCAL 2023 FINANCIAL RESULTSOptical Cable Corporation (Nasdaq GM: OCC) ("OCC®" or the "Company") today announced financial results for its fiscal year and its fourth quarter ended October 31, 2023. |

OPTICAL CABLE CORPORATION SCHEDULES CONFERENCE CALL TO DISCUSS FOURTH QUARTER AND FISCAL YEAR 2023 RESULTSOptical Cable Corporation (Nasdaq GM: OCC) ("OCC®") today announced that it will release its fourth quarter and fiscal year 2023 results on Wednesday, December 20, 2023. The fourth quarter and full year results are for the three-month and twelve-month periods ended October 31, 2023. The Company will also host a conference call on Wednesday, December 20, 2023, at 11:00 a.m. Eastern Time. |

OCC Price Returns

| 1-mo | -2.66% |

| 3-mo | -10.88% |

| 6-mo | -2.91% |

| 1-year | -27.25% |

| 3-year | -42.21% |

| 5-year | -31.54% |

| YTD | -1.11% |

| 2023 | -38.91% |

| 2022 | -17.69% |

| 2021 | 100.30% |

| 2020 | -17.51% |

| 2019 | -14.70% |

Continue Researching OCC

Here are a few links from around the web to help you further your research on Optical Cable Corp's stock as an investment opportunity:Optical Cable Corp (OCC) Stock Price | Nasdaq

Optical Cable Corp (OCC) Stock Quote, History and News - Yahoo Finance

Optical Cable Corp (OCC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...