Ocean Power Technologies, Inc. (OPTT): Price and Financial Metrics

OPTT Price/Volume Stats

| Current price | $0.31 | 52-week high | $0.61 |

| Prev. close | $0.42 | 52-week low | $0.12 |

| Day low | $0.29 | Volume | 12,688,217 |

| Day high | $0.38 | Avg. volume | 13,682,141 |

| 50-day MA | $0.25 | Dividend yield | N/A |

| 200-day MA | $0.28 | Market Cap | 18.33M |

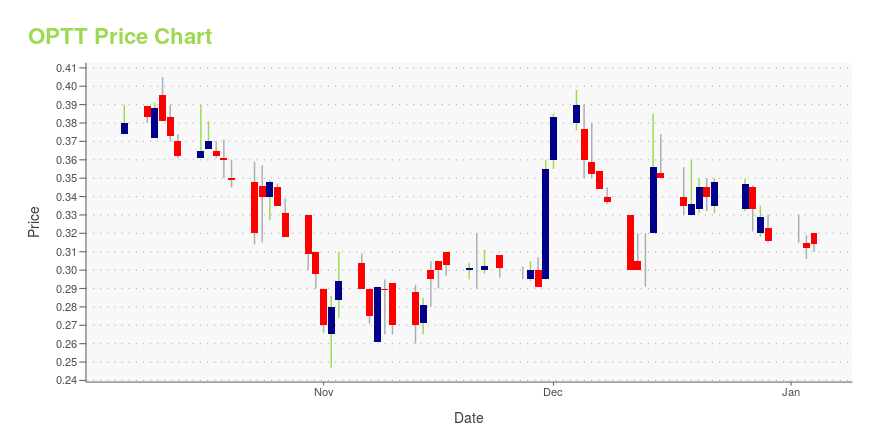

OPTT Stock Price Chart Interactive Chart >

Ocean Power Technologies, Inc. (OPTT) Company Bio

Ocean Power Technologies, Inc. manufactures equipment that generates electricity from the motion of ocean waves. The Company develops wave energy technology and converts ocean waves energy into electricity. Ocean Power Technologies serves customers worldwide.

Latest OPTT News From Around the Web

Below are the latest news stories about OCEAN POWER TECHNOLOGIES INC that investors may wish to consider to help them evaluate OPTT as an investment opportunity.

Paragon Reminds OPT Shareholders to ONLY Vote Blue Proxy and Send Message to OPT Board that Change is Needed to Avoid Continued Shareholder LossesEASTON, PA / ACCESSWIRE / December 28, 2023 / Paragon Technologies, Inc. ("Paragon"), a diversified holding company, and the largest shareholder of Ocean Power Technologies, Inc. (NYSE American:OPTT), ("Company") ("OPT"), would like to thank shareholders ... |

Paragon Technologies Issues Statement to the Stockholders of Ocean Power Technologies. Reminds Stockholders to Vote ONLY the Blue Proxy CardExpresses Serious Concerns About OPT's alarming financial and Stock Price Underperformance Under the Current Board and CEO. Believes that the Board and CEO Are Misleading Shareholders by Making Positive Statements About the Future of Ocean Power While ... |

Paragon Technologies Commences Mailing of BLUE Proxy Card and Issues Letter to Ocean Power Technologies ShareholdersEASTON, PA / ACCESSWIRE / December 18, 2023 / Paragon Technologies, Inc. ("Paragon"), a diversified holding company, owning approximately 4.9% of the outstanding shares of Ocean Power Technologies, Inc. (NYSE American:OPTT), ("Company") ("OPT"), today ... |

OPTT Stock Earnings: Ocean Power Techs Reported Results for Q2 2024Ocean Power Techs just reported results for the second quarter of 2024. |

Ocean Power Technologies, Inc. Announces Second Quarter Fiscal 2024 ResultsAchieved First Multi-Buoy and Multi-Vessel OrdersMONROE TOWNSHIP, N.J., Dec. 13, 2023 (GLOBE NEWSWIRE) -- Ocean Power Technologies, Inc. ("OPT" or "the Company") (NYSE American: OPTT), today announced financial results for its fiscal second quarter ended October 31, 2023 (“Q224”), including year-over-year revenue, gross profit, and pipeline growth. Financial Highlights from the second quarter: OPT’s pipeline at October 31, 2023 (“Q224”) was approximately $93 million, representing a 221% year-ove |

OPTT Price Returns

| 1-mo | 71.08% |

| 3-mo | 63.16% |

| 6-mo | 1.64% |

| 1-year | -47.98% |

| 3-year | -84.10% |

| 5-year | -81.66% |

| YTD | -1.90% |

| 2023 | -29.79% |

| 2022 | -69.59% |

| 2021 | -44.98% |

| 2020 | 209.20% |

| 2019 | -87.21% |

Continue Researching OPTT

Here are a few links from around the web to help you further your research on Ocean Power Technologies Inc's stock as an investment opportunity:Ocean Power Technologies Inc (OPTT) Stock Price | Nasdaq

Ocean Power Technologies Inc (OPTT) Stock Quote, History and News - Yahoo Finance

Ocean Power Technologies Inc (OPTT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...