PFSweb, Inc. (PFSW): Price and Financial Metrics

PFSW Price/Volume Stats

| Current price | $7.49 | 52-week high | $11.45 |

| Prev. close | $7.49 | 52-week low | $3.80 |

| Day low | $7.48 | Volume | 115,500 |

| Day high | $7.50 | Avg. volume | 164,196 |

| 50-day MA | $6.29 | Dividend yield | N/A |

| 200-day MA | $5.35 | Market Cap | 170.36M |

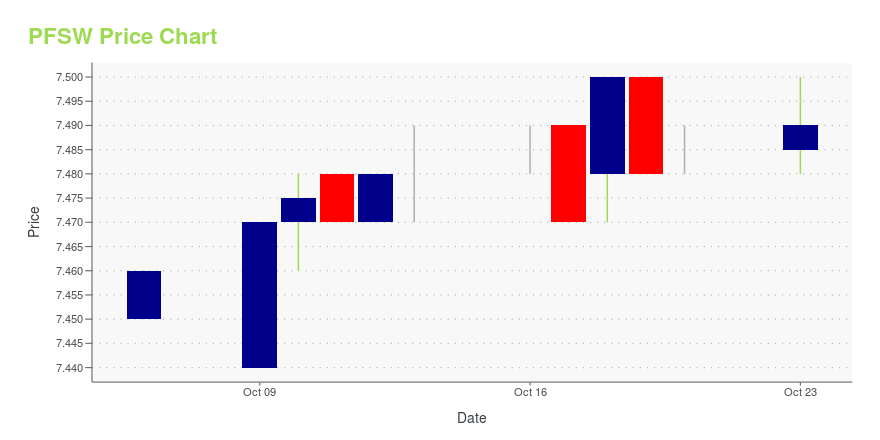

PFSW Stock Price Chart Interactive Chart >

PFSweb, Inc. (PFSW) Company Bio

PFSweb Inc. is a global provider of end-to-end eCommerce solutions including digital agency and marketing services, technology development services, business process outsourcing services and a complete omni-channel technology ecosystem. The company was founded in 1999 and is based in Allen, Texas.

Latest PFSW News From Around the Web

Below are the latest news stories about PFSWEB INC that investors may wish to consider to help them evaluate PFSW as an investment opportunity.

Favourable Signals For PFSweb: Numerous Insiders Acquired StockUsually, when one insider buys stock, it might not be a monumental event. But when multiple insiders are buying like... |

This Growth Stock Just Made Another Acquisition. Is It a Buy?GXO Logistics (NYSE: GXO) was created in 2021 in a spinoff from XPO with a simple value proposition for investors. The company would be the largest pure-play contract logistics company and would use its size and scale to grow in a fragmented industry through acquisitions, new technology, and organic growth. Thus far, the company has kept that promise, delivering solid organic growth and making its first acquisition last year, taking over Clipper Logistics, a U.K.-based company known for its prowess in reverse logistics (processing returns). |

Analysts on Wall Street Lower Ratings for These 10 StocksIn this article, we will discuss the 10 stocks recently downgraded by analysts. If you want to see more such stocks on the list, you can directly visit Analysts on Wall Street Lower Ratings for These 5 Stocks. Stock markets displayed volatility as traders prepared for the possibility of a hawkish message from major central banks […] |

GXO acquires luxury goods fulfillment provider PFSwebGXO has expanded into high-end verticals with its acquisition of PFS Web. The post GXO acquires luxury goods fulfillment provider PFSweb appeared first on FreightWaves. |

PFSweb, Inc. to be Acquired by GXO Logistics, Inc.- GXO Logistics to Acquire All Outstanding PFSweb Shares for $7.50 Per Share, Representing a 58% Premium to PFSW’s 20-Day VWAP - - Transaction Expected to be Completed in the Fourth Quarter of 2023 - IRVING, Texas, Sept. 14, 2023 (GLOBE NEWSWIRE) -- PFSweb, Inc. (NASDAQ: PFSW) (the “Company” or “PFSweb”) has entered into an Agreement and Plan of Merger to be acquired by GXO Logistics, Inc. (NYSE: GXO) (“GXO”), the world’s largest pure-play contract logistics provider, for an equity value of appr |

PFSW Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 66.08% |

| 3-year | 14.88% |

| 5-year | 300.34% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -15.27% |

| 2021 | 91.38% |

| 2020 | 76.18% |

| 2019 | -25.54% |

Continue Researching PFSW

Want to do more research on Pfsweb Inc's stock and its price? Try the links below:Pfsweb Inc (PFSW) Stock Price | Nasdaq

Pfsweb Inc (PFSW) Stock Quote, History and News - Yahoo Finance

Pfsweb Inc (PFSW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...