PropertyGuru Limited (PGRU): Price and Financial Metrics

PGRU Price/Volume Stats

| Current price | $6.44 | 52-week high | $6.63 |

| Prev. close | $6.45 | 52-week low | $3.15 |

| Day low | $6.25 | Volume | 115,710 |

| Day high | $6.54 | Avg. volume | 27,585 |

| 50-day MA | $5.20 | Dividend yield | N/A |

| 200-day MA | $3.99 | Market Cap | 1.05B |

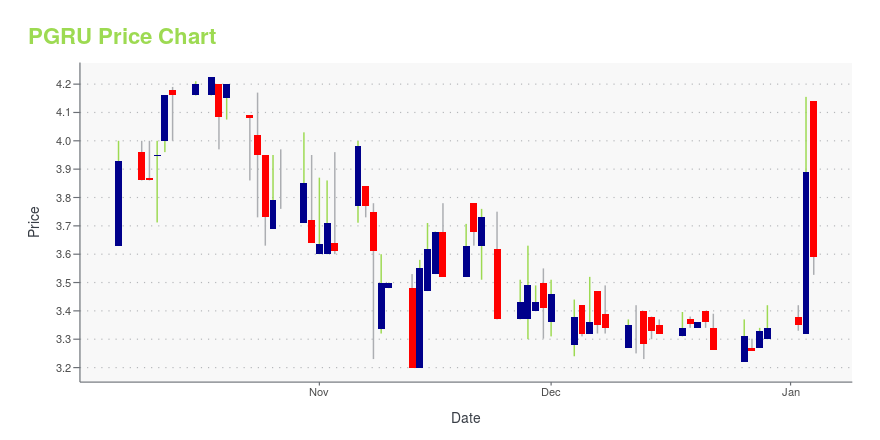

PGRU Stock Price Chart Interactive Chart >

PropertyGuru Limited (PGRU) Company Bio

PropertyGuru Limited operates online property classifieds marketplaces in Singapore, Vietnam, Malaysia, Thailand, and Indonesia. It serves agents and developers to advertise residential and commercial properties for sale or rent to property seekers. The company was incorporated in 2006 and is based in Singapore.

Latest PGRU News From Around the Web

Below are the latest news stories about PROPERTYGURU GROUP LTD that investors may wish to consider to help them evaluate PGRU as an investment opportunity.

PropertyGuru Reports Third Quarter 2023 ResultsSINGAPORE, November 21, 2023--PropertyGuru Group Limited (NYSE: PGRU) ("PropertyGuru" or the "Company"), Southeast Asia’s leading2, property technology ("PropTech") company, today announced financial results for the quarter ended September 30, 2023. Revenue of S$39 million in the third quarter 2023 increased 13% year over year. Net profit was S$0.3 million in the third quarter and Adjusted EBITDA3 was S$5 million. This compares to a net loss of S$7 million4 and Adjusted EBITDA of S$2 million in |

PropertyGuru Appoints Ray Ferguson as Chairman of the Board With Effect From January 1, 2024SINGAPORE, November 16, 2023--PropertyGuru Group Limited (NYSE: PGRU) ("PropertyGuru" or the "Company"), Southeast Asia’s leading1 property technology ("PropTech") company, today announced the appointment by the board of directors ("Board") of Mr. Ray Ferguson as an independent non-executive director and Chairman of the Board with effect from January 1, 2024. |

PropertyGuru Group Limited to Report Third Quarter 2023 Financial Results on November 21, 2023SINGAPORE, October 31, 2023--PropertyGuru Group Limited (NYSE: PGRU) ("PropertyGuru" or "the Company"), Southeast Asia’s leading1 property technology company, today announced that it will report third quarter 2023 financial results on Tuesday, November 21, 2023. Management will host a conference call and webcast on Tuesday, November 21 at 7:30am Eastern Standard Time (EST) / 8:30pm Singapore Standard Time (SGT), following the release of its earnings materials, to discuss the Company’s financial |

PropertyGuru Reports Second Quarter 2023 ResultsSINGAPORE, August 24, 2023--PropertyGuru Group Limited (NYSE: PGRU) ("PropertyGuru" or the "Company"), Southeast Asia’s leading2, property technology ("PropTech") company, today announced financial results for the quarter ended June 30, 2023. Revenue of S$37 million in the second quarter of 2023 increased 12% year over year. Net loss was S$6 million in the second quarter and Adjusted EBITDA3 was positive S$5 million. This compares to net income of S$4 million and Adjusted EBITDA4 of positive S$0 |

PropertyGuru Group Limited to Report Second Quarter 2023 Financial Results on August 24, 2023SINGAPORE, August 04, 2023--PropertyGuru Group Limited (NYSE: PGRU) ("PropertyGuru" or "the Company"), Southeast Asia’s leading1 property technology company, today announced that it will report second quarter 2023 financial results on Thursday, August 24, 2023. Management will host a conference call and webcast on Thursday, August 24 at 8:00am Eastern Standard Time (EST) / 8:00pm Singapore Standard Time (SGT), following the release of its earnings materials, to discuss the Company’s financial re |

PGRU Price Returns

| 1-mo | 26.27% |

| 3-mo | 71.73% |

| 6-mo | 93.39% |

| 1-year | 57.23% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 92.81% |

| 2023 | -22.51% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...