POSCO Holdings Inc. ADR (PKX): Price and Financial Metrics

PKX Price/Volume Stats

| Current price | $65.36 | 52-week high | $125.51 |

| Prev. close | $64.94 | 52-week low | $62.50 |

| Day low | $64.53 | Volume | 103,132 |

| Day high | $65.49 | Avg. volume | 105,021 |

| 50-day MA | $68.22 | Dividend yield | 2.21% |

| 200-day MA | $79.32 | Market Cap | 19.77B |

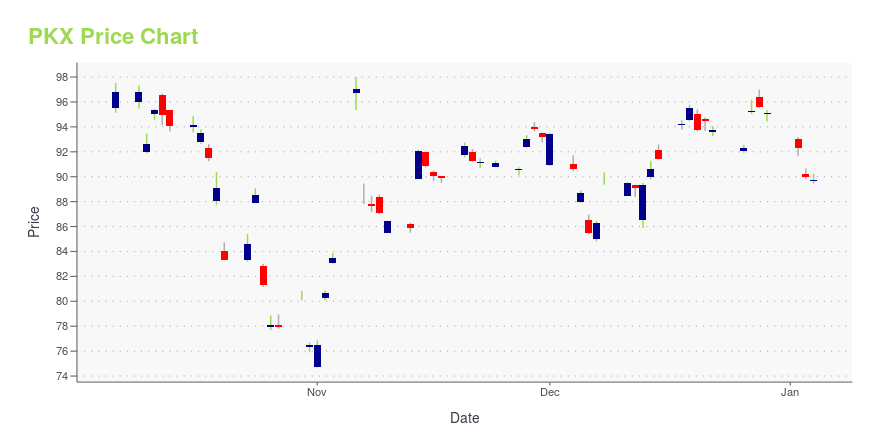

PKX Stock Price Chart Interactive Chart >

POSCO Holdings Inc. ADR (PKX) Company Bio

POSCO (formerly Pohang Iron and Steel Company) is a South Korean steel-making company headquartered in Pohang, South Korea. It had an output of 42,000,000 metric tons (41,000,000 long tons; 46,000,000 short tons) of crude steel in 2015, making it the world's fourth-largest steelmaker by this measure. In 2010, it was the world's largest steel manufacturing company by market value. Also, in 2012, it was named as the world's 146th-largest corporation by the Fortune Global 500. (Source:Wikipedia)

Latest PKX News From Around the Web

Below are the latest news stories about POSCO HOLDINGS INC that investors may wish to consider to help them evaluate PKX as an investment opportunity.

Korea Battery Stocks Gain on US Rules to Curb China(Bloomberg) -- South Korean battery stocks rose Monday after the US released guidelines designed to limit electric car makers from sourcing battery materials from China. Most Read from BloombergCarlyle’s Rubenstein Is in Talks to Acquire Baltimore OriolesElon Musk's SpaceX Valued at $175 Billion or More in Tender OfferWall Street’s AI Craze Drives Nasdaq 100 Up 1.5%: Markets WrapHarvard, Penn Heads Walk Back Genocide Answers After BacklashApple Readies New iPads and M3 MacBook Air to Combat Sale |

20 Most Valuable Mining Companies in the WorldThis article will list the top global mining companies and their current dynamics. If you want to skip our overview of the recent development in the mining sector, read 5 Most Valuable Mining Companies in the World. According to the Business Research Company, the global mining industry was valued at $2.14 trillion in 2023, an increase from $2.02 trillion […] |

Teck Resources (TECK) Sells Steelmaking Coal Unit, Shares Up 3%Teck Resources (TECK) sells its steelmaking coal business, which sets the stage for the company's growth as a major Canadian-based producer of copper and other future-oriented metals. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayWe're starting off the trading week right with a breakdown of the biggest pre-market stock movers worth noting on Monday morning! |

POSCO Holdings Inc. (NYSE:PKX) Q3 2023 Earnings Call TranscriptPOSCO Holdings Inc. (NYSE:PKX) Q3 2023 Earnings Call Transcript October 29, 2023 Operator: We will now begin the 2023 Third Quarter Earnings Release Conference Call of POSCO Holdings. As for today’s conference call, after the presentation of POSCO Holdings, we will have a Q&A session with the participants. [Operator Instructions] Now we will start the […] |

PKX Price Returns

| 1-mo | -0.12% |

| 3-mo | -8.72% |

| 6-mo | -14.27% |

| 1-year | -42.18% |

| 3-year | -10.07% |

| 5-year | 50.39% |

| YTD | -30.34% |

| 2023 | 77.20% |

| 2022 | -3.53% |

| 2021 | -3.64% |

| 2020 | 25.13% |

| 2019 | -6.03% |

PKX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PKX

Here are a few links from around the web to help you further your research on Posco's stock as an investment opportunity:Posco (PKX) Stock Price | Nasdaq

Posco (PKX) Stock Quote, History and News - Yahoo Finance

Posco (PKX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...