Polymet Mining Corporation Ordinary Shares (Canada) (PLM): Price and Financial Metrics

PLM Price/Volume Stats

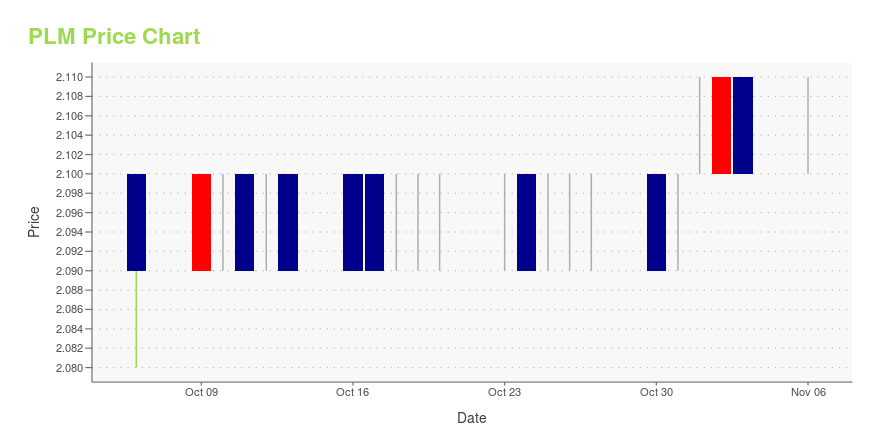

| Current price | $2.10 | 52-week high | $3.22 |

| Prev. close | $2.11 | 52-week low | $0.75 |

| Day low | $2.10 | Volume | 486,700 |

| Day high | $2.11 | Avg. volume | 314,280 |

| 50-day MA | $2.09 | Dividend yield | N/A |

| 200-day MA | $1.99 | Market Cap | 408.37M |

PLM Stock Price Chart Interactive Chart >

Polymet Mining Corporation Ordinary Shares (Canada) (PLM) Company Bio

PolyMet Mining Corporation engages in the exploration and development of natural resource properties. The company was formerly known as Fleck Resources Ltd. and changed its name to PolyMet Mining Corp. in June 1998. The company was founded in 1981 and is based in Toronto, Canada.

Latest PLM News From Around the Web

Below are the latest news stories about POLYMET MINING CORP that investors may wish to consider to help them evaluate PLM as an investment opportunity.

PolyMet Shareholders to Vote on Arrangement with GlencorePolyMet's Unconflicted Board of Directors recommends Minority Shareholders vote FOR the ArrangementBoth leading independent proxy advisors, ISS and Glass Lewis, recommend shareholders vote in favor of the transactionShareholders are encouraged to vote in advance of the proxy deadline on October 30, 2023, at 12:00 p.m. (Eastern Time)Shareholders who have questions or need assistance with voting their shares can contact Laurel Hill Advisory Group at 1-877-452-7184 or by e-mail at assistance@laurel |

ISS and Glass Lewis Recommend Polymet Mining Shareholders Vote FOR the Arrangement with GlencoreISS finds "significant premium of 167%", consideration of alternatives, and the risks of non-approval as its basis for supporting the all-cash transactionGlass Lewis cites the certainty and liquidity of cash, safeguarding of minority shareholder interests, and compelling premium as rationale for its endorsementShareholders are encouraged to vote well in advance of the proxy deadline on October 30, 2023, at 12:00 p.m. (Eastern Time)St. Paul, Minnesota--(Newsfile Corp. - October 16, 2023) - PolyMe |

PolyMet files Management Information Circular to consider the US$2.11 per share Glencore proposalUnanimous support from the Board of Directors to acquire the remaining approximately 17.8%A 167% premium to the day prior to the offerFor any shareholder inquiries and voting support contact Laurel Hill Advisory Group North American Toll Free: 1-877-452-7184 (or 416-304-0211 for shareholders outside North America) Email: [email protected]. Paul, Minnesota--(Newsfile Corp. - October 2, 2023) - PolyMet Mining Corp. (TSX: POM) (NYSE American: PLM) ("PolyMet" or the "Company") announced to |

PolyMet Receives Interim Order for Proposed Arrangement with Glencore and Provides Details of Shareholders' MeetingSt. Paul, Minnesota--(Newsfile Corp. - September 28, 2023) - PolyMet Mining Corp. (TSX: POM) (NYSE American: PLM) ("PolyMet" or the "Company") announced today that the Supreme Court of British Columbia (the "Court") has granted an interim order (the "Interim Order") in connection with the previously announced statutory plan of arrangement under Part 9, Division 5 of the Business Corporations Act (British Columbia), pursuant to which, among other things and subject to the satisfaction or ... |

PolyMet Mining reports results for period ended June 30, 2023St. Paul, Minnesota--(Newsfile Corp. - August 10, 2023) - PolyMet Mining Corp. (TSX: POM) (NYSE American: PLM) ("PolyMet" or the "company"), today reports its financial results for the three and six months ended June 30, 2023.The company experienced three significant events during the period:Completed an offering of rights to shareholders of common shares of the company raising approximately $195M in gross proceeds (the "Rights Offering") to repay outstanding debt, fund PolyMet's share of the .. |

PLM Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 0.96% |

| 3-year | -32.26% |

| 5-year | -44.74% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 6.00% |

| 2021 | -26.69% |

| 2020 | 33.99% |

| 2019 | -68.58% |

Loading social stream, please wait...