Palantir Technologies Inc. (PLTR): Price and Financial Metrics

PLTR Price/Volume Stats

| Current price | $141.41 | 52-week high | $144.86 |

| Prev. close | $137.40 | 52-week low | $21.23 |

| Day low | $139.81 | Volume | 80,476,734 |

| Day high | $144.86 | Avg. volume | 100,321,117 |

| 50-day MA | $115.26 | Dividend yield | N/A |

| 200-day MA | $79.06 | Market Cap | 333.72B |

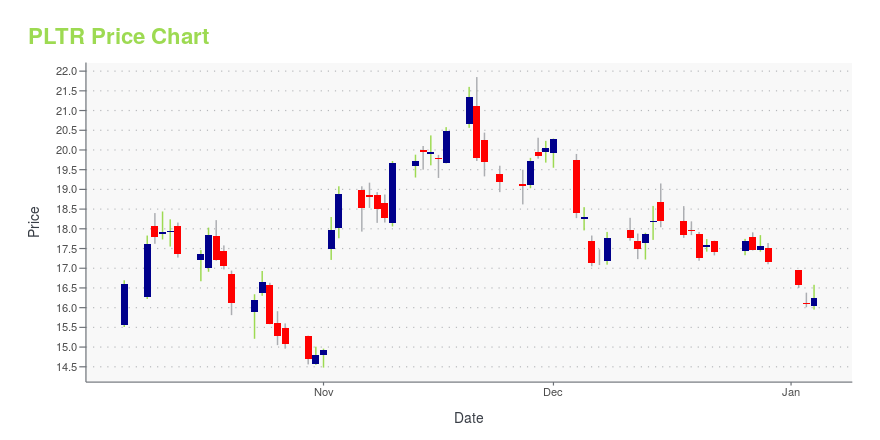

PLTR Stock Price Chart Interactive Chart >

Palantir Technologies Inc. (PLTR) Company Bio

Palantir Technologies is a public American software company that specializes in big data analytics. Headquartered in Denver, Colorado, it was founded by Peter Thiel,Nathan Gettings, Joe Lonsdale, Stephen Cohen, and Alex Karp in 2003. The company's name is derived from The Lord of the Rings where the magical palantíri were "seeing-stones," described as indestructible balls of crystal used for communication and to see events in other parts of the world. (Source:Wikipedia)

PLTR Price Returns

| 1-mo | 9.18% |

| 3-mo | 68.57% |

| 6-mo | 97.75% |

| 1-year | 499.96% |

| 3-year | 1,616.14% |

| 5-year | N/A |

| YTD | 86.98% |

| 2024 | 340.48% |

| 2023 | 167.45% |

| 2022 | -64.74% |

| 2021 | -22.68% |

| 2020 | N/A |

Loading social stream, please wait...