Perdoceo Education Corporation (PRDO): Price and Financial Metrics

PRDO Price/Volume Stats

| Current price | $29.12 | 52-week high | $34.60 |

| Prev. close | $29.31 | 52-week low | $20.55 |

| Day low | $29.05 | Volume | 499,700 |

| Day high | $29.55 | Avg. volume | 576,463 |

| 50-day MA | $31.58 | Dividend yield | 1.76% |

| 200-day MA | $26.95 | Market Cap | 1.91B |

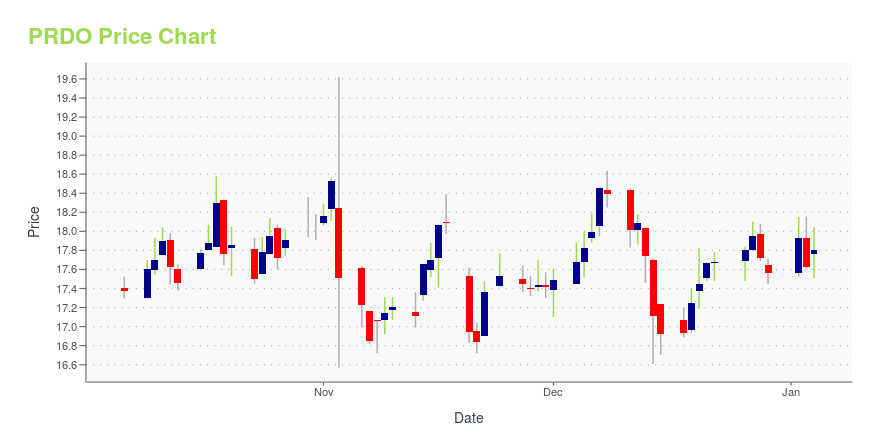

PRDO Stock Price Chart Interactive Chart >

Perdoceo Education Corporation (PRDO) Company Bio

Perdoceo Education Corporation (formerly Career Education Corporation) operates colleges, institutions, and universities that provide education to student population in various career-oriented disciplines through online, on-ground, and hybrid learning program offerings in the United States. The company operates through four segments: Colorado Technical University (CTU), American InterContinental University (AIU), Career Colleges, and Transitional Group. The company was founded in 1994 and is based in Schaumburg, Illinois.

PRDO Price Returns

| 1-mo | -8.57% |

| 3-mo | 13.01% |

| 6-mo | 7.52% |

| 1-year | 34.93% |

| 3-year | 147.35% |

| 5-year | 78.86% |

| YTD | 11.02% |

| 2024 | 54.04% |

| 2023 | 27.99% |

| 2022 | 18.20% |

| 2021 | -6.89% |

| 2020 | -31.32% |

PRDO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...