PROG Holdings, Inc. (PRG): Price and Financial Metrics

PRG Price/Volume Stats

| Current price | $43.93 | 52-week high | $44.54 |

| Prev. close | $42.33 | 52-week low | $26.39 |

| Day low | $42.94 | Volume | 1,191,467 |

| Day high | $44.54 | Avg. volume | 400,646 |

| 50-day MA | $35.51 | Dividend yield | 1.39% |

| 200-day MA | $32.15 | Market Cap | 1.90B |

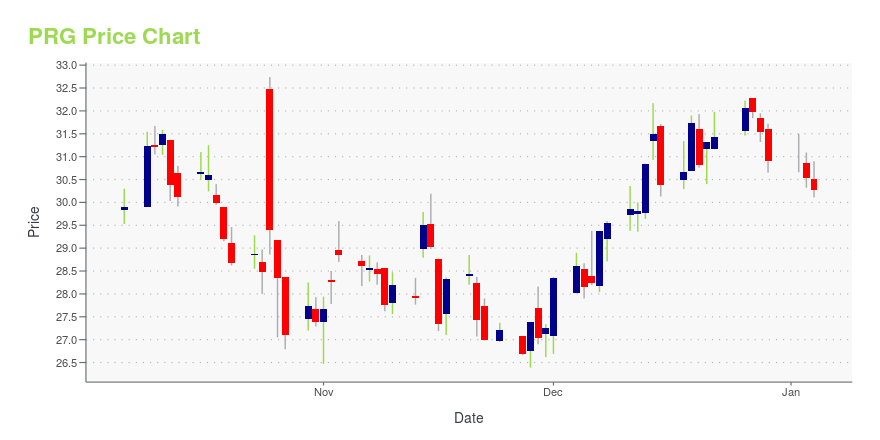

PRG Stock Price Chart Interactive Chart >

PROG Holdings, Inc. (PRG) Company Bio

PROG Holdings, Inc. operates as a holding company. The Company, through its subsidiaries, provides commercial equipment finance and leasing services. PROG Holdings serves customers in the United States.

Latest PRG News From Around the Web

Below are the latest news stories about PROG HOLDINGS INC that investors may wish to consider to help them evaluate PRG as an investment opportunity.

PROG Foundation to Hold Community Open House for Grand Opening of PROG Development Center in West Valley CityWEST VALLEY CITY, Utah, November 09, 2023--The PROG Foundation, the non-profit founded by PROG Holdings, Inc. (NYSE:PRG), announces a community open house event celebrating the grand opening of its PROG Development Center in West Valley City, UT on Thursday, November 9, 2023. |

PROG Holdings Beats Third Quarter 2023 Expectations, Raises Full-Year Financial OutlookSALT LAKE CITY, October 25, 2023--PROG Holdings, Inc. (NYSE:PRG), the fintech holding company for Progressive Leasing, Vive Financial, Four Technologies, and Build, today announced financial results for the third quarter ended September 30, 2023. |

PROG Holdings, Inc. to Release Third Quarter 2023 Financial Results on October 25, 2023SALT LAKE CITY, October 04, 2023--PROG Holdings, Inc. (NYSE:PRG), the fintech holding company for Progressive Leasing, Vive Financial, Four Technologies, and Build, is scheduled to release financial results for the third quarter of 2023 on Wednesday, October 25, 2023, prior to market open. |

Will Discover Financial (DFS) Divest its Student-Loan Unit?Analysts are wondering whether Discover Financial (DFS) will continue its student loan operations as it also intends to simplify the offerings. |

Here's Why Investors Are Retaining Synchrony (SYF) Stock NowSynchrony's (SYF) Health & Wellness platform is expected to continue its growth track, thanks to a solid CareCredit brand. |

PRG Price Returns

| 1-mo | 26.31% |

| 3-mo | 29.57% |

| 6-mo | 38.91% |

| 1-year | 6.18% |

| 3-year | -2.97% |

| 5-year | N/A |

| YTD | 43.14% |

| 2023 | 83.01% |

| 2022 | -62.56% |

| 2021 | -16.26% |

| 2020 | 11.80% |

| 2019 | N/A |

PRG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...