Partner Communications Company Ltd., each representing one ordinary share (PTNR): Price and Financial Metrics

PTNR Price/Volume Stats

| Current price | $6.61 | 52-week high | $9.49 |

| Prev. close | $6.72 | 52-week low | $6.31 |

| Day low | $6.47 | Volume | 35,700 |

| Day high | $6.65 | Avg. volume | 15,461 |

| 50-day MA | $6.96 | Dividend yield | N/A |

| 200-day MA | $7.40 | Market Cap | 1.23B |

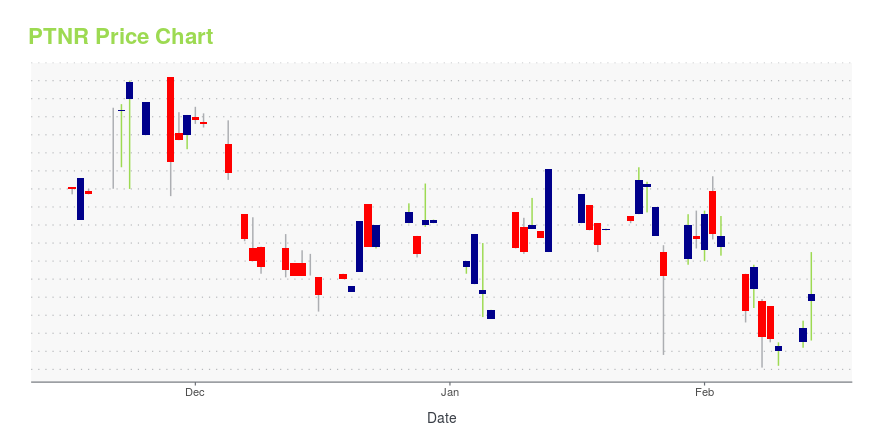

PTNR Stock Price Chart Interactive Chart >

Partner Communications Company Ltd., each representing one ordinary share (PTNR) Company Bio

Partner Communications Company Ltd. provides cellular and fixed-line telecommunication services in Israel. The company was founded in 1997 and is based in Rosh Ha-ayin, Israel.

Latest PTNR News From Around the Web

Below are the latest news stories about PARTNER COMMUNICATIONS CO LTD that investors may wish to consider to help them evaluate PTNR as an investment opportunity.

PARTNER COMMUNICATIONS ANNOUNCES THE DISMISSAL OF A MOTION FOR THE RECOGNITION OF A LAWSUIT AS A CLASS ACTIONPartner Communications Company Ltd. ("Partner" or "the Company") (NASDAQ: PTNR) (TASE: PTNR), a leading Israeli communications operator, announced, that, further to the Company's immediate report on November 8, 2020, regarding the receipt of two lawsuits and a motion for the recognition of these lawsuits as class actions, filed against Partner and its subsidiaries (together the "Respondents") in the Tel Aviv-Jaffa District Court (the "Motion"), according to which the Respondents charged the cust |

PARTNER COMMUNICATIONS ANNOUNCES DELISTING FROM NASDAQ AND CONCENTRATION OF ITS SHARE TRADING ON THE TEL AVIV STOCK EXCHANGEPartner Communications Company Ltd. ("Partner" or "the Company") (NASDAQ: PTNR) (TASE: PTNR), a leading Israeli communications operator, announced that it intends to voluntarily delist its American Depositary Shares ("ADSs") from the NASDAQ Global Select Market ("NASDAQ") and concentrate its share trading on one single exchange, the Tel Aviv Stock Exchange ("TASE"). Following the effectiveness of the delisting from NASDAQ, the Company intends to deregister and terminate its reporting obligations |

Investing in Partner Communications (NASDAQ:PTNR) three years ago would have delivered you a 65% gainBy buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with... |

PARTNER COMMUNICATIONS ANNOUNCES RECEIVING A LETTER FROM THE MINISTRY OF COMMUNICATIONS STATING IT IS SATISFIED THAT THE AGREEMENT WITH BEZEQ, FOR THE PURCHASE OF AN INDEFEASIBLE RIGHT OF USE OF FIBER-OPTIC INFRASTRUCTURE LINES, HAS NO RISK OF CREATING SIGNIFICANT DAMAGE TO THE COMPETITIONPartner Communications Company Ltd. ("Partner" or "the Company") (NASDAQ: PTNR) (TASE: PTNR), a leading Israeli communications operator, announced, further to the Company's immediate reports on December 22, 2022 and on December 28, 2022, that on January 16, 2023, a letter was received by the Company from the Ministry of Communications, concerning the agreement which was executed between the Company and Bezeq - the Israel Telecommunication Corp. Ltd. ("Bezeq" and "the Agreement"), regarding the p |

Is It Too Late To Consider Buying Partner Communications Company Ltd. (NASDAQ:PTNR)?While Partner Communications Company Ltd. ( NASDAQ:PTNR ) might not be the most widely known stock at the moment, it... |

PTNR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 57.38% |

| 5-year | 63.21% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -10.98% |

| 2021 | 49.71% |

| 2020 | 22.71% |

| 2019 | -7.63% |

Continue Researching PTNR

Want to do more research on Partner Communications Co Ltd's stock and its price? Try the links below:Partner Communications Co Ltd (PTNR) Stock Price | Nasdaq

Partner Communications Co Ltd (PTNR) Stock Quote, History and News - Yahoo Finance

Partner Communications Co Ltd (PTNR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...