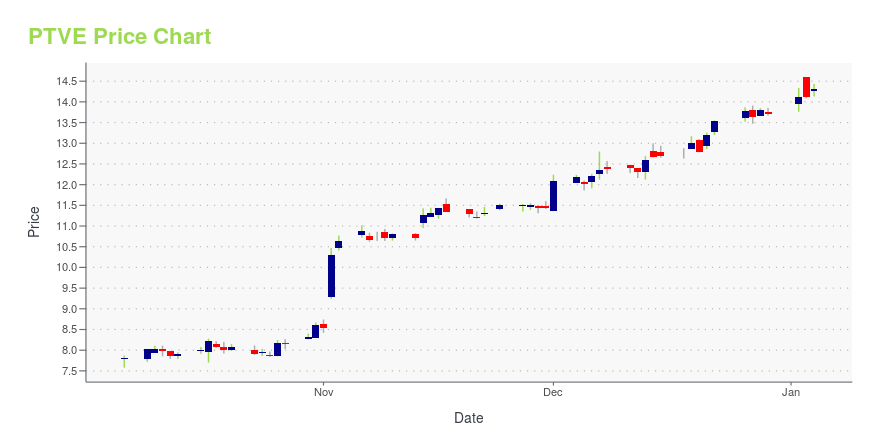

Pactiv Evergreen Inc. (PTVE): Price and Financial Metrics

PTVE Price/Volume Stats

| Current price | $13.11 | 52-week high | $15.84 |

| Prev. close | $12.75 | 52-week low | $7.41 |

| Day low | $12.83 | Volume | 224,581 |

| Day high | $13.11 | Avg. volume | 384,590 |

| 50-day MA | $12.12 | Dividend yield | 3.06% |

| 200-day MA | $12.75 | Market Cap | 2.35B |

PTVE Stock Price Chart Interactive Chart >

Pactiv Evergreen Inc. (PTVE) Company Bio

Pactiv Evergreen Inc. manufactures and distributes fresh foodservice and food merchandising products, and fresh beverage cartons in North America and internationally. It operates through three segments: Foodservice, Food Merchandising, and Beverage Merchandising. The Foodservice segment provides food containers, hot and cold cups, lids, plates, bowls, cutlery and straws, wraps, and cafeteria trays. The Food Merchandising segment offers containers for delicatessen, bakery, produce, and snack food applications; microwaveable containers for fresh, prepared, and ready-to-eat food; and trays for meat, poultry, and eggs. The Beverage Merchandising segment provides fresh cartons for refrigerated beverage products. The company serves full service restaurants, quick service restaurants, foodservice distributors, supermarkets, grocery and healthy eating retailers, other food stores, food and beverage producers, food packers and food processors. The company was incorporated in 2006 and is headquartered in Lake Forest, Illinois.

Latest PTVE News From Around the Web

Below are the latest news stories about PACTIV EVERGREEN INC that investors may wish to consider to help them evaluate PTVE as an investment opportunity.

Pactiv Evergreen Inc. (PTVE) Is Attractively Priced Despite Fast-paced MomentumPactiv Evergreen Inc. (PTVE) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen. |

Top Stock Picks for Week of December 11, 2023A Top Tech Stock with a Top Growth Score and a Consumer Services Stock with Fast-Paced Momentum at a Bargain. |

Are Investors Undervaluing H&R Block (HRB) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Just Four Days Till Pactiv Evergreen Inc. (NASDAQ:PTVE) Will Be Trading Ex-DividendPactiv Evergreen Inc. ( NASDAQ:PTVE ) is about to trade ex-dividend in the next 4 days. The ex-dividend date is one... |

Pactiv Evergreen Inc. (PTVE) Shows Fast-paced Momentum But Is Still a Bargain StockIf you are looking for stocks that have gained strong momentum recently but are still trading at reasonable prices, Pactiv Evergreen Inc. (PTVE) could be a great choice. It is one of the several stocks that passed through our 'Fast-Paced Momentum at a Bargain' screen. |

PTVE Price Returns

| 1-mo | 14.40% |

| 3-mo | -14.88% |

| 6-mo | -9.21% |

| 1-year | 60.91% |

| 3-year | -0.37% |

| 5-year | N/A |

| YTD | -2.85% |

| 2023 | 26.42% |

| 2022 | -6.90% |

| 2021 | -28.15% |

| 2020 | N/A |

| 2019 | N/A |

PTVE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...