Power REIT (MD) (PW): Price and Financial Metrics

PW Price/Volume Stats

| Current price | $1.21 | 52-week high | $2.75 |

| Prev. close | $1.17 | 52-week low | $0.63 |

| Day low | $1.17 | Volume | 57,400 |

| Day high | $1.23 | Avg. volume | 32,254 |

| 50-day MA | $1.14 | Dividend yield | N/A |

| 200-day MA | $1.18 | Market Cap | 4.11M |

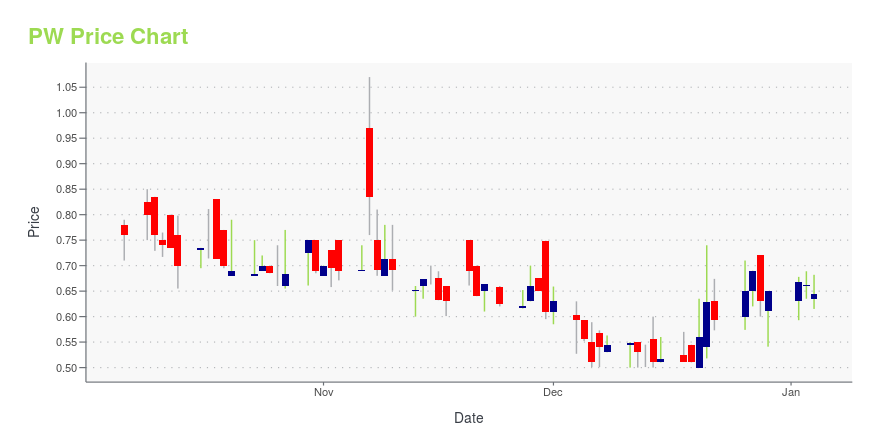

PW Stock Price Chart Interactive Chart >

Power REIT (MD) (PW) Company Bio

Power REIT is a real estate investment trust (REIT) that owns real estate related to infrastructure assets including properties for Controlled Environment Agriculture, Renewable Energy and Transportation. Power REIT is actively seeking to expand its real estate portfolio related to Controlled Environment Agriculture.

PW Price Returns

| 1-mo | 7.10% |

| 3-mo | 6.14% |

| 6-mo | 0.83% |

| 1-year | 39.06% |

| 3-year | -91.00% |

| 5-year | -95.52% |

| YTD | -9.02% |

| 2024 | 104.71% |

| 2023 | -83.55% |

| 2022 | -94.27% |

| 2021 | 157.92% |

| 2020 | 196.78% |

Continue Researching PW

Want to do more research on Power REIT's stock and its price? Try the links below:Power REIT (PW) Stock Price | Nasdaq

Power REIT (PW) Stock Quote, History and News - Yahoo Finance

Power REIT (PW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...