Rite Aid Corporation (RAD): Price and Financial Metrics

RAD Price/Volume Stats

| Current price | $0.61 | 52-week high | $7.37 |

| Prev. close | $0.65 | 52-week low | $0.38 |

| Day low | $0.61 | Volume | 5,426 |

| Day high | $0.61 | Avg. volume | 4,159,601 |

| 50-day MA | $1.01 | Dividend yield | N/A |

| 200-day MA | $2.14 | Market Cap | 34.70M |

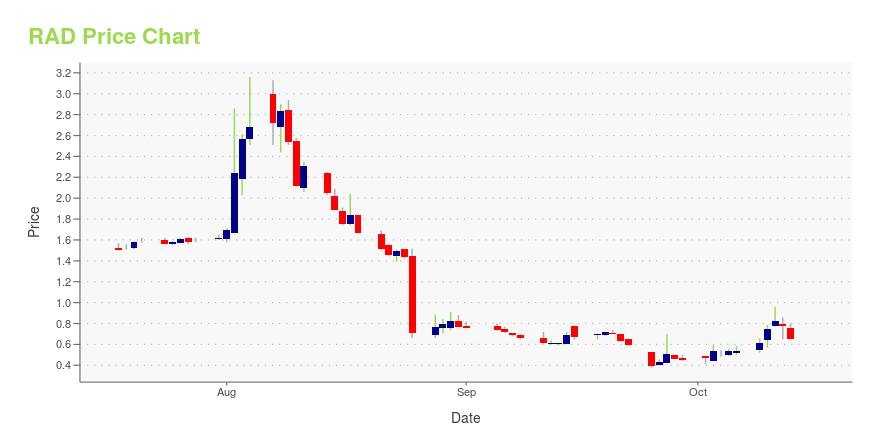

RAD Stock Price Chart Interactive Chart >

Rite Aid Corporation (RAD) Company Bio

Rite Aid Corporation operates a chain of retail drugstores in the United States. The company sells prescription drugs and a range of other merchandise, including over-the-counter medications, health and beauty aids, personal care items, cosmetics, household items, food and beverages, greeting cards, seasonal merchandise, and other every day and convenience products. The company was founded in 1927 and is based in Camp Hill, Pennsylvania.

Latest RAD News From Around the Web

Below are the latest news stories about RITE AID CORP that investors may wish to consider to help them evaluate RAD as an investment opportunity.

Bankrupt Rite Aid resolves drug supply dispute with McKessonPharmacy chain Rite Aid has settled a critical dispute with drug supplier McKesson Corp to ensure that customers' prescriptions will continue to be filled during Rite Aid's bankruptcy, attorneys said on Tuesday. Rite Aid, which filed for Chapter 11 bankruptcy on Sunday night in New Jersey, sued McKesson the following morning, seeking to stop it from terminating a drug supply agreement that accounts for 98% of the pharmacy chain's prescription drug sales. Joshua Sussberg, an attorney for Rite Aid, announced the settlement at a Tuesday court hearing in Trenton, saying that McKesson would continue supplying drugs at least through the end of Rite Aid's bankruptcy case. |

Will More Rite Aid Stores Close? Bankruptcy Restructuring Process BeginsRite Aid plans to close or sell more than 250 stores so far under a court-supervised restructuring process. |

Bankrupt Rite Aid Settles With Drug Supplier McKesson to Avoid Shortages(Bloomberg) -- Rite Aid Corp. resolved a fight with its largest supplier of prescription drugs, McKesson Corp., that the retailer said threatened its ability to continue providing customers with life saving medicines and imperiled its ability to survive bankruptcy.Most Read from BloombergHundreds Dead at Gaza Hospital as Israel, Hamas Trade BlameIsrael Latest: Biden to Visit as Oil Climbs After Hospital BlastTreasury Yields Climb as Hot Data Fuel Fed Wagers: Markets WrapWill Xi Jinping’s Gamble |

Should You Expect Sales as Rite Aid Files for Bankruptcy?Rite Aid filed for Chapter 11 bankruptcy protection while dealing with losses from opioid-related lawsuits. Other brick-and-mortar retailers have experienced the same fate in recent years. If Rite Aid... |

Rite Aid's bankruptcy plan stirs worries of new 'pharmacy deserts'Rite Aid’s plan to close more stores as part of its bankruptcy process could hurt access to medicine and care, particularly in some majority Black and Hispanic neighborhoods and in rural areas, experts say. The drugstore chain said late Sunday that its voluntary Chapter 11 process will allow it to speed up its plan to close underperforming stores. It said it doesn’t know yet which ones will close, but The Wall Street Journal reported last month that the company has proposed closing 400 to 500 of them. |

RAD Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -61.39% |

| 3-year | -95.92% |

| 5-year | -90.88% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -77.26% |

| 2021 | -7.20% |

| 2020 | 2.33% |

| 2019 | 8.94% |

Continue Researching RAD

Want to see what other sources are saying about Rite Aid Corp's financials and stock price? Try the links below:Rite Aid Corp (RAD) Stock Price | Nasdaq

Rite Aid Corp (RAD) Stock Quote, History and News - Yahoo Finance

Rite Aid Corp (RAD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...