Recruiter.com Group, Inc. (RCRT): Price and Financial Metrics

RCRT Price/Volume Stats

| Current price | $2.07 | 52-week high | $6.97 |

| Prev. close | $2.06 | 52-week low | $1.04 |

| Day low | $2.00 | Volume | 5,300 |

| Day high | $2.09 | Avg. volume | 52,694 |

| 50-day MA | $1.97 | Dividend yield | N/A |

| 200-day MA | $1.66 | Market Cap | 5.59M |

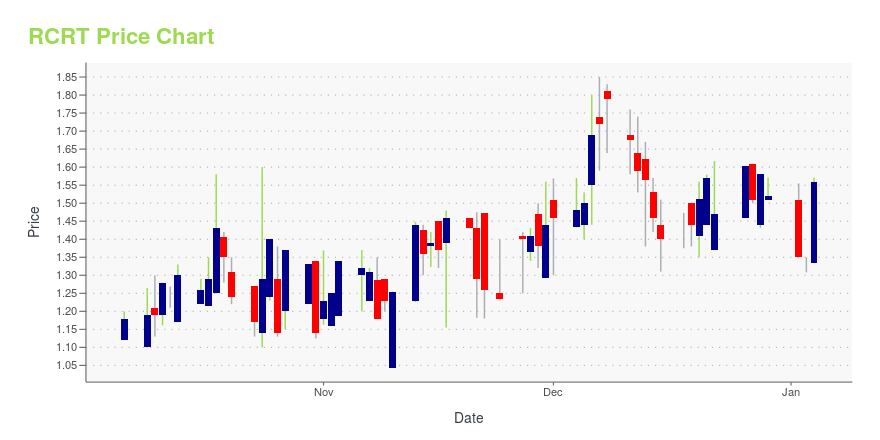

RCRT Stock Price Chart Interactive Chart >

Recruiter.com Group, Inc. (RCRT) Company Bio

Recruiter.com Group, Inc. operates an on-demand recruiting platform in the United States and internationally. It offers consulting and staffing services for the placement of professional recruiters; and consulting and staffing personnel services to employers. The company also provides referrals of qualified candidates to employers; and subscription to its web-based platforms that help employers recruit talent. In addition, it offers sponsorship of digital newsletters, online content promotion, social media distribution, banner advertising, and other branded electronic communications services for businesses; and resume distribution services, which involve promoting these job seekers' profiles and resumes to assist with their procuring employment, and upskilling and training for individuals to assist with career development and advancement. The company was founded in 2015 and is based in New York, New York.

Latest RCRT News From Around the Web

Below are the latest news stories about RECRUITERCOM GROUP INC that investors may wish to consider to help them evaluate RCRT as an investment opportunity.

Recruiter.com Group, Inc. Announces Third Quarter 2023 Financial ResultsAchieves Significant Reduction in Net Loss through Cost Management Continues Progress toward Proposed Strategic Transactions with GoLogiq and Job Mobz NEW YORK, NY / ACCESSWIRE / November 20, 2023 / Recruiter.com Group, Inc. (NASDAQ:RCRT)(NASDAQ:RCRTW) ... |

Recruiter.com Group, Inc. Announces Successful Closing of Transaction with FuturisNEW YORK, NY / ACCESSWIRE / October 3, 2023 / Recruiter.com Group, Inc. (NASDAQ:RCRT)(NASDAQ:RCRTW) ("Recruiter.com" or "the Company") is pleased to announce that the acquisition of its specialized healthcare staffing business by Futuris Company (OTC ... |

Recruiter.com Announces Update on Strategic TransactionsRecruiter.com Group, Inc. (NASDAQ:RCRT)(NASDAQ:RCRTW) ("Recruiter.com" or "the Company") announces pivotal moves in the form of two strategic transactions: the targeted acquisition of fintech assets from GoLogiq (OTC:GOLQ) and the divestiture of certain Recruiter.com intellectual property (IP) to Job Mobz. These initiatives are designed to sharpen the Company's core focus, tap into lucrative market segments, and enhance shareholder value. |

GoLogiq Plans to Present at the 25th Annual H.C. Wainwright, September 11-13, 2023NEW YORK and STOCKHOLM, Sweden, Sept. 06, 2023 (GLOBE NEWSWIRE) -- GoLogiq, Inc. (OTC:GOLQ), a U.S.-based global provider of fintech and consumer data analytics, has been invited to present at the 25th Annual H.C. Wainwright Global Investment Conference being held at Lotte New York Palace Hotel in New York City on September 11-13, 2023. The conference will feature on-demand presentations by companies across a range of industries. GoLogiq CEO Granger Whitelaw will be joined by the company’s chair |

Is Recruiter.Com Group (RCRT) Too Good to Be True? A Comprehensive Analysis of a Potential ...Unpacking the Risks and Rewards of Investing in Recruiter.Com Group (RCRT) |

RCRT Price Returns

| 1-mo | 10.11% |

| 3-mo | 47.86% |

| 6-mo | 33.55% |

| 1-year | -32.35% |

| 3-year | -96.90% |

| 5-year | -98.59% |

| YTD | 36.18% |

| 2023 | -75.81% |

| 2022 | -84.01% |

| 2021 | -68.24% |

| 2020 | 153.85% |

| 2019 | N/A |

Loading social stream, please wait...