RELX PLC ADR (RELX): Price and Financial Metrics

RELX Price/Volume Stats

| Current price | $53.71 | 52-week high | $56.33 |

| Prev. close | $53.09 | 52-week low | $43.45 |

| Day low | $52.96 | Volume | 1,384,100 |

| Day high | $54.02 | Avg. volume | 776,674 |

| 50-day MA | $53.64 | Dividend yield | 2.29% |

| 200-day MA | $0.00 | Market Cap | 98.65B |

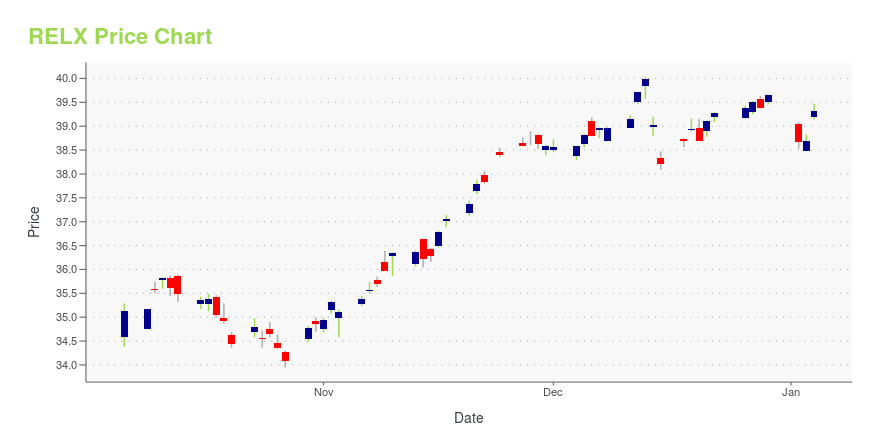

RELX Stock Price Chart Interactive Chart >

RELX PLC ADR (RELX) Company Bio

RELX plc (pronounced "Rel-ex") is a British multinational information and analytics company headquartered in London, England. Its businesses provide scientific, technical and medical information and analytics; legal information and analytics; decision-making tools; and organise exhibitions. It operates in 40 countries and serves customers in over 180 nations. It was previously known as Reed Elsevier, and came into being in 1993 as a result of the merger of Reed International, a British trade book and magazine publisher, and Elsevier, a Netherlands-based scientific publisher. (Source:Wikipedia)

RELX Price Returns

| 1-mo | 0.75% |

| 3-mo | 1.43% |

| 6-mo | 11.19% |

| 1-year | 21.25% |

| 3-year | 101.07% |

| 5-year | 182.17% |

| YTD | 19.59% |

| 2024 | 16.63% |

| 2023 | 46.13% |

| 2022 | -13.20% |

| 2021 | 35.47% |

| 2020 | 0.20% |

RELX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching RELX

Here are a few links from around the web to help you further your research on Relx Plc's stock as an investment opportunity:Relx Plc (RELX) Stock Price | Nasdaq

Relx Plc (RELX) Stock Quote, History and News - Yahoo Finance

Relx Plc (RELX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...