Rapid Micro Biosystems, Inc. (RPID): Price and Financial Metrics

RPID Price/Volume Stats

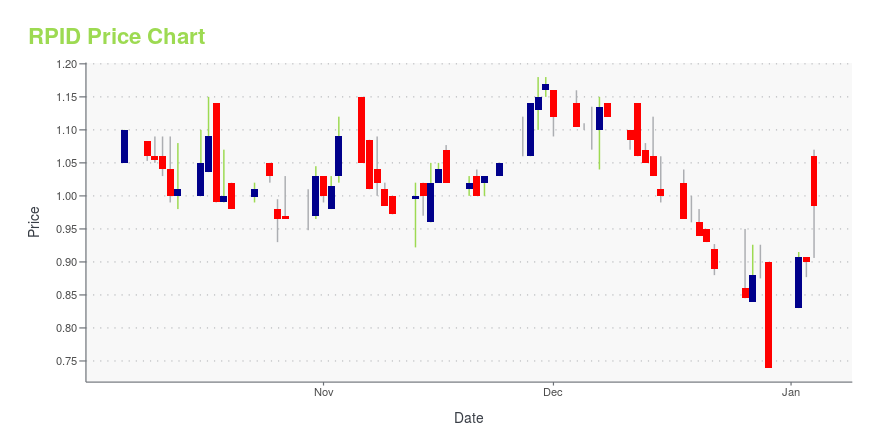

| Current price | $0.67 | 52-week high | $1.19 |

| Prev. close | $0.69 | 52-week low | $0.58 |

| Day low | $0.67 | Volume | 10,500 |

| Day high | $0.70 | Avg. volume | 104,236 |

| 50-day MA | $0.74 | Dividend yield | N/A |

| 200-day MA | $0.92 | Market Cap | 28.72M |

RPID Stock Price Chart Interactive Chart >

Rapid Micro Biosystems, Inc. (RPID) Company Bio

Rapid Micro Biosystems, Inc. provides products for the detection of microbial contamination in the manufacture of pharmaceutical, biotechnology, and personal care products. It offers Growth Direct system that includes an automated imaging instrument that analyzes user-prepared proprietary consumables. The company also provides on-site installation, instrument, validation services, regulatory compliance assistance, system certification training and training re-freshers, and business case preparation and return-on-investment analysis services; and technical support services in the Americas and Europe. It solutions are used in environmental monitoring, water testing, and bioburden testing applications. Rapid Micro Biosystems, Inc. was formerly known as Genomic Profiling Systems, Inc. and changed its name to Rapid Micro Biosystems, Inc. in January 2007. The company was incorporated in 2006 and is based in Lowell, Massachusetts with an additional office in Freising/Weihenstephan, Germany.

Latest RPID News From Around the Web

Below are the latest news stories about RAPID MICRO BIOSYSTEMS INC that investors may wish to consider to help them evaluate RPID as an investment opportunity.

Rapid Micro Biosystems to Participate in Upcoming Investor ConferencesLOWELL, Mass., Nov. 07, 2023 (GLOBE NEWSWIRE) -- Rapid Micro Biosystems, Inc. (Nasdaq: RPID) (the “Company”), an innovative life sciences technology company providing mission critical automation solutions to facilitate the efficient manufacturing and fast, safe release of healthcare products, today announced that the Company will participate in the following investor conferences in New York, NY: Stifel 2023 Healthcare ConferenceQuestion-and-answer session with analyst on Wednesday, November 15th |

Rapid Micro Biosystems, Inc. (NASDAQ:RPID) Q3 2023 Earnings Call TranscriptRapid Micro Biosystems, Inc. (NASDAQ:RPID) Q3 2023 Earnings Call Transcript November 3, 2023 Rapid Micro Biosystems, Inc. beats earnings expectations. Reported EPS is $-0.31086, expectations were $-0.32. Operator: Thank you for holding, and welcome, everyone, to the Rapid Micro Biosystems’ Third Quarter 2023 Earnings Call. All lines have been placed on mute to prevent any […] |

Rapid Micro Biosystems, Inc. (RPID) Reports Q3 Loss, Tops Revenue EstimatesRapid Micro Biosystems, Inc. (RPID) delivered earnings and revenue surprises of 3.12% and 11.22%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Rapid Micro Biosystems Inc (RPID) Reports 30% Revenue Growth in Q3 2023Company Reaffirms Full Year 2023 Revenue Guidance at $22.0 Million |

Rapid Micro Biosystems Reports Third Quarter 2023 Financial ResultsReports third quarter 2023 total revenue of $6.1 million, representing growth of 30% compared to third quarter 2022 Reaffirms full year 2023 total revenue guidance of at least $22.0 million, representing growth of approximately 30% compared to full year 2022 LOWELL, Mass., Nov. 03, 2023 (GLOBE NEWSWIRE) -- Rapid Micro Biosystems, Inc. (Nasdaq: RPID) (the “Company”), an innovative life sciences technology company providing mission critical automation solutions to facilitate the efficient manufact |

RPID Price Returns

| 1-mo | -3.46% |

| 3-mo | -29.15% |

| 6-mo | -30.18% |

| 1-year | -34.31% |

| 3-year | -96.99% |

| 5-year | N/A |

| YTD | -9.46% |

| 2023 | -34.51% |

| 2022 | -89.38% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...