S&W Seed Company (SANW): Price and Financial Metrics

SANW Price/Volume Stats

| Current price | $0.40 | 52-week high | $1.26 |

| Prev. close | $0.40 | 52-week low | $0.24 |

| Day low | $0.38 | Volume | 102,100 |

| Day high | $0.40 | Avg. volume | 91,018 |

| 50-day MA | $0.31 | Dividend yield | N/A |

| 200-day MA | $0.50 | Market Cap | 17.34M |

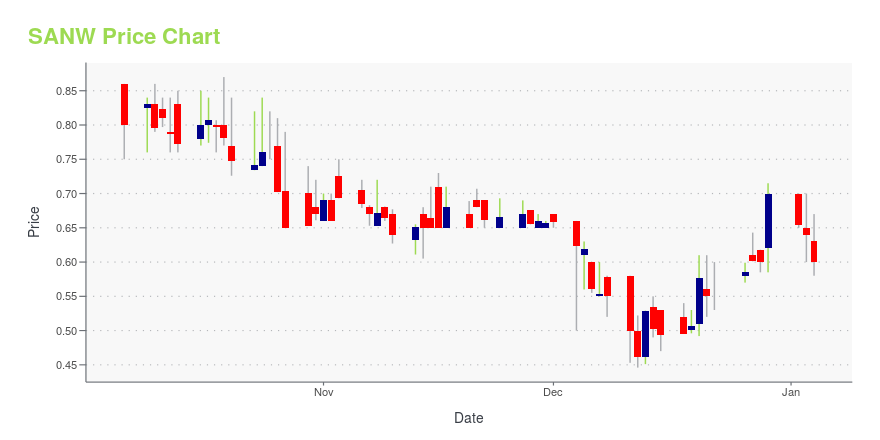

SANW Stock Price Chart Interactive Chart >

S&W Seed Company (SANW) Company Bio

S&W Seed Company, an agricultural company, engages in breeding, growing, processing, and selling alfalfa seeds. S&W Seed Company was founded in 1980 and is based in Hanford, California.

Latest SANW News From Around the Web

Below are the latest news stories about S&W SEED CO that investors may wish to consider to help them evaluate SANW as an investment opportunity.

S&W Seed Company Appoints Jeffrey Rona to Its Board of DirectorsS&W Seed Company (Nasdaq: SANW), a global agricultural technology company, today announced the nomination of senior biotechnology executive Jeffrey Rona to its Board of Directors. |

Why S&W Seed Company (NASDAQ:SANW) Could Be Worth WatchingS&W Seed Company ( NASDAQ:SANW ), might not be a large cap stock, but it received a lot of attention from a substantial... |

S&W Seed Company (NASDAQ:SANW) Q1 2024 Earnings Call TranscriptS&W Seed Company (NASDAQ:SANW) Q1 2024 Earnings Call Transcript November 9, 2023 S&W Seed Company misses on earnings expectations. Reported EPS is $-0.11 EPS, expectations were $-0.1. Operator: Good morning, everyone, and welcome to the S&W Seed Company Reports First Quarter Fiscal Year 2024 Financial Results Conference Call. All participants will be in a listen-only […] |

Q1 2024 S&W Seed Co Earnings CallQ1 2024 S&W Seed Co Earnings Call |

S&W Seed Co (SANW) Reports Mixed Q1 Fiscal 2024 Results Amid Operational ChallengesRevenue Declines but Gross Profit Margin Improves; Company Focuses on Strategic Initiatives |

SANW Price Returns

| 1-mo | 10.80% |

| 3-mo | -4.76% |

| 6-mo | -27.40% |

| 1-year | -66.94% |

| 3-year | -88.30% |

| 5-year | -86.62% |

| YTD | -42.86% |

| 2023 | -53.02% |

| 2022 | -45.42% |

| 2021 | -6.83% |

| 2020 | 39.52% |

| 2019 | 16.02% |

Continue Researching SANW

Want to do more research on S&W Seed Co's stock and its price? Try the links below:S&W Seed Co (SANW) Stock Price | Nasdaq

S&W Seed Co (SANW) Stock Quote, History and News - Yahoo Finance

S&W Seed Co (SANW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...