Sally Beauty Holdings Inc. (SBH): Price and Financial Metrics

SBH Price/Volume Stats

| Current price | $11.34 | 52-week high | $13.91 |

| Prev. close | $11.03 | 52-week low | $7.21 |

| Day low | $11.04 | Volume | 1,133,700 |

| Day high | $11.42 | Avg. volume | 1,393,108 |

| 50-day MA | $11.07 | Dividend yield | N/A |

| 200-day MA | $11.14 | Market Cap | 1.17B |

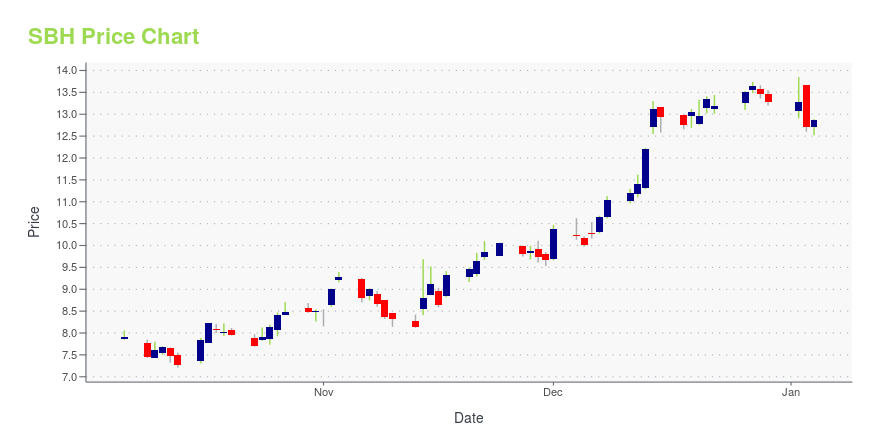

SBH Stock Price Chart Interactive Chart >

Sally Beauty Holdings Inc. (SBH) Company Bio

Sally Beauty Holdings operates as a specialty retailer and distributor of professional beauty supplies primarily in North America, South America, and Europe. The company was founded in 1964 and is based in Denton, Texas.

Latest SBH News From Around the Web

Below are the latest news stories about SALLY BEAUTY HOLDINGS INC that investors may wish to consider to help them evaluate SBH as an investment opportunity.

Ongoing Headwinds Affected Sally Beauty Holdings (SBH) in Q3Meridian Funds, managed by ArrowMark Partners, released its “Meridian Hedged Equity Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the quarter, the fund declined -1.36% (net), outperforming its benchmark, the S&P 500 Index, which declined -3.27%. The firm focuses on high-quality companies for long-term growth. In addition, […] |

Is Sally Beauty Holdings, Inc. (NYSE:SBH) Trading At A 47% Discount?Key Insights The projected fair value for Sally Beauty Holdings is US$24.84 based on 2 Stage Free Cash Flow to Equity... |

Sally Beauty launches digital hair color consultationsWith the Licensed Colorist OnDemand service, participants talk with a professional for free via video or chat. |

Sally Beauty (SBH) Up 34% Since Last Earnings Report: Can It Continue?Sally Beauty (SBH) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Sally Beauty Launches Free & Fast Digital Hair Color ConsultationsSally Beauty, the industry-leading destination for salon-quality hair color and care, is proud to announce the US launch of Licensed Colorist OnDemand. This free, innovative, and fast digital consultation service is empowering individuals to color their hair with confidence thanks to trusted recommendations from licensed professionals. |

SBH Price Returns

| 1-mo | 5.88% |

| 3-mo | 3.09% |

| 6-mo | -7.05% |

| 1-year | -7.20% |

| 3-year | -49.33% |

| 5-year | -5.50% |

| YTD | -14.61% |

| 2023 | 6.07% |

| 2022 | -32.18% |

| 2021 | 41.56% |

| 2020 | -28.55% |

| 2019 | 7.04% |

Continue Researching SBH

Want to do more research on Sally Beauty Holdings Inc's stock and its price? Try the links below:Sally Beauty Holdings Inc (SBH) Stock Price | Nasdaq

Sally Beauty Holdings Inc (SBH) Stock Quote, History and News - Yahoo Finance

Sally Beauty Holdings Inc (SBH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...