Companhia de Saneamento Basico do Estado de Sao Paulo ADR (SBS): Price and Financial Metrics

SBS Price/Volume Stats

| Current price | $15.40 | 52-week high | $17.14 |

| Prev. close | $15.46 | 52-week low | $10.76 |

| Day low | $15.14 | Volume | 1,116,600 |

| Day high | $15.40 | Avg. volume | 999,752 |

| 50-day MA | $14.57 | Dividend yield | 1.36% |

| 200-day MA | $14.76 | Market Cap | 10.53B |

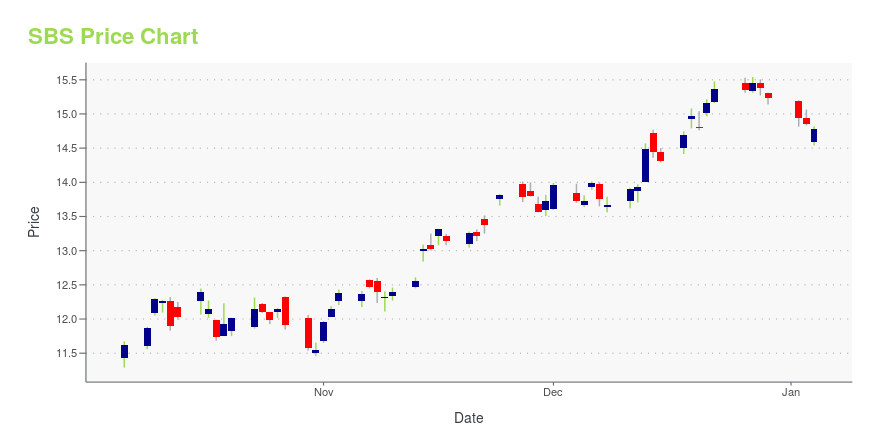

SBS Stock Price Chart Interactive Chart >

Companhia de Saneamento Basico do Estado de Sao Paulo ADR (SBS) Company Bio

Companhia de Saneamento Basico do Estado de Sao Paulo SABESP engages in the provision of water and sewage service. It also offers advisory services on the rational use of water, planning and commercial, and financial and operational management. The company was founded on September 6, 1973 and is headquartered in São Paulo, Brazil.

Latest SBS News From Around the Web

Below are the latest news stories about COMPANHIA DE SANEAMENTO BASICO DO ESTADO DE SAO PAULO-SABESP that investors may wish to consider to help them evaluate SBS as an investment opportunity.

20 Most Valuable Brazilian Companies Heading into 2024In this article, we will take a look at the 20 most valuable Brazilian companies heading into 2024. If you want to skip our detailed analysis, you can go directly to 5 Most Valuable Brazilian Companies Heading into 2024. Brazil’s Economic Outlook: At a Glance According to a report by Deloitte, the Brazilian economy has been […] |

Companhia De Saneamento Basico Do Estado De Sao Paulo (SBS): A Closer Look at Its ValuationIs the Brazilian water and waste management company modestly overvalued? |

Companhia De Saneamento Basico Do Estado De Sao Paulo: A Good Outperformance Potential with a ...Companhia De Saneamento Basico Do Estado De Sao Paulo (NYSE:SBS), a leading player in the Utilities - Regulated industry, has been making waves in the stock market. With a market cap of $7.81 billion, SBS has a GF Score of 86 out of 100, indicating good outperformance potential. The Financial Strength of SBS is ranked at 5/10. |

Sao Paulo government to privatize Sabesp water utility but keep stakeBrazilian state-run water utility Sabesp will be partially privatized through the sale of shares, Sao Paulo state Governor Tarcisio de Freitas said on Monday, adding that the state will maintain a minority stake. The plan aims to add additional 10 billion reais in investments and generate around 66 billion reais ($13.97 billion) by 2029 for the utility, Freitas said during an event. In March, Freitas said the state would hire the World Bank's International Finance Corporation for privatization studies, which is expected to take place in 2024. |

Sao Paulo govt to hire World Bank to study privatizing water utilitySao Paulo's state government will hire the World Bank's International Finance Corporation (IFC) in the next few days for studies on the possible privatization of state water utility Sabesp, Governor Tarcisio de Freitas said on Friday. "The privatization of Sabesp is a very complex matter," Tarcisio told Reuters after attending an event in Rio de Janeiro. |

SBS Price Returns

| 1-mo | 11.43% |

| 3-mo | -3.75% |

| 6-mo | -0.19% |

| 1-year | 31.73% |

| 3-year | 135.80% |

| 5-year | 21.21% |

| YTD | 2.49% |

| 2023 | 46.47% |

| 2022 | 47.45% |

| 2021 | -13.91% |

| 2020 | -41.38% |

| 2019 | 90.32% |

SBS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SBS

Here are a few links from around the web to help you further your research on Companhia De Saneamento Basico Do Estado De Sao Paulo-Sabesp's stock as an investment opportunity:Companhia De Saneamento Basico Do Estado De Sao Paulo-Sabesp (SBS) Stock Price | Nasdaq

Companhia De Saneamento Basico Do Estado De Sao Paulo-Sabesp (SBS) Stock Quote, History and News - Yahoo Finance

Companhia De Saneamento Basico Do Estado De Sao Paulo-Sabesp (SBS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...