Stitch Fix, Inc. - (SFIX): Price and Financial Metrics

SFIX Price/Volume Stats

| Current price | $4.87 | 52-week high | $5.20 |

| Prev. close | $4.60 | 52-week low | $2.06 |

| Day low | $4.69 | Volume | 1,400,326 |

| Day high | $4.92 | Avg. volume | 1,829,339 |

| 50-day MA | $3.64 | Dividend yield | N/A |

| 200-day MA | $3.23 | Market Cap | 595.80M |

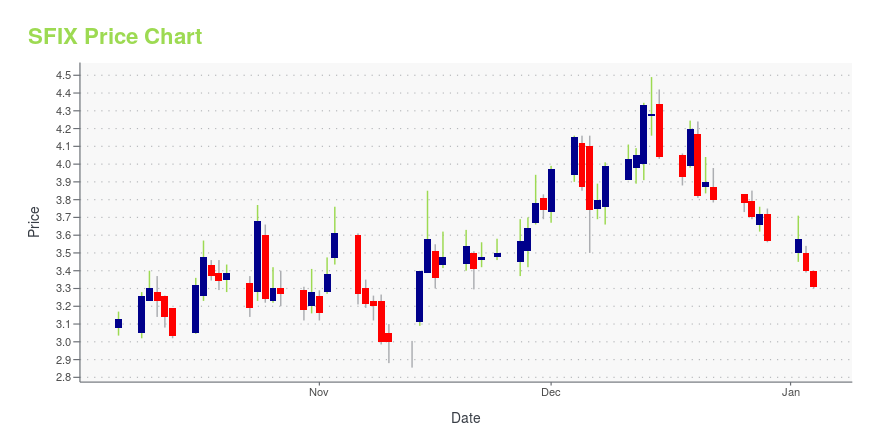

SFIX Stock Price Chart Interactive Chart >

Stitch Fix, Inc. - (SFIX) Company Bio

Stitch Fix, Inc. operates as an online subscription and personal shopping platform. The Company offers shirt, jacket, sweater, blazer, leggings, vests, scarf, jeans, loafers, and boots for men and women.

Latest SFIX News From Around the Web

Below are the latest news stories about STITCH FIX INC that investors may wish to consider to help them evaluate SFIX as an investment opportunity.

Stitch Fix (SFIX) is Poised on Operational Excellence & GrowthStitch Fix's (SFIX) focus on efficiency, client satisfaction and advanced technologies position it for success despite challenges in active client retention. |

Stitch Fix Announces New Employee Inducement GrantsSAN FRANCISCO, Dec. 15, 2023 (GLOBE NEWSWIRE) -- Stitch Fix, Inc. (NASDAQ:SFIX), the leading online personal styling service, today announced that effective December 15, 2023, the compensation committee of the company’s board of directors granted restricted stock units (RSUs) to two new employees to acquire an aggregate of 283,588 shares of the company’s Class A common stock. One fourth of these restricted stock units will vest on March 13, 2024, and the remainder will vest in 3 equal quarterly |

Stitch Fix Announces New Employee Inducement GrantSAN FRANCISCO, Dec. 12, 2023 (GLOBE NEWSWIRE) -- Stitch Fix, Inc. (NASDAQ:SFIX), the leading online personal styling service, today announced that effective December 8, 2023, the compensation committee of the company’s board of directors granted Tony Bacos, Chief Product and Technology Officer, the option to purchase 722,543 shares of the company’s Class A common stock, at a per share exercise price of $3.99, and restricted stock units (RSUs) to acquire 361,272 shares of the company’s Class A co |

Stitch Fix, Inc. (NASDAQ:SFIX) Q1 2024 Earnings Call TranscriptStitch Fix, Inc. (NASDAQ:SFIX) Q1 2024 Earnings Call Transcript December 5, 2023 Stitch Fix, Inc. beats earnings expectations. Reported EPS is $-0.22, expectations were $-0.23. Operator: Good afternoon and thank you for standing by. Welcome to the First Quarter of Fiscal Year 2024 Stitch Fix Earnings Call. At this time, all participants will be in […] |

Stitch Fix Leans Into Private, Fewer Brands to Cut Costs, Improve MarginsStitch Fix is switching its inventory-offering model toward private brands to reduce its costs and improve its profitability, CEO Matt Baer says on a call with analysts. The styling services company says these brands perform well, and generate higher keep rates among customers, as well as higher margins. Over the past few years, Stitch Fix has increased its private brands from about one-third to nearly 50% of total sales, Baer says. |

SFIX Price Returns

| 1-mo | 26.82% |

| 3-mo | 125.46% |

| 6-mo | 51.71% |

| 1-year | 8.71% |

| 3-year | -91.25% |

| 5-year | -82.30% |

| YTD | 36.41% |

| 2023 | 14.79% |

| 2022 | -83.56% |

| 2021 | -67.78% |

| 2020 | 128.84% |

| 2019 | 50.15% |

Continue Researching SFIX

Want to do more research on Stitch Fix Inc's stock and its price? Try the links below:Stitch Fix Inc (SFIX) Stock Price | Nasdaq

Stitch Fix Inc (SFIX) Stock Quote, History and News - Yahoo Finance

Stitch Fix Inc (SFIX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...