Saga Communications, Inc. - (SGA): Price and Financial Metrics

SGA Price/Volume Stats

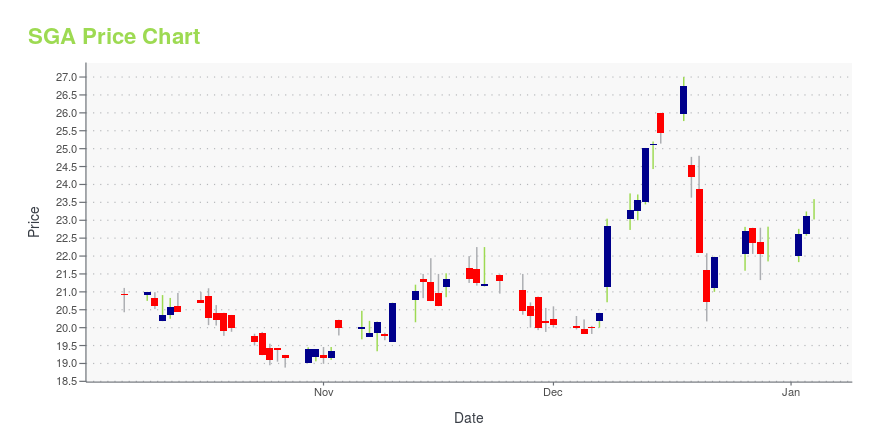

| Current price | $15.09 | 52-week high | $27.00 |

| Prev. close | $14.98 | 52-week low | $14.06 |

| Day low | $14.86 | Volume | 17,800 |

| Day high | $15.10 | Avg. volume | 15,865 |

| 50-day MA | $16.55 | Dividend yield | 6.69% |

| 200-day MA | $20.77 | Market Cap | 94.51M |

SGA Stock Price Chart Interactive Chart >

Saga Communications, Inc. - (SGA) Company Bio

Saga Communications operates through two segments, Radio and Television, with radio formats that include classic hits, adult contemporary, classic rock, news/talk, and country. The company was founded in 1986 and is based in Grosse Pointe Farms, Michigan.

Latest SGA News From Around the Web

Below are the latest news stories about SAGA COMMUNICATIONS INC that investors may wish to consider to help them evaluate SGA as an investment opportunity.

Saga Communications, Inc.'s (NASDAQ:SGA) Stock Is Rallying But Financials Look Ambiguous: Will The Momentum Continue?Saga Communications (NASDAQ:SGA) has had a great run on the share market with its stock up by a significant 23% over... |

PARA, SGA among major communication services gainers; IHRT, AREN among losersMore on Communication Services Select Sector SPDR Fund |

Saga Communications, Inc. Declares a Special Cash Dividend of $2.00 per ShareGROSSE POINTE FARMS, Mich., Dec. 07, 2023 (GLOBE NEWSWIRE) -- Saga Communications, Inc. (Nasdaq - SGA) (the “Company”, “Saga” or “our”) today announced that its Board of Directors (“Board”) declared a special cash dividend of $2.00 per share. The dividend will be paid on January 12, 2024, to shareholders of record on December 20, 2023. The aggregate amount of the payment to be made in connection with the special dividend will be approximately $12.5 million. The special cash dividend will be fund |

Saga Communications (NASDAQ:SGA) investors are sitting on a loss of 21% if they invested five years agoSaga Communications, Inc. ( NASDAQ:SGA ) shareholders should be happy to see the share price up 11% in the last month... |

Saga Communications, Inc. Declares a Quarterly Cash Dividend of $0.25 per ShareGROSSE POINTE FARMS, Mich., Nov. 16, 2023 (GLOBE NEWSWIRE) -- Saga Communications, Inc. (Nasdaq - SGA) (the “Company”, “Saga” or “our”) today announced that its Board of Directors (“Board”) declared a quarterly cash dividend of $0.25 per share. The dividend will be paid on December 15, 2023, to shareholders of record on November 27, 2023. The aggregate amount of the payment to be made in connection with the quarterly dividend will be approximately $1.5 million. The quarterly dividend will be fun |

SGA Price Returns

| 1-mo | -1.05% |

| 3-mo | -34.62% |

| 6-mo | -33.81% |

| 1-year | -16.78% |

| 3-year | 0.01% |

| 5-year | -24.47% |

| YTD | -28.67% |

| 2023 | 6.82% |

| 2022 | 16.79% |

| 2021 | 4.95% |

| 2020 | -19.89% |

| 2019 | -4.89% |

SGA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SGA

Want to see what other sources are saying about Saga Communications Inc's financials and stock price? Try the links below:Saga Communications Inc (SGA) Stock Price | Nasdaq

Saga Communications Inc (SGA) Stock Quote, History and News - Yahoo Finance

Saga Communications Inc (SGA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...