Shenandoah Telecommunications Co (SHEN): Price and Financial Metrics

SHEN Price/Volume Stats

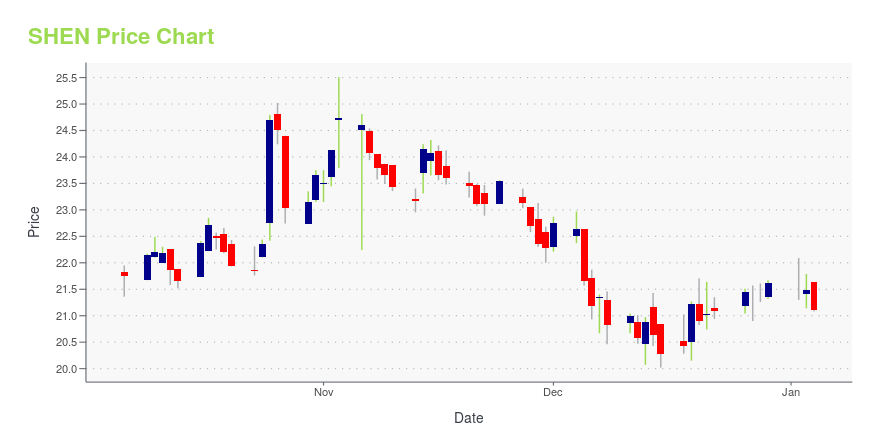

| Current price | $20.78 | 52-week high | $25.51 |

| Prev. close | $20.46 | 52-week low | $11.87 |

| Day low | $20.41 | Volume | 135,700 |

| Day high | $20.84 | Avg. volume | 172,637 |

| 50-day MA | $17.66 | Dividend yield | 0.46% |

| 200-day MA | $19.14 | Market Cap | 1.13B |

SHEN Stock Price Chart Interactive Chart >

Shenandoah Telecommunications Co (SHEN) Company Bio

Shenandoah Communications provides regulated and unregulated telecommunications services to end-user customers and other telecommunications providers in Virginia, West Virginia, central Pennsylvania, and western Maryland. The company was founded in 1902 and is based in Edinburg, Virginia.

Latest SHEN News From Around the Web

Below are the latest news stories about SHENANDOAH TELECOMMUNICATIONS CO that investors may wish to consider to help them evaluate SHEN as an investment opportunity.

Shenandoah Telecommunications Company (NASDAQ:SHEN) is favoured by institutional owners who hold 62% of the companyKey Insights Institutions' substantial holdings in Shenandoah Telecommunications implies that they have significant... |

Shenandoah Telecommunications Company (NASDAQ:SHEN) Q3 2023 Earnings Call TranscriptShenandoah Telecommunications Company (NASDAQ:SHEN) Q3 2023 Earnings Call Transcript November 3, 2023 Shenandoah Telecommunications Company beats earnings expectations. Reported EPS is $0.03, expectations were $-0.01. Operator: Good morning, everyone. Welcome to Shenandoah Telecommunications’ Third Quarter 2023 Earnings Conference Call. Today’s conference is being recorded. At this time, I would like to turn the conference over […] |

Can Shenandoah Telecommunications Company's (NASDAQ:SHEN) Weak Financials Pull The Plug On The Stock's Current Momentum On Its Share Price?Most readers would already be aware that Shenandoah Telecommunications' (NASDAQ:SHEN) stock increased significantly by... |

Q3 2023 Shenandoah Telecommunications Co Earnings CallQ3 2023 Shenandoah Telecommunications Co Earnings Call |

Shenandoah Telecommunications Co (SHEN) Reports Q3 2023 Earnings: Revenue Grows by 7. ...Company's Glo Fiber Markets witness a 90.5% growth in revenue, contributing to the overall financial performance |

SHEN Price Returns

| 1-mo | 32.27% |

| 3-mo | 55.19% |

| 6-mo | -0.48% |

| 1-year | 11.29% |

| 3-year | -60.35% |

| 5-year | -48.37% |

| YTD | -3.89% |

| 2023 | 36.64% |

| 2022 | -37.45% |

| 2021 | -40.89% |

| 2020 | 4.70% |

| 2019 | -5.21% |

SHEN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SHEN

Want to see what other sources are saying about Shenandoah Telecommunications Co's financials and stock price? Try the links below:Shenandoah Telecommunications Co (SHEN) Stock Price | Nasdaq

Shenandoah Telecommunications Co (SHEN) Stock Quote, History and News - Yahoo Finance

Shenandoah Telecommunications Co (SHEN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...