Shapeways Holdings, Inc. (SHPW): Price and Financial Metrics

SHPW Price/Volume Stats

| Current price | $0.30 | 52-week high | $5.53 |

| Prev. close | $0.36 | 52-week low | $0.20 |

| Day low | $0.30 | Volume | 920,400 |

| Day high | $0.34 | Avg. volume | 811,337 |

| 50-day MA | $0.98 | Dividend yield | N/A |

| 200-day MA | $1.82 | Market Cap | 1.98M |

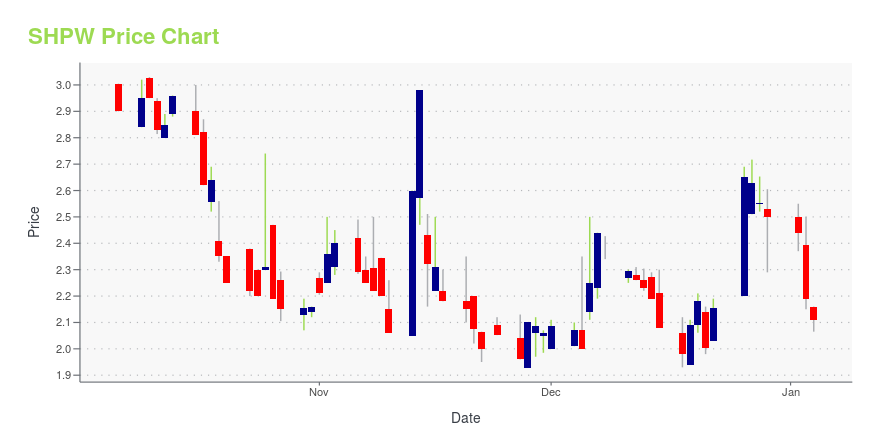

SHPW Stock Price Chart Interactive Chart >

Shapeways Holdings, Inc. (SHPW) Company Bio

Shapeways Holdings, Inc. facilitates the design, manufacture, and sale of 3D printed products in the United States, Europe, and internationally. Its website provides services to 3D designers for uploading and printing their models that enables them to turn their digital creations into physical products. The company's website also offers a marketplace, which enables designers to share and sell their products, including a range of personalized custom-made items, such as jewelry, household items, and art products. The company was founded in 2008 and is based in Long Island City, New York.

Latest SHPW News From Around the Web

Below are the latest news stories about SHAPEWAYS HOLDINGS INC that investors may wish to consider to help them evaluate SHPW as an investment opportunity.

Shapeways Reports Third Quarter 2023 Results- Expanded gross margins sequentially from the second quarter -- Secured several multi-year contracts with enterprise customers in key target industries - NEW YORK, Nov. 14, 2023 (GLOBE NEWSWIRE) -- Shapeways Holdings, Inc. (NASDAQ: SHPW) (“Shapeways” or the “Company”), a leader in the large and fast-growing digital manufacturing industry, announced its results for the third quarter ended September 30, 2023. “As we navigate the dynamic landscape of the digital manufacturing industry, Shapeways c |

Shapeways to Report Third Quarter 2023 Financial ResultsNEW YORK, Oct. 24, 2023 (GLOBE NEWSWIRE) -- Shapeways Holdings Inc. (“Shapeways”), a leader in the large and fast-growing digital manufacturing industry, will release its financial results for the third quarter ended September 30, 2023, after the market close on Tuesday, November 14, 2023. Shapeways will host a conference call and webcast on Tuesday, November 14, 2023, at 5:00 P.M. ET. To participate in the call, please dial 1-877-322-9565 or 1-412-542-4177 for international participants, ten mi |

Shapeways Launches First Annual Shapeways Manufacturing WeekVirtual Event Follows Impressive First Half 26% Year-Over-Year Enterprise GrowthNEW YORK, Sept. 29, 2023 (GLOBE NEWSWIRE) -- Shapeways Holdings, Inc. (NASDAQ: SHPW), a recognized leader in digital manufacturing, today announced their schedule for the company’s first annual Shapeways Manufacturing Week (SWM Week). Set for October 2-6, the highly anticipated virtual event follows notable 26% year-over-year enterprise growth for Shapeways during the first half of 2023. The event will address core t |

Shapeways Strengthens Position in its Multi-Million-Dollar Automotive SectorNewly Secured Electric Vehicle Contract Accelerates GrowthNEW YORK, Sept. 22, 2023 (GLOBE NEWSWIRE) -- Shapeways Holdings, Inc. (NASDAQ: SHPW), a global leader in the large and fast-growing digital manufacturing industry, announced today accelerated growth within its multi-million-dollar automotive business—most recently in the electric vehicle (EV) sector. Shapeways Enterprise Manufacturing Solutions signed a contract for over a quarter of a million dollars, reinforcing the company's continued |

Shapeways Holdings, Inc. Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)NEW YORK, Sept. 20, 2023 (GLOBE NEWSWIRE) -- Shapeways Holdings, Inc. (Nasdaq: SHPW) (“Shapeways” or the “Company”), a leader in the large and fast-growing digital manufacturing industry, today announced that on September 20, 2023 (the “Date of Grant”), the Company granted inducement stock options covering an aggregate of 30,625 shares of Shapeways’ common stock to 10 newly hired non-executive employees. The awards were granted under the Company’s 2022 New Employee Equity Incentive Plan (the “In |

SHPW Price Returns

| 1-mo | -69.48% |

| 3-mo | -82.56% |

| 6-mo | -86.11% |

| 1-year | -93.12% |

| 3-year | -99.62% |

| 5-year | N/A |

| YTD | -88.00% |

| 2023 | -42.53% |

| 2022 | -85.34% |

| 2021 | -63.63% |

| 2020 | 4.08% |

| 2019 | N/A |

Loading social stream, please wait...