Companhia Siderurgica Nacional S.A. (SID): Price and Financial Metrics

SID Price/Volume Stats

| Current price | $2.13 | 52-week high | $4.03 |

| Prev. close | $2.12 | 52-week low | $2.08 |

| Day low | $2.09 | Volume | 1,459,900 |

| Day high | $2.14 | Avg. volume | 2,386,246 |

| 50-day MA | $2.39 | Dividend yield | 12.47% |

| 200-day MA | $2.95 | Market Cap | 2.96B |

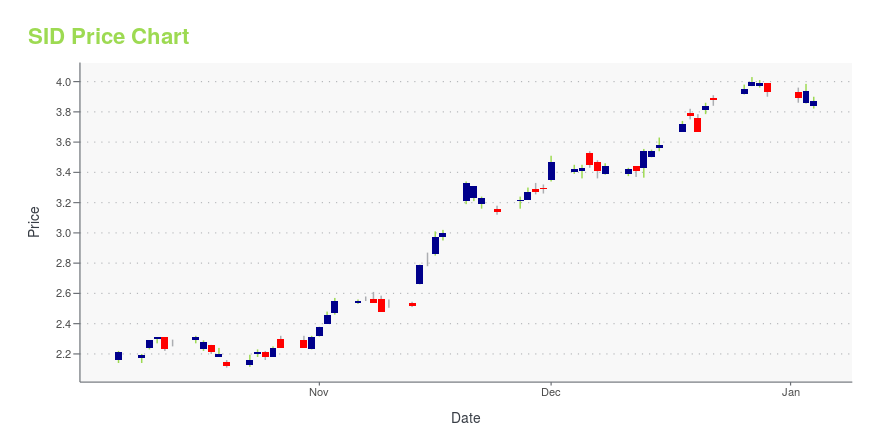

SID Stock Price Chart Interactive Chart >

Companhia Siderurgica Nacional S.A. (SID) Company Bio

Companhia Siderúrgica Nacional produces steel. The company operates through five segments including steel, mining, cement, logistics, and energy. The company primarily produces carbon steel and various steel products for the distribution, packaging, automotive, home appliance, and construction industries. The company was founded in 1941 and is based in São Paulo, Brazil.

Latest SID News From Around the Web

Below are the latest news stories about NATIONAL STEEL CO that investors may wish to consider to help them evaluate SID as an investment opportunity.

Announcement of Expiration of Tender Offer for Any and All 2026 Notes by CSN Resources S.A.Companhia Siderúrgica Nacional ("CSN") (NYSE: SID) announced today that the cash tender offer (the "Tender Offer") by its subsidiary, CSN Resources S.A. ("CSN Resources"), for any and all of its outstanding US$300,000,000 in aggregate principal amount of 7.625% Senior Unsecured Guaranteed Notes due 2026 (the "Notes") (144A CUSIP / ISIN: 12644VAC2 / US12644VAC28 and Regulation S CUSIP / ISIN: L21779AD2 / USL21779AD28), fully, unconditionally and irrevocably guaranteed by CSN, expired today at 5:0 |

Announcement of Tender Offer for Any and All 2026 Notes by CSN Resources S.A.Companhia Siderúrgica Nacional ("CSN") (NYSE: SID) announced today that its subsidiary, CSN Resources S.A. ("CSN Resources"), has commenced a cash tender offer (the "Tender Offer") for any and all of its outstanding 7.625% Senior Unsecured Guaranteed Notes due 2026 (the "Notes"). The Notes are fully, unconditionally and irrevocably guaranteed by CSN. |

The 3 Most Undervalued Under-$10 Stocks to Buy in September 2023Undervalued stocks are not just found in older industries; rather, many can be found in emerging spaces as well. |

Companhia Siderúrgica Nacional (NYSE:SID) Q2 2023 Earnings Call TranscriptCompanhia Siderúrgica Nacional (NYSE:SID) Q2 2023 Earnings Call Transcript August 3, 2023 Operator: Good morning, ladies and gentlemen, and thank you for holding. At this time, we would like to welcome you to CSN’s conference call to present results for the second quarter 2023. Today, we have with us the Company’s executive officers. We would […] |

Comprehensive GF Score Analysis of Companhia Siderurgica Nacional (SID)Companhia Siderurgica Nacional (NYSE:SID) is a prominent player in the steel industry. In this article, we will delve into the company's GF Score of 91/100, which indicates the highest outperformance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which has been found to be closely correlated with the long-term performances of stocks. |

SID Price Returns

| 1-mo | -6.99% |

| 3-mo | -19.41% |

| 6-mo | -39.17% |

| 1-year | -19.29% |

| 3-year | -67.83% |

| 5-year | -30.23% |

| YTD | -43.20% |

| 2023 | 60.55% |

| 2022 | -30.36% |

| 2021 | -22.45% |

| 2020 | 72.70% |

| 2019 | 68.43% |

SID Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SID

Want to do more research on National Steel Co's stock and its price? Try the links below:National Steel Co (SID) Stock Price | Nasdaq

National Steel Co (SID) Stock Quote, History and News - Yahoo Finance

National Steel Co (SID) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...