SelectQuote Inc. (SLQT): Price and Financial Metrics

SLQT Price/Volume Stats

| Current price | $4.17 | 52-week high | $4.46 |

| Prev. close | $4.09 | 52-week low | $1.03 |

| Day low | $4.02 | Volume | 1,992,438 |

| Day high | $4.27 | Avg. volume | 824,779 |

| 50-day MA | $3.15 | Dividend yield | N/A |

| 200-day MA | $1.93 | Market Cap | 705.39M |

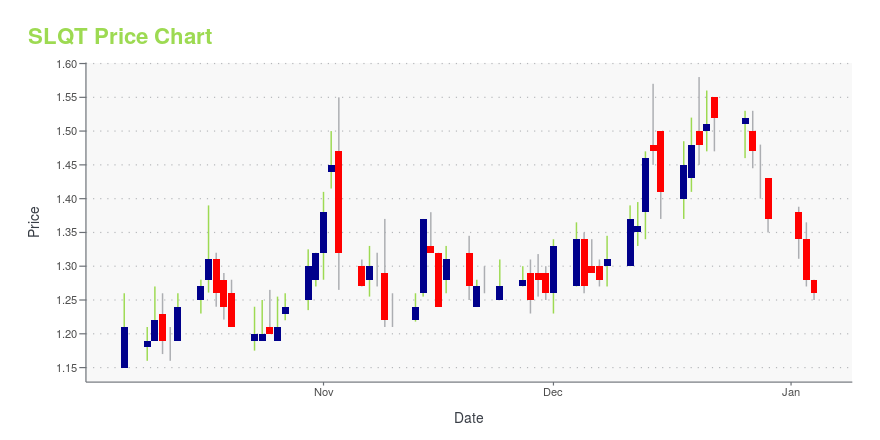

SLQT Stock Price Chart Interactive Chart >

SelectQuote Inc. (SLQT) Company Bio

SelectQuote, Inc. is a technology-enabled, direct-to-consumer distribution platform that provides consumers with a transparent and convenient venue to shop for complex senior health, life and auto & home insurance policies from a curated panel of insurance carriers. The company operates through three business lines: SelectQuote Senior, SelectQuote Life and SelectQuote Auto & Home. The SelectQuote Senior provides unbiased comparison shopping for Medicare Advantage and Medicare Supplement insurance plans as well as prescription drug plan, dental, vision and hearing and critical illness products. The SelectQuote Life provides unbiased comparison shopping for life insurance and ancillary products including term life, guaranteed issue, final expense, accidental death and juvenile insurance. The SelectQuote Auto & Home provides unbiased comparison shopping platform for auto, home and specialty insurance lines. The company was founded on August 18, 1999 and is headquartered in Overland Park, KS.

Latest SLQT News From Around the Web

Below are the latest news stories about SELECTQUOTE INC that investors may wish to consider to help them evaluate SLQT as an investment opportunity.

7 Micro-Cap Stocks for Risk-Tolerant Investors to Buy in 2024Whether you’re looking at automotive stocks, financial stocks, tech stocks, value or growth, or the hottest trend of artificial intelligence, there’s something for every investing palate. |

Sidoti Events, LLC’s Virtual November Micro-Cap ConferenceNEW YORK, NY / ACCESSWIRE / November 14, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day November Micro-Cap Conference taking place Wednesday and Thursday, November ... |

It's Probably Less Likely That SelectQuote, Inc.'s (NYSE:SLQT) CEO Will See A Huge Pay Rise This YearKey Insights SelectQuote's Annual General Meeting to take place on 14th of November Total pay for CEO Tim Danker... |

SelectQuote, Inc. (NYSE:SLQT) Q1 2024 Earnings Call TranscriptSelectQuote, Inc. (NYSE:SLQT) Q1 2024 Earnings Call Transcript November 2, 2023 SelectQuote, Inc. beats earnings expectations. Reported EPS is $-0.19, expectations were $-0.27. Operator: Hello, and welcome to SelectQuote’s Fiscal First Quarter 2024 Earnings Call. My name is Terry, and I’ll be coordinating your call today. [Operator Instructions] It is now my pleasure to introduce […] |

SelectQuote (SLQT) Q1 2024 Earnings Call TranscriptThank you, and good morning, everyone, and welcome to SelectQuote's fiscal first-quarter earnings call. Joining me from the company, I have our chief executive officer, Tim Danker; and chief financial officer, Ryan Clement. |

SLQT Price Returns

| 1-mo | 53.87% |

| 3-mo | 159.01% |

| 6-mo | 253.39% |

| 1-year | 145.29% |

| 3-year | -75.87% |

| 5-year | N/A |

| YTD | 204.38% |

| 2023 | 103.90% |

| 2022 | -92.58% |

| 2021 | -56.34% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...