Stein Mart, Inc. (SMRT): Price and Financial Metrics

SMRT Price/Volume Stats

| Current price | $2.48 | 52-week high | $4.01 |

| Prev. close | $2.43 | 52-week low | $2.12 |

| Day low | $2.43 | Volume | 574,203 |

| Day high | $2.50 | Avg. volume | 1,281,579 |

| 50-day MA | $2.42 | Dividend yield | N/A |

| 200-day MA | $2.72 | Market Cap | 500.53M |

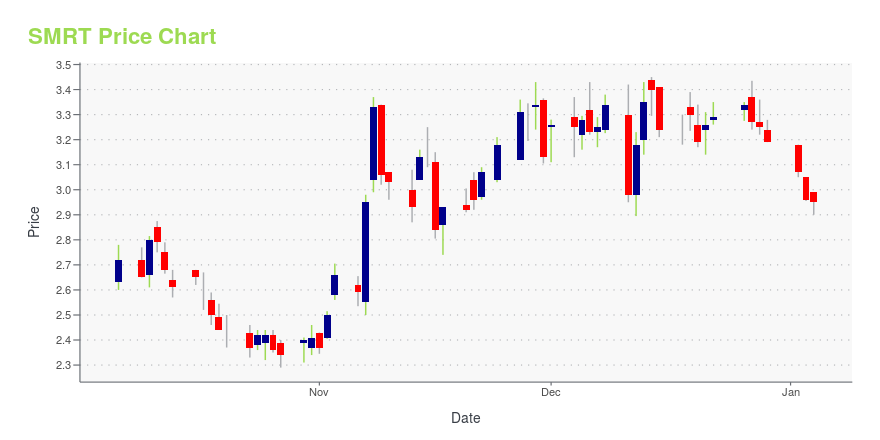

SMRT Stock Price Chart Interactive Chart >

Stein Mart, Inc. (SMRT) Company Bio

Stein Mart is a retailer which offers fashion apparel for women and men, as well as accessories, shoes, and home fashions. It primarily focuses on 35-65 year old woman customers. The company was founded in 1908 and is based in Jacksonville, Florida.

Latest SMRT News From Around the Web

Below are the latest news stories about SMARTRENT INC that investors may wish to consider to help them evaluate SMRT as an investment opportunity.

The Towbes Group Deploys SmartRent Solutions to Modernize the Resident ExperienceSCOTTSDALE, Ariz. & SANTA BARBARA, Calif., December 12, 2023--SmartRent today announced the rollout of its access control and IoT solutions at 2,500 apartment homes in The Towbes Group portfolio. |

3 Growth Stocks With Untapped Potential GaloreThese three growth stocks with untapped potential are likely to defy all odds even as the U.S. economy noticeably slows going into 2024. |

Popular retailer looks set for Chapter 11 bankruptcy filingNew data shows that a number of popular retail brands face severe concerns about whether their parent company can pay its bills. |

SmartRent Names Daryl Stemm as Chief Financial OfficerSCOTTSDALE, Ariz., November 15, 2023--SmartRent today announced the appointment of Daryl Stemm as its Chief Financial Officer. |

SmartRent Earns Coveted Spot on Deloitte's 2023 Technology Fast 500™ ListSCOTTSDALE, Ariz., November 08, 2023--The Arizona-based enterprise joins the annual list recognizing innovative and rapidly growing companies in North America. |

SMRT Price Returns

| 1-mo | 5.08% |

| 3-mo | 5.08% |

| 6-mo | -17.33% |

| 1-year | -35.25% |

| 3-year | -80.16% |

| 5-year | N/A |

| YTD | -22.26% |

| 2023 | 31.28% |

| 2022 | -74.90% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Continue Researching SMRT

Want to do more research on Stein Mart Inc's stock and its price? Try the links below:Stein Mart Inc (SMRT) Stock Price | Nasdaq

Stein Mart Inc (SMRT) Stock Quote, History and News - Yahoo Finance

Stein Mart Inc (SMRT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...