Sonder Holdings Inc. (SOND): Price and Financial Metrics

SOND Price/Volume Stats

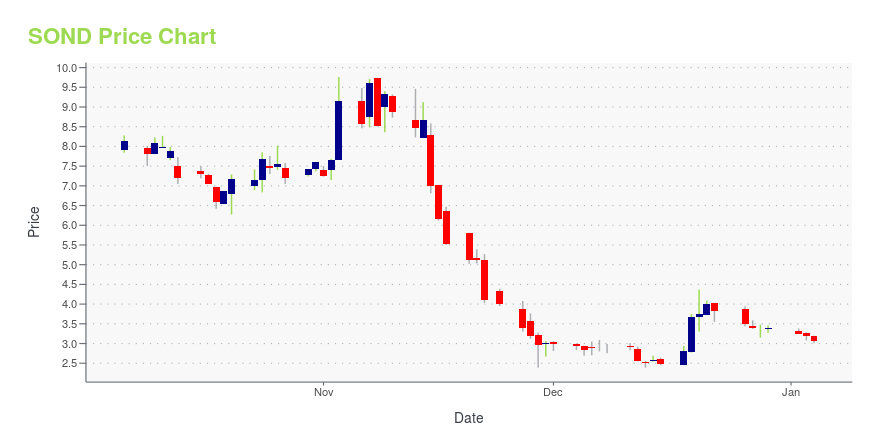

| Current price | $3.04 | 52-week high | $12.40 |

| Prev. close | $2.88 | 52-week low | $2.33 |

| Day low | $2.61 | Volume | 85,300 |

| Day high | $3.09 | Avg. volume | 56,790 |

| 50-day MA | $3.67 | Dividend yield | N/A |

| 200-day MA | $4.23 | Market Cap | 33.64M |

SOND Stock Price Chart Interactive Chart >

Sonder Holdings Inc. (SOND) Company Bio

Sonder Holdings Inc. engages in the hospitality business. It offers short-term and long-term accommodations to travelers in various cities across North America, Europe, and the Middle East. The company also provides 1, 2, and 3 bedroom and studio apartments, and 1-bedroom hotel rooms. As of September 30, 2021, it had approximately 6,300 live units, as well as approximately 10,000 additional contracted units. The company was founded in 2014 and is headquartered in San Francisco, California.

Latest SOND News From Around the Web

Below are the latest news stories about SONDER HOLDINGS INC that investors may wish to consider to help them evaluate SOND as an investment opportunity.

Sonder Holdings Inc. Appoints Tom Buoy as Executive Vice President and Chief Commercial OfficerSAN FRANCISCO, December 11, 2023--Sonder Holdings Inc. Appoints Tom Buoy as Executive Vice President and Chief Commercial Officer |

Sonder Holdings Inc. Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)SAN FRANCISCO, November 28, 2023--Sonder Holdings Inc. Reports Inducement Grants Under Nasdaq Listing Rule 5635(c)(4) |

Sonder Holdings Inc. Announces Third Quarter 2023 Financial ResultsSAN FRANCISCO, Nov. 14, 2023 (GLOBE NEWSWIRE) -- Sonder Holdings Inc. (NASDAQ: SOND), a leading next-generation hospitality company that is redefining the guest experience through technology and design, today announced third quarter 2023 financial results. A Shareholder Letter containing the results can be found on the Company’s website at investors.sonder.com. Management will host a webcast at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time to discuss the Company's financial and business result |

Sonder Holdings Inc. to Report Third Quarter 2023 Financial Results on November 14, 2023SAN FRANCISCO, Nov. 09, 2023 (GLOBE NEWSWIRE) -- Sonder Holdings Inc. (NASDAQ: SOND), a leading next-generation hospitality company that is redefining the guest experience through technology and design, today announced that it will report third quarter 2023 financial results on Tuesday, November 14, 2023. Sonder will share a brief advisory containing a link to the third quarter 2023 Shareholder Letter, available on the Company’s website. Management will host a conference call and webcast at 2:00 |

Sonder Holdings Inc. Expands in Southern California with Openings in Downtown Los Angeles and Orange County, Including Office-to-Hotel ConversionsLOS ANGELES, October 16, 2023--Sonder Holdings Inc. Expands in Southern California with Openings in Downtown Los Angeles and Orange County, Including Office-to-Hotel Conversions |

SOND Price Returns

| 1-mo | -27.27% |

| 3-mo | -34.20% |

| 6-mo | 25.62% |

| 1-year | -71.92% |

| 3-year | -98.46% |

| 5-year | N/A |

| YTD | -10.32% |

| 2023 | -86.33% |

| 2022 | -87.56% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...