SP Plus Corporation (SP): Price and Financial Metrics

SP Price/Volume Stats

| Current price | $53.99 | 52-week high | $54.42 |

| Prev. close | $53.97 | 52-week low | $34.17 |

| Day low | $53.98 | Volume | 594,000 |

| Day high | $54.00 | Avg. volume | 225,382 |

| 50-day MA | $51.79 | Dividend yield | N/A |

| 200-day MA | $48.34 | Market Cap | 1.07B |

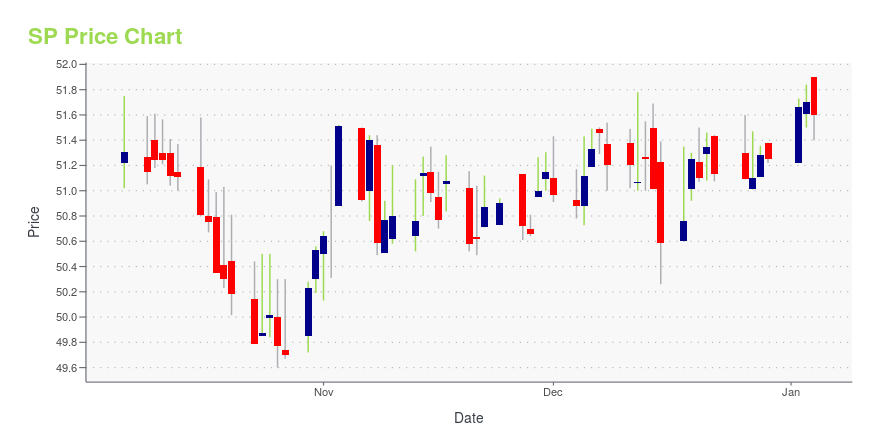

SP Stock Price Chart Interactive Chart >

SP Plus Corporation (SP) Company Bio

SP Plus Corporation provides professional parking, ground transportation, facility maintenance, security and event logistics services to property owners and managers in all markets of the real estate industry. The company was founded in 1929 and is based in Chicago, Illinois.

Latest SP News From Around the Web

Below are the latest news stories about SP PLUS CORP that investors may wish to consider to help them evaluate SP as an investment opportunity.

SP Plus Corporation Upgrades Parking Services on the University of Akron CampusCHICAGO, Dec. 12, 2023 (GLOBE NEWSWIRE) -- SP+® Corporation (SP+), (Nasdaq: SP) a best-in-class technology and operations management provider of mobility services for aviation, commercial, hospitality, and institutional clients throughout North America and Europe, today announced an agreement to operate, manage, and maintain the University of Akron’s parking system at the main campus in Akron, Ohio. The University of Akron has entered into a 35-year parking monetization, structured as a tax-exem |

SP Plus Corporation Awarded Five-Year Contract at San Francisco International AirportCHICAGO, Dec. 04, 2023 (GLOBE NEWSWIRE) -- SP+® Corporation (SP+) (Nasdaq: SP), a best-in-class technology and operations management provider of mobility services for aviation, commercial, hospitality, and institutional clients throughout North America and Europe, today announced its five-year contract for ground transportation management, parking, and concierge/ambassador services at San Francisco International Airport (SFO) in San Mateo County, California. SP+ worked collaboratively and effici |

Southwest Gas, SP Plus, and More Stocks See Action From Activist InvestorsIcahn Capital reached an amended cooperation pact with Southwest Gas. Magnetar Capital disclosed a large stake in transportation-services firm SP Plus. |

SP Plus Corp (SP) Announces Record Gross Profit in Q3 2023Strong Performance Across Commercial and Aviation Segments |

SP Plus Corporation Announces Third Quarter 2023 Results--Record Gross Profit Reflects Positive Momentum Across the Commercial and Aviation Segments-- --Tenth Consecutive Quarter of Net Location Growth; Maintains High Location Retention Rate of 94%-- --Technology Solutions Continue to Gain Traction with Clients-- CHICAGO, Nov. 01, 2023 (GLOBE NEWSWIRE) -- SP® Plus Corporation (Nasdaq:SP), a best-in-class technology and operations management provider of mobility services for aviation, commercial, hospitality, and institutional clients throughout North |

SP Price Returns

| 1-mo | N/A |

| 3-mo | 5.55% |

| 6-mo | 4.15% |

| 1-year | 41.08% |

| 3-year | 74.33% |

| 5-year | 52.99% |

| YTD | 5.35% |

| 2023 | 47.61% |

| 2022 | 23.03% |

| 2021 | -2.12% |

| 2020 | -32.05% |

| 2019 | 43.64% |

Continue Researching SP

Want to see what other sources are saying about SP Plus Corp's financials and stock price? Try the links below:SP Plus Corp (SP) Stock Price | Nasdaq

SP Plus Corp (SP) Stock Quote, History and News - Yahoo Finance

SP Plus Corp (SP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...