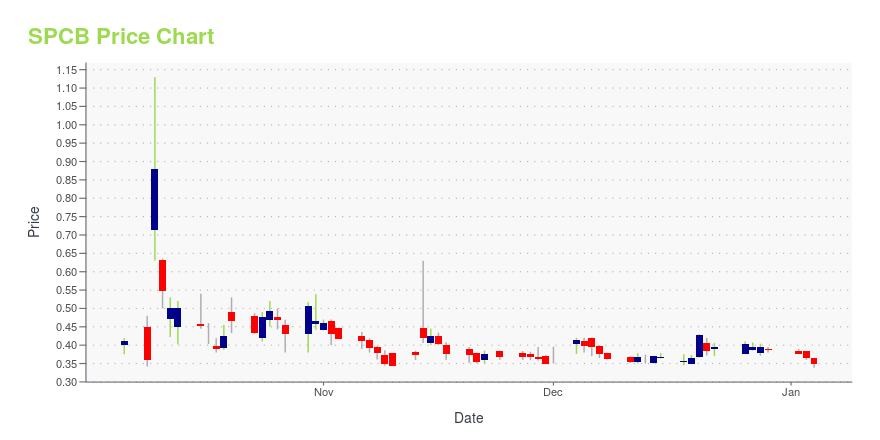

SuperCom Ltd. (SPCB): Price and Financial Metrics

SPCB Price/Volume Stats

| Current price | $0.17 | 52-week high | $1.19 |

| Prev. close | $0.17 | 52-week low | $0.15 |

| Day low | $0.17 | Volume | 607,600 |

| Day high | $0.18 | Avg. volume | 5,567,566 |

| 50-day MA | $0.19 | Dividend yield | N/A |

| 200-day MA | $0.27 | Market Cap | 2.32M |

SPCB Stock Price Chart Interactive Chart >

SuperCom Ltd. (SPCB) Company Bio

SuperCom Ltd. provides digital identity, Internet of Things and connectivity, and cyber security products and solutions to governments, and private and public organizations worldwide. The company offers MAGNA, a common platform for ID registries, e-passports, biometric visas, automated fingerprint identification systems, digitized driver's licenses, and electronic voter registration and election management. Its PureRF suite is a solution based on RFID tag technology to identify, locate, track, monitor, count, and protect people and objects. The company's PureRF suite comprises PureRF tags, hands-free long-range RFID asset and vehicle tags, PureRF readers, PureRF activators, and PureRF initializers. It also provides house arrest monitoring systems, PureTag RF bracelets, PureCom RF base stations, GPS offender tracking systems, PureTrack smartphone device, PureBeacon, PureMonitor offender electronic monitoring software, inmate monitoring systems, DoorGuard tracking station, and personnel tags. In addition, the company offers domestic violence victim protection systems. Further, it provides connectivity products and solutions comprising AVIDITY WBSac, BOLSTER WBSn, BreezeULTRA P6000, Arena controller, and BreezeNET B. Additionally, the company offers Safend's Encryption Suite that protects the organization's sensitive data; and designs solutions for carrier Wi-Fi, enterprise connectivity, smart city, smart hospitality, connected campuses, and connected events. SuperCom Ltd. sells its systems and products through local representatives, subsidiaries, and distribution channels, as well as independent representatives and resellers. The company was formerly known as Vuance Ltd. and changed its name to SuperCom Ltd. in January 2013. SuperCom Ltd. was founded in 1988 and is based in Tel Aviv-Yafo, Israel.

Latest SPCB News From Around the Web

Below are the latest news stories about SUPERCOM LTD that investors may wish to consider to help them evaluate SPCB as an investment opportunity.

SuperCom Secures New USA Electronic Monitoring Contract for its PureOne and Domestic Violence SolutionsSuperCom (NASDAQ: SPCB), a global provider of secured solutions for the e-Government, IoT, and Cybersecurity sectors, is pleased to announce that it has secured a new contract with a prominent Kentucky-based service provider of electronic monitoring (EM) products and services. This contract marks another valuable step in SuperCom's expansion within the US, as well as progression in the deployment of its newest proprietary technologies: the new PureOne GPS bracelet and domestic violence (DV) moni |

SuperCom Reports 550% YoY EBITDA Growth and 5-Year-Record Net Profit for the Third Quarter 2023SuperCom (NASDAQ: SPCB), a global provider of secured solutions for the e-Government, IoT, and Cybersecurity sectors, today reported financial and operating results for the three and nine months ended September 30, 2023. |

SuperCom to Report Third Quarter 2023 Financial Results on November 14, 2023SuperCom (NASDAQ: SPCB), a global provider of secured solutions for the e-Government, IoT and Cybersecurity sectors, will hold a conference call on Tuesday, November 14, 2023, at 10:00 a.m. Eastern time (7:00 a.m. Pacific Time / 5:00 p.m. IL Time) to discuss its financial results for the third quarter ended September 30, 2023. Financial results will be issued in a press release prior to the call. |

SuperCom Receives Third Order Valued at Over $3.4 Million from Romania's Ministry of InteriorSuperCom (NASDAQ: SPCB), a global provider of secured solutions for the e-Government, IoT, and Cybersecurity sectors, is pleased to announce, together with its local partner, the receipt of a third order by Romania's Ministry of Interior, further extending their successful partnership and reinforcing their commitment to Romania's National Electronic Monitoring (EM) Project. The order is valued at approximately $3.4 million and is anticipated to be delivered by the end of the fourth quarter of 20 |

Electronic Alcohol Monitoring Contract, Worth Up to $3M, Adds to Track Record of e-Security Solutions Provider SuperComLOS ANGELES, CA - (NewMediaWire) - October 27, 2023 - (InvestorBrandNetwork via NewMediaWire) - IBN, a multifaceted financial news, content creation and publishing company, is utilized by both public and private companies to optimize investor awarene... |

SPCB Price Returns

| 1-mo | -10.29% |

| 3-mo | -29.14% |

| 6-mo | -22.76% |

| 1-year | -83.00% |

| 3-year | -98.65% |

| 5-year | -98.41% |

| YTD | -55.98% |

| 2023 | -78.30% |

| 2022 | -67.93% |

| 2021 | -46.12% |

| 2020 | 66.16% |

| 2019 | -55.08% |

Continue Researching SPCB

Want to see what other sources are saying about SuperCom Ltd's financials and stock price? Try the links below:SuperCom Ltd (SPCB) Stock Price | Nasdaq

SuperCom Ltd (SPCB) Stock Quote, History and News - Yahoo Finance

SuperCom Ltd (SPCB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...