Splunk Inc. (SPLK): Price and Financial Metrics

SPLK Price/Volume Stats

| Current price | $156.90 | 52-week high | $156.97 |

| Prev. close | $156.51 | 52-week low | $82.19 |

| Day low | $156.90 | Volume | 18,211,800 |

| Day high | $156.97 | Avg. volume | 2,084,977 |

| 50-day MA | $154.44 | Dividend yield | N/A |

| 200-day MA | $134.21 | Market Cap | 26.44B |

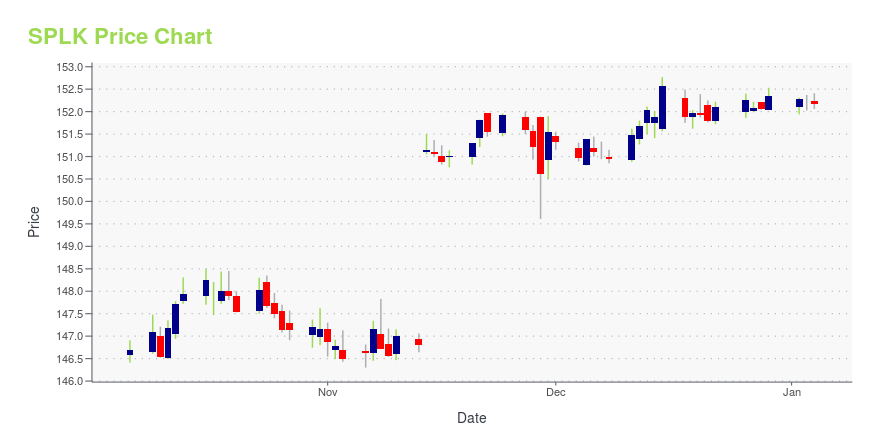

SPLK Stock Price Chart Interactive Chart >

Splunk Inc. (SPLK) Company Bio

Splunk Inc. is an American software company based in San Francisco, California, that produces software for searching, monitoring, and analyzing machine-generated data via a Web-style interface. (Source:Wikipedia)

SPLK Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 63.34% |

| 5-year | -21.54% |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | 76.97% |

| 2022 | -25.60% |

| 2021 | -31.89% |

| 2020 | 13.43% |

Continue Researching SPLK

Want to do more research on Splunk Inc's stock and its price? Try the links below:Splunk Inc (SPLK) Stock Price | Nasdaq

Splunk Inc (SPLK) Stock Quote, History and News - Yahoo Finance

Splunk Inc (SPLK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...