Steel Partners Holdings LP LTD PARTNERSHIP UNIT (SPLP): Price and Financial Metrics

SPLP Price/Volume Stats

| Current price | $37.50 | 52-week high | $47.96 |

| Prev. close | $37.50 | 52-week low | $33.12 |

| Day low | $36.97 | Volume | 4,900 |

| Day high | $37.50 | Avg. volume | 6,661 |

| 50-day MA | $37.45 | Dividend yield | N/A |

| 200-day MA | $40.13 | Market Cap | 764.74M |

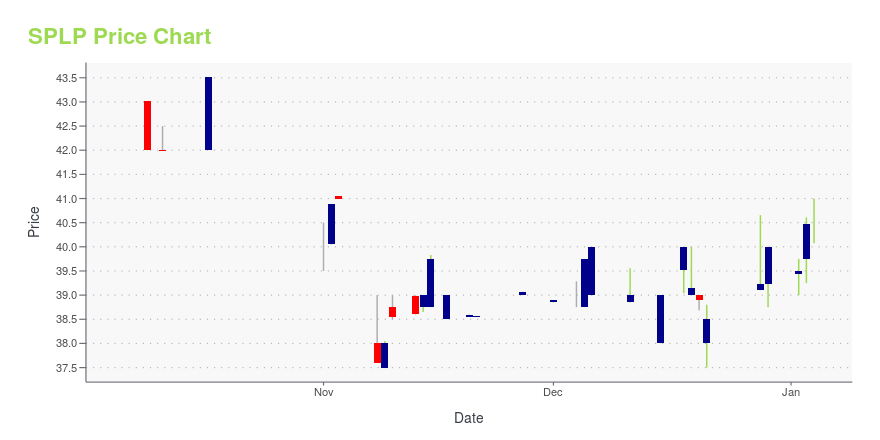

SPLP Stock Price Chart Interactive Chart >

Steel Partners Holdings LP LTD PARTNERSHIP UNIT (SPLP) Company Bio

Steel Partners Holdings, L.P., through its subsidiaries, engages in industrial products, energy, defense, supply chain management and logistics, banking, food products and services, sports, training, education, and the entertainment and lifestyle businesses. The company was founded in 1992 and is based in New York, New York.

Latest SPLP News From Around the Web

Below are the latest news stories about STEEL PARTNERS HOLDINGS LP that investors may wish to consider to help them evaluate SPLP as an investment opportunity.

Steel Partners Holdings LP (SPLP) Reports Mixed Third Quarter Results Amidst Revenue Growth and ...Challenges Reflected in EBITDA and Net Income Metrics Despite Revenue Uptick |

Steel Partners Holdings Reports Third Quarter Financial Results and Declares Quarterly Distribution on its Series A Preferred UnitsNEW YORK, November 09, 2023--Steel Partners Holdings L.P. (NYSE: SPLP) (the "Company"), a diversified global holding company, today announced operating results for the third quarter ended September 30, 2023. The financial results of Steel Connect, Inc. ("Steel Connect" or "STCN") have been included in the Company's consolidated financial statements since the exchange transaction on May 1, 2023. |

Steel Partners Holdings Reports Second Quarter Financial Results and Declares Quarterly Distribution on its Series A Preferred UnitsNEW YORK, August 09, 2023--Steel Partners Holdings L.P. (NYSE: SPLP), a diversified global holding company, today announced operating results for the second quarter ended June 30, 2023. The financial results of Steel Connect, Inc. ("Steel Connect" or "STCN") have been included in the Company's consolidated financial statements since the exchange transaction on May 1, 2023. |

Steel Partners Holdings Announces Ryan O’Herrin Named Chief Financial OfficerNEW YORK, August 07, 2023--Steel Partners Holdings L.P. (NYSE: SPLP), a diversified global holding company, today announced the appointment of Ryan O’Herrin as Chief Financial Officer. |

STEEL PARTNERS HOLDINGS L.P. Reduces Stake in Aerojet Rocketdyne Holdings IncSTEEL PARTNERS HOLDINGS L.P. (Trades, Portfolio), a prominent investment firm, recently made a significant transaction in its portfolio. The firm reduced its stake in Aerojet Rocketdyne Holdings Inc (NYSE:AJRD), a leading manufacturer of aerospace and defense products. This article will delve into the details of the transaction, provide an overview of the guru and the traded company, and analyze the potential implications of this move for value investors. |

SPLP Price Returns

| 1-mo | 1.35% |

| 3-mo | 2.04% |

| 6-mo | N/A |

| 1-year | -16.67% |

| 3-year | 26.82% |

| 5-year | 183.35% |

| YTD | -6.25% |

| 2023 | -6.54% |

| 2022 | 1.90% |

| 2021 | 290.70% |

| 2020 | -11.17% |

| 2019 | -6.78% |

Continue Researching SPLP

Here are a few links from around the web to help you further your research on Steel Partners Holdings Lp's stock as an investment opportunity:Steel Partners Holdings Lp (SPLP) Stock Price | Nasdaq

Steel Partners Holdings Lp (SPLP) Stock Quote, History and News - Yahoo Finance

Steel Partners Holdings Lp (SPLP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...