StarTek, Inc. (SRT): Price and Financial Metrics

SRT Price/Volume Stats

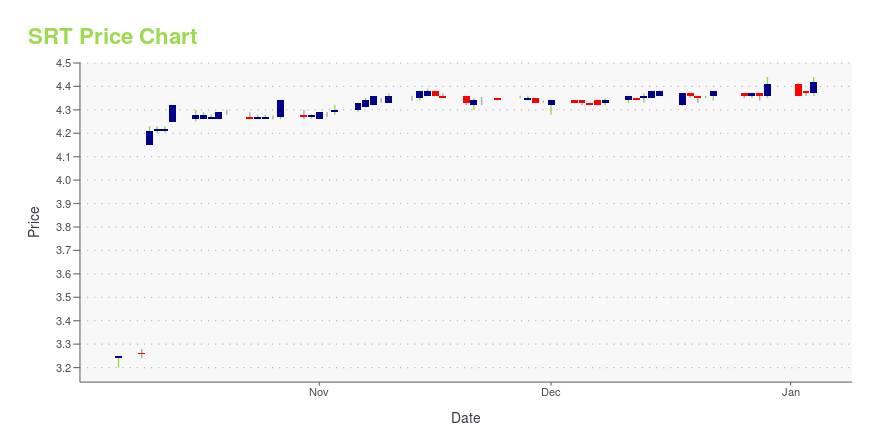

| Current price | $4.42 | 52-week high | $4.53 |

| Prev. close | $4.37 | 52-week low | $2.64 |

| Day low | $4.36 | Volume | 169,200 |

| Day high | $4.44 | Avg. volume | 107,733 |

| 50-day MA | $4.34 | Dividend yield | N/A |

| 200-day MA | $3.52 | Market Cap | 178.33M |

SRT Stock Price Chart Interactive Chart >

StarTek, Inc. (SRT) Company Bio

StarTek, Inc. provides business process outsourcing services in the United States, Canada, Honduras, Jamaica, and the Philippines. It operates in three segments: Domestic, Nearshore, and Offshore. The companys service offerings include customer care, sales support, inbound sales, complex order processing, accounts receivable management, technical and product support, up-sell and cross-sell opportunities, and other industry-specific processes. The company was founded in 1987 and is based in Greenwood Village, Colorado.

Latest SRT News From Around the Web

Below are the latest news stories about STARTEK INC that investors may wish to consider to help them evaluate SRT as an investment opportunity.

StarTek (SRT) Shows Fast-paced Momentum But Is Still a Bargain StockStarTek (SRT) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen. |

Are Investors Undervaluing Adecco (AHEXY) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

SRT vs. EXLS: Which Stock Is the Better Value Option?SRT vs. EXLS: Which Stock Is the Better Value Option? |

Is Barrett Business Services (BBSI) Stock Undervalued Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Startek Honored with Comparably Awards for Best Company for Women and Best Company for DiversityStartek® (NYSE: SRT), a global customer experience (CX) solutions provider, is proud to announce its recent recognition with two prestigious Comparably Awards: Best Company for Women and Best Company for Diversity. |

SRT Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 45.39% |

| 3-year | -38.01% |

| 5-year | -35.85% |

| YTD | 0.23% |

| 2023 | 17.60% |

| 2022 | -28.16% |

| 2021 | -30.59% |

| 2020 | -5.76% |

| 2019 | 20.00% |

Continue Researching SRT

Want to see what other sources are saying about StarTek Inc's financials and stock price? Try the links below:StarTek Inc (SRT) Stock Price | Nasdaq

StarTek Inc (SRT) Stock Quote, History and News - Yahoo Finance

StarTek Inc (SRT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...