Steel Connect, Inc. (STCN): Price and Financial Metrics

STCN Price/Volume Stats

| Current price | $12.81 | 52-week high | $13.00 |

| Prev. close | $12.78 | 52-week low | $7.36 |

| Day low | $12.50 | Volume | 34,208 |

| Day high | $12.85 | Avg. volume | 11,787 |

| 50-day MA | $12.25 | Dividend yield | N/A |

| 200-day MA | $10.39 | Market Cap | 80.77M |

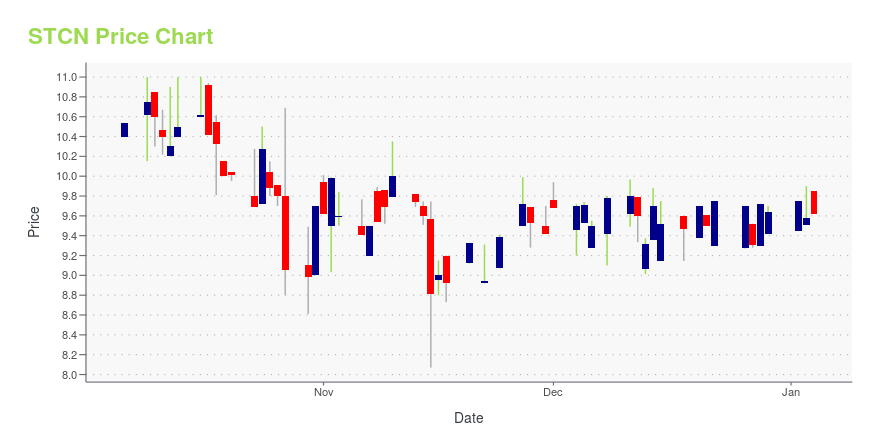

STCN Stock Price Chart Interactive Chart >

Steel Connect, Inc. (STCN) Company Bio

Steel Connect, Inc. operates as a holding company. The Company, through its subsidiaries, provides global supply chain management services and solutions. Steel Connect also invests in a variety of technology ventures including Internet, software, IT, and clean energy companies. Steel Connect serves telecommunications, software, and retail industries worldwide.

Latest STCN News From Around the Web

Below are the latest news stories about STEEL CONNECT INC that investors may wish to consider to help them evaluate STCN as an investment opportunity.

Steel Connect Inc (STCN) Reports Significant Increase in Net Income and Adjusted EBITDA for Q4 ...Financial Highlights Reflect Strong Earnings Amidst Revenue Challenges |

Steel Connect Reports Fourth Quarter Fiscal 2023 Financial ResultsNEW YORK, November 08, 2023--Steel Connect, Inc. (the "Company") (NASDAQ: STCN) today announced financial results for its fourth quarter and fiscal year ended July 31, 2023. |

Is Steel Connect Inc (STCN) Significantly Overvalued?An In-depth Analysis of Steel Connect's Valuation and Financial Health |

The 19% return this week takes Steel Connect's (NASDAQ:STCN) shareholders three-year gains to 101%It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes... |

Steel Connect Reports Third Quarter Fiscal 2023 Financial ResultsNEW YORK, June 12, 2023--Steel Connect, Inc. (the "Company") (NASDAQ: STCN) today announced financial results for its third quarter ended April 30, 2023. |

STCN Price Returns

| 1-mo | -0.23% |

| 3-mo | 5.65% |

| 6-mo | 31.65% |

| 1-year | 29.33% |

| 3-year | -28.89% |

| 5-year | -22.02% |

| YTD | 32.95% |

| 2023 | -27.81% |

| 2022 | 2.14% |

| 2021 | 77.89% |

| 2020 | -46.10% |

| 2019 | -15.61% |

Continue Researching STCN

Here are a few links from around the web to help you further your research on Steel Connect Inc's stock as an investment opportunity:Steel Connect Inc (STCN) Stock Price | Nasdaq

Steel Connect Inc (STCN) Stock Quote, History and News - Yahoo Finance

Steel Connect Inc (STCN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...