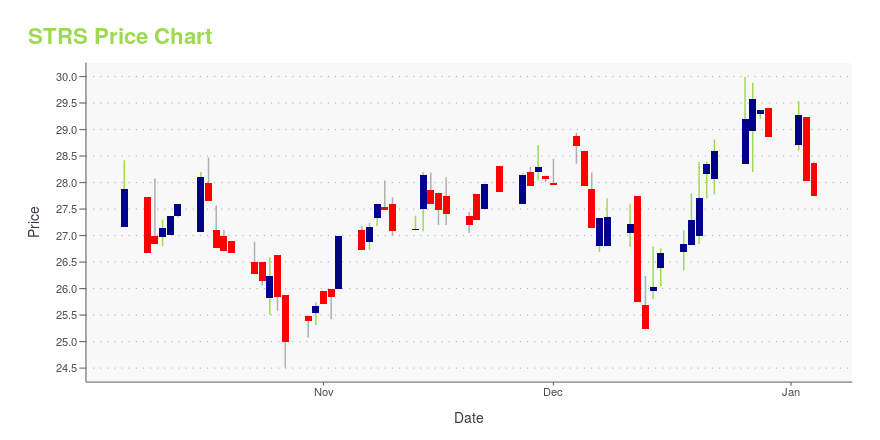

Stratus Properties Inc. (STRS): Price and Financial Metrics

STRS Price/Volume Stats

| Current price | $28.99 | 52-week high | $30.66 |

| Prev. close | $28.86 | 52-week low | $20.30 |

| Day low | $28.32 | Volume | 7,540 |

| Day high | $29.15 | Avg. volume | 7,091 |

| 50-day MA | $25.50 | Dividend yield | N/A |

| 200-day MA | $24.93 | Market Cap | 234.15M |

STRS Stock Price Chart Interactive Chart >

Stratus Properties Inc. (STRS) Company Bio

Stratus Properties Inc., a real estate company, engages in the acquisition, entitlement, development, management, operation, and sale of commercial, hotel, entertainment, and multi-and single-family residential real estate properties primarily in Austin, Texas. The company operates through four segments: Hotel, Entertainment, Real Estate Operations, and Commercial Leasing. The company was founded in 1992 and is based in Austin, Texas.

Latest STRS News From Around the Web

Below are the latest news stories about STRATUS PROPERTIES INC that investors may wish to consider to help them evaluate STRS as an investment opportunity.

Stratus Properties Inc (STRS) Faces Net Loss in Q3 2023 Despite Strong Cash Position and Share ...Stratus Properties Inc (STRS) Reports Third-Quarter 2023 Results with Mixed Financial Performance |

Stratus Properties Inc. Reports Third-Quarter 2023 ResultsAUSTIN, Texas, November 14, 2023--Stratus Properties Inc. (NASDAQ: STRS), a diversified real estate company with holdings, interests and operations in the Austin, Texas area and other select markets in Texas, today reported third-quarter 2023 results. |

Investing in Stratus Properties (NASDAQ:STRS) a year ago would have delivered you a 14% gainIf you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost... |

Stratus Properties Inc. Reports Second-Quarter 2023 ResultsAUSTIN, Texas, August 14, 2023--Stratus Properties Inc. (NASDAQ: STRS), a diversified real estate company with holdings, interests and operations in the Austin, Texas area and other select markets in Texas, today reported second-quarter 2023 results. |

Institutional investors own a significant stake of 38% in Stratus Properties Inc. (NASDAQ:STRS)Key Insights Given the large stake in the stock by institutions, Stratus Properties' stock price might be vulnerable to... |

STRS Price Returns

| 1-mo | 22.22% |

| 3-mo | 27.37% |

| 6-mo | 20.79% |

| 1-year | 7.81% |

| 3-year | -4.86% |

| 5-year | 3.06% |

| YTD | 0.45% |

| 2023 | 49.61% |

| 2022 | -47.25% |

| 2021 | 43.41% |

| 2020 | -17.69% |

| 2019 | 29.19% |

Continue Researching STRS

Want to do more research on Stratus Properties Inc's stock and its price? Try the links below:Stratus Properties Inc (STRS) Stock Price | Nasdaq

Stratus Properties Inc (STRS) Stock Quote, History and News - Yahoo Finance

Stratus Properties Inc (STRS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...