Sunworks Inc. (SUNW): Price and Financial Metrics

SUNW Price/Volume Stats

| Current price | $0.06 | 52-week high | $2.14 |

| Prev. close | $0.10 | 52-week low | $0.04 |

| Day low | $0.06 | Volume | 32,643,500 |

| Day high | $0.08 | Avg. volume | 25,469,229 |

| 50-day MA | $0.22 | Dividend yield | N/A |

| 200-day MA | $0.72 | Market Cap | 3.41M |

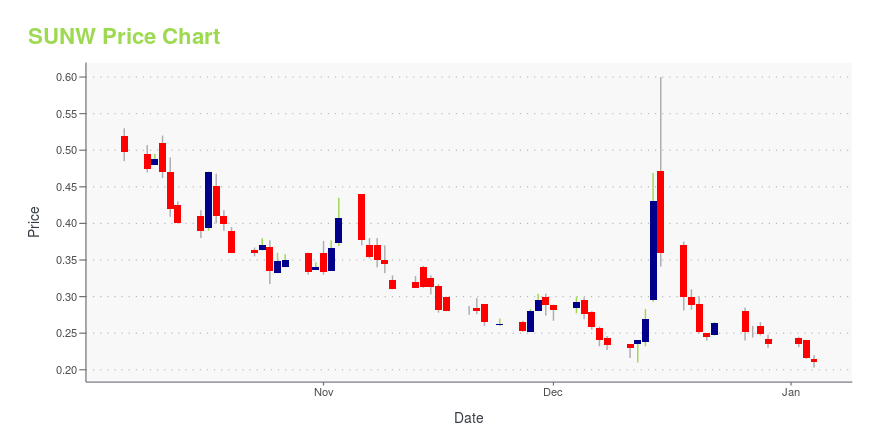

SUNW Stock Price Chart Interactive Chart >

Sunworks Inc. (SUNW) Company Bio

Sunworks, Inc. engages in the provision of photovoltaic based power systems for the residential, commercial, and agricultural markets. Its services include design, system engineering, procurement, project installation, construction, grid connection, warranty, system monitoring, and maintenance. The company was founded by Roland F. Bryan, Mark P. Harris, and Christopher T. Kleveland in 1983 and is headquartered in Roseville, CA.

Latest SUNW News From Around the Web

Below are the latest news stories about SUNWORKS INC that investors may wish to consider to help them evaluate SUNW as an investment opportunity.

Four Bright Solar Stocks Heading Into 2024When it comes to solar stocks, the landscape is transforming. The once prohibitive costs are now on a downward spiral, making solar ventures more financially appealing. Bloomberg New Energy Finance... |

Sunworks, Inc. (NASDAQ:SUNW) Q3 2023 Earnings Call TranscriptSunworks, Inc. (NASDAQ:SUNW) Q3 2023 Earnings Call Transcript November 10, 2023 Operator: Greetings, and welcome to Sunworks Third Quarter 2023 Results Conference Call. [Operator Instructions] As a reminder, this conference is being recorded. It is now my pleasure to introduce Jason Bonfigt, Chief Financial Officer. Thank you. You may begin. Jason Bonfigt: Thank you, operator. […] |

Q3 2023 Sunworks Inc Earnings CallQ3 2023 Sunworks Inc Earnings Call |

Sunworks Announces Third Quarter 2023 ResultsPROVO, UT / ACCESSWIRE / November 10, 2023 / Sunworks, Inc. (NASDAQ:SUNW), a leading provider of solar power, battery storage, and electric vehicle charging solutions for residential, agriculture, commercial, industrial, and public works markets, ... |

Sunworks Announces Third Quarter 2023 Results Conference Call and Webcast DatePROVO, UT / ACCESSWIRE / November 3, 2023 / Sunworks, Inc. (NASDAQ:SUNW), a leading provider of solar power and battery storage solutions for residential, agriculture, commercial, industrial, and public works markets, today announced that it will ... |

SUNW Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -73.68% |

| 1-year | -96.27% |

| 3-year | -99.28% |

| 5-year | -98.48% |

| YTD | -74.45% |

| 2023 | -85.14% |

| 2022 | -48.53% |

| 2021 | -40.04% |

| 2020 | 309.60% |

| 2019 | -31.84% |

Continue Researching SUNW

Want to do more research on Sunworks Inc's stock and its price? Try the links below:Sunworks Inc (SUNW) Stock Price | Nasdaq

Sunworks Inc (SUNW) Stock Quote, History and News - Yahoo Finance

Sunworks Inc (SUNW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...